Google Pay는 새로운 전략을 개발합니다. All in Crypto도 될까요?

블룸버그(Bloomberg) 보도에 따르면, 구글은 자사의 결제 사업인 구글 페이(Google Pay)를 이끌기 위해 페이팔(PayPal)의 수석 부사장이자 수석 제품 설계자인 아놀드 골드버그(Arnold Goldberg)를 고용했습니다.

Google은 수년 동안 Google Pay 사용자를 위한 디지털 체킹 및 저축 서비스인 "Plex"를 탐색해 왔으며 서비스를 시작하기 위해 11개 은행과 제휴했지만 10월에 플러그를 뽑았습니다. Google Pay는 특정 파트너뿐만 아니라 전체 소비자 금융 산업의 "커넥터"가 되기를 원하며 은행이 되기를 원하지 않습니다.

Google은 은행 진출을 포기한 후 Google Pay의 새로운 방향을 설정했습니다.

Google은 오랫동안 검색 및 기타 온라인 서비스를 지배했지만 금융계를 뒤흔든 적은 없습니다. 지금까지 Google Pay는 인도에서만 어느 정도 주목을 받았고 다른 곳에서는 어려움을 겪었습니다. 경쟁사인 애플페이보다 훨씬 뒤떨어져 있고 자체 신용카드도 없고 애플과 같은 금융상품도 없다. 업계 분석가인 Tom Noyes는 2020년에 Google Pay가 미국 내 현금 없는 또는 비접촉식 결제의 4%만을 차지하며 서비스를 "대부분 실패"했다고 추정합니다.

그러나 구글은 엄청난 소비자 영향력을 갖고 있다. 2015년에 출시되어 2020년에 업그레이드된 Google Pay는 소비자가 비용을 추적하고 할인을 찾을 수 있는 허브가 되도록 설계되었으며 사용자가 거래에 Google Pay를 사용할 때 수수료가 부과되지 않습니다. 당시 Google은 이 앱의 전 세계 월간 활성 사용자가 1억 5천만 명이라고 밝혔습니다.

구글의 빌 레디 커머스 사장은 블룸버그와의 인터뷰에서 "우리의 목표는 갈등을 일으키는 것이 아니라 관계를 구축하는 것"이라고 말했다.

따라서 개편의 일환으로 Google Pay는 검색엔진과 쇼핑 서비스에 결제 기능을 더 추가하고 이를 위해 보다 광범위한 금융 서비스(암호화 자산 포함)와 협력하여 "통합 디지털 지갑"이 되는 데 주력할 것입니다. ."

레디는 "암호화는 우리가 매우 집중하고 있는 부분이며 사용자 요구와 판매자 요구가 진화함에 따라 우리도 함께 진화할 것입니다.”

Google Pay는 실제로 암호화 산업에서 초기 진전을 이루었습니다.

2020년 3월 Google Pay는 Coinbase 카드에 대한 지원을 추가하여 사용자가 암호화된 자산을 사용하여 매장에서 더 쉽게 사용할 수 있도록 했습니다. 코인베이스 카드(Coinbase Card)는 2019년 4월 암호화폐 거래소 코인베이스(Coinbase)에서 출시한 비자 직불카드입니다. 카드 사용자는 Visa 결제를 허용하는 모든 상점에서 Coinbase 잔액에서 직접 10가지 암호화 자산으로 결제할 수 있으며 구매 시 최대 4%의 수익을 올릴 수도 있습니다.

2021년 8월 Google Pay는 BitPay MasterCard Crypto Debit Card에 대한 지원을 추가했습니다. 두 달 뒤 암호화폐 거래소 백트(Bakkt)와 비자(Visa)가 공동으로 출시한 직불카드도 구글페이에 통합돼 암호화폐 자산을 매일 소비할 수 있게 됐다.

Google이 암호화폐 시장에 처음으로 진출한 것도 아닙니다.

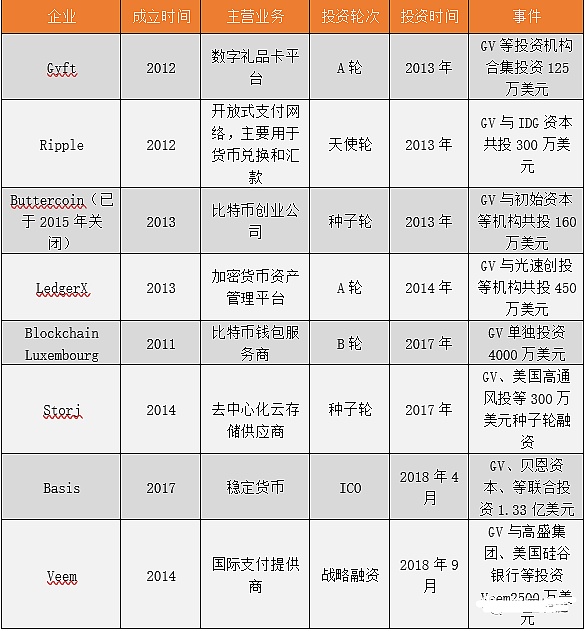

2017년 말 분석업체 CBInsights가 발표한 보고서에 따르면 2012년부터 2017년까지 구글벤처스(이하"GV"이미지 설명

이미지: Zero One Think Tank에서 제공하는 암호화 산업에 대한 Google의 일부 투자 이벤트

현재 Google Pay는 여전히 암호화폐 거래를 지원하지 않지만 암호화폐 회사와의 파트너십을 계속 확장할 것입니다. 분명히 암호화는 미래 개발 전략의 일부이며 아마도 이것이 전 Paypal 임원을 고용하는 이유 중 하나일 것입니다.

Arnold Goldberg는 PayPal의 수석 제품 설계자 및 총책임자로 재직하면서 회사의 핵심 체크아웃 및 판매자 서비스 사업을 이끌었습니다. Goldberg의 재임 기간인 2020년 Paypal은 미국 금융 서비스부로부터 라이선스를 취득한 후 암호화 사업을 추가했습니다. 이후 Paypal은 이를 하위 앱인 Venmo로 확장하여 전 세계 2,600만 판매자를 위한 "암호화 결제" 기능을 만들었습니다.

2021년에는 영국 시장에도 진출하여 영국 고객들에게 암호화폐 거래 서비스를 제공할 예정이며, 고객들은 BTC, ETH, LTC, BCH 등 주요 암호화폐 자산을 거래할 수 있습니다.

같은 해 말에 Paypal은 잠정적으로 "PayPal Coin"이라는 자체 안정 통화를 출시할 것이라고 확인했습니다. 스테이블 코인의 내부 개발은 Paypal의 iPhone 앱 소스 코드에서 개발자 Steve Moser가 처음 발견했습니다. 페이팔의 호세 페르난데즈 다 폰테(Jose Fernandez da Ponte) 디지털 통화 수석 부사장은 인터뷰에서 "우리는 스테이블 코인을 탐색하고 있다. 우리가 앞으로 나아가고자 한다면 당연히 관련 규제 당국과 긴밀히 협력할 것"이라고 밝혔다.

Google의 암호화 계획이 더 이상 공개되지는 않았지만 인터뷰의 한 문장을 상기할 가치가 있습니다.자유롭고 개방적중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.

위험 경고:

중앙은행 및 기타 부서에서 발행한 "가상 화폐 거래의 과대 광고 위험 추가 방지 및 처리에 관한 통지"에 따르면 이 기사의 내용은 정보 공유만을 위한 것이며 어떠한 운영 및 투자를 장려하거나 지지하지 않습니다. 불법적인 금융 행위에 가담하지 마십시오.