a16z寻求为其新加密基金筹集45亿美元资金

本文来自 Newsfounded

Odaily星球日报译者 | 余顺遂

![]()

Andreessen Horowitz(a16z)计划为一组新的加密货币基金筹集高达 45 亿美元的资金。与不到一年前的基金筹资金额相比,这一筹资目标增加 1 倍多。

据英国金融时报报道,参与讨论的知情人士表示,这家总部位于硅谷的风投机构上周告诉投资者,它计划为最新的加密货币风投基金最多筹集 35 亿美元,并为一只专注于数字资产初创企业种子投资的独立基金最多筹集 10 亿美元。

其中一名知情人士表示,a16z 计划在 3 月份敲定其新基金。该公司拒绝置评。

众所周知,a16z 是硅谷最顶尖的风投公司之一,此前曾是 Facebook、Twitter、Airbnb、Stripe、Coinbase和许多其他知名科技集团的早期投资者。

如果筹资成功的话,a16z 的两只基金很容易超越任何其他为早期投资加密货币初创公司而募集的基金。

此举表明各大头部风投机构正逐渐积累加密领域的投资,引发了一场热潮,导致数百个项目旨在取代传统金融。

投资者通常会拒绝那些试图快速大量筹资的风投机构,他们更喜欢规模较小、专注于业绩的基金。

然而,最近 a16z 和其他科技投资者毫不费力地从大型机构筹集数十亿美元用于投资加密货币项目,这使得该行业获得了前所未有的巨额资金。

Paradigm 是由红杉资本(Sequoia Capital)前合伙人 Matt Huang 和 Coinbase 联合创始人 Fred Ehrsam 领导的公司。Paradigm 在去年 11 月为当时最大的加密货币风投基金筹集 25 亿美元。

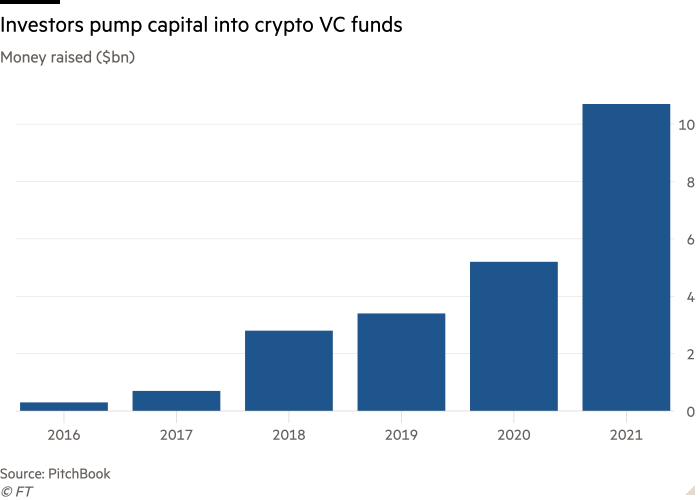

PitchBook 数据显示,2021 年,全球风投机构为专用于加密货币的基金筹集 107 亿美元,而 2020 年为 52 亿美元。

由 Chris Dixon 和另外两个投资合伙人领导的 a16z 加密货币部门此前在 2021 年 6 月为第三只加密货币基金(Crypto Fund III)筹集 22 亿美元,是其最初筹资目标的两倍多。该公司已经将该基金的大部分资金用于投资。

一只 10 亿美元加密货币种子投资基金将是第二大同类投资基金规模的两倍,后者是由 Greylock Partners 在去年 9 月筹集的 5 亿美元基金。当时,Greylock 称其为“业内致力于在第一天就为项目创始人提供支持的最大风险投资池”。

PitchBook 数据显示,随着对冲基金和其他非传统支持者寻求从快速增长的数字资产项目中获利,投资者去年向加密货币初创企业投入 316 亿美元资金,是 2020 年的近 7 倍。

a16z 是去年最活跃的加密货币投资者之一,与游戏初创公司 Sky Mavis、区块链开发商 Solana Labs 和 NFT 市场 OpenSea达成了大额投资交易。

在 a16z 为其基金发起筹资活动之前,其顶级合伙人之一 Katie Haun 离职并成立了自己的投资集团。Katie Haun 计划为两只独立的加密货币基金筹集至少 9 亿美元。a16z 已承诺向这些基金投资 5000 万美元。

本月,a16z 表示,已为其最新的生物技术、风险投资和成长型股票基金筹集 90 亿美元,使该公司管理的资产规模超过 280 亿美元。

知情人士表示,a16z 上周告诉投资者,该公司还计划为一只专注于游戏投资的新基金筹集至多 5 亿美元。