ETH周报 | Polygon将硬分叉引入燃烧机制;印度将推出首个比特币和以太坊期货ETF(1.10~1.16)

作者 | 秦晓峰

编辑 | 郝方舟

出品 | Odaily星球日报

一、整体概述

加密企业Torus Kling Blockchain IFSC已与印度INX签署了一份谅解备忘录 (MoU),以推出该国首个比特币和以太坊期货交易所交易基金 (ETF),将成为美国以外首个由加密货币支持的期货ETF。该期货ETF预计将在本财年末在国际金融服务中心管理局 (IFSCA) 的沙盒结构下推出,产品的推出需获得IFSCA和其他监管部门的批准。

1月12日,Polygon(MATIC)发推称:“继去年在孟买测试网上成功升级EIP-1559之后,期待已久的伦敦主网上硬分叉即将开始!#EIP1559和相关的EIP将于在区块高度23,850,000时被验证激活,预估日期在2022年1月18日星期二上午8:00(UTC)/上午3:00(ET)。”

据悉,2021年12月,Polygon在孟买测试网上推出了以太坊改进提案1559的测试网实施方案,以引入MATIC代币燃烧和更好的gas费可见性,此举借鉴了以太坊的燃烧机制。

二级市场方面,目前 ETH 价格短时可能小幅回调,支撑位 2900 美元、2500 美元,阻力位 3470 美元。

二、二级市场

1.现货市场

OKEx 行情数据显示,上周 ETH 价格一度跌至 2933 美元,周内收于 3352 美元,环比上涨 8.2%。

(ETH 日线图,图片来自OKEx)

日线图上显示,价格目前站上布林带下轨,短期内价格可能继续下探 3000 美元关口;下方支撑位是 2900 美元、2500 美元,上方阻力位是 3470 美元,该点位是 200 日均线与 20 日均线交汇点。

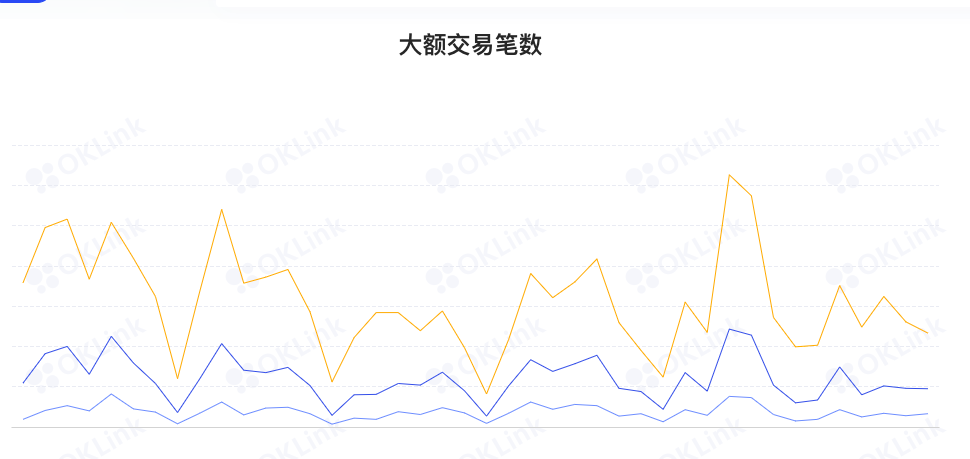

2.大额异动

欧科云链OKlink数据显示,链上转账次数上周大幅下降,“1000 ETH 以上”、“2000 ETH 以上”以及“5000 ETH 以上”分别环比下降 15.2%、30% 以及 36%,大额巨鲸交易热情明显下降。

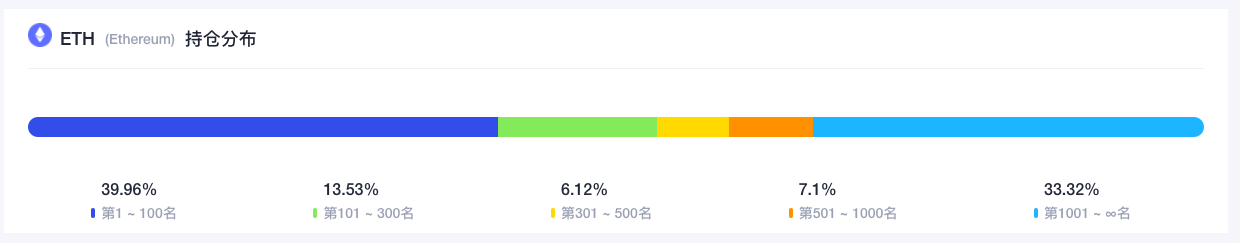

3.富豪榜地址

欧科云链OKlink数据显示,目前 ETH 持仓前 300 名,掌握了总计 53.49% 的 ETH,环比下降 0.12%;此外,整个持仓分布呈现椭圆形结构,各个部分占比分别是:第 1~100 名,占比 39.96% ,环比下降 0.06%;第 101 ~ 300 名,占比 13.53% ,环比下降 0.06%;第 301 ~ 500 名占比 6.12% ,环比上涨 0.02%;第 501 ~ 1000 名,占比 7.1%,环比上涨 0.05%;第 1001 名后,占比 33.32%,环比上涨 0.05%。

三、生态与技术

1.技术进展

1月7日,以太坊核心开发者进行电话会议。以太坊开发者Tim Beiko更新会议内容表示,以太坊2.0测试网Kintsugi进行了大量测试,但以太坊开发者MariusVanDerWijden再次成功破解网络,网络约13小时没有产生区块。希望再启动一个合并测试网,这可能是合并之前的最后一个。此外,将于1月21日进行下次电话会议。

2.社区之声

Pantera Capital CIO:以太坊市场主导地位不会受到威胁

美国加密货币投资机构Pantera Capital联席CIO Joey Krug在最近的一次采访中表示,“即使所谓的‘以太坊杀手’网络爆炸式增长,也不会威胁到以太坊区块链的市场主导地位。”

他预计在10-20年内,全球超过50%的金融交易将以某种方式连接到以太坊网络。如果以太坊切换为权益证明(PoS)机制,许多竞争项目最终将更加依赖以太坊。据了解,Pantera是最早的数字资产投资公司之一,以58亿美元的资产位居加密基金前五名。(彭博社)

3.项目动向

(1)ENS新提案提议将过期域名的临时溢价从2000美元提高至10万美元

以太坊域名项目ENS现已在Snapshot发起对最新治理提案的投票,计划将过期域名的临时溢价起始价格从2000美元提高到10万美元,每小时下调150美元,并在28天后降低为0,以防止域名“狙击(sniping)”的情况。

(2)NFT市场LooksRare发布LOOKS质押奖励规则,用户可获得WETH及LOOKS代币

官方消息,NFT市场LooksRare发布LOOKS质押奖励规则。用户质押LOOKS可获得平台的交易手续费WETH,以及额外的LOOKS代币。基于每天6,500个以太坊区块的基础上, LOOKS的质押奖励将分为四个阶段,每个阶段的奖励数量不同。

(3)Polygon Zero公布Plonky2,称其为最快的ZK扩容技术

Polygon在周一的博客文章中宣称,Polygon Zero的“Plonky2”技术在速度和可扩展性方面树立新的里程碑,这可能是以太坊吞吐量方面的一个突破。Polygon团队在博客中写道,“Plonky2是一种递归SNARK,是现有替代方案速度的100倍,并且与以太坊兼容。它结合了PLONK和FRI的优点,具有快速证明和不需要信任的设置;还结合SNARKs的优点,支持以太坊上的递归和低验证成本。”据此前报道,Polygon以4亿美元收购零知识技术开发商Mir,将其更名为Polygon Zero。(CoinDesk)

Dune Analytics数据显示,截至1月10日,OpenSea市场(以太坊)NFT本月交易量已经达到21亿美元。如果一切顺利的话,OpenSea有望在今年1月达到60亿美元,打破2021年8月创下的35亿美元月度交易量记录。

目前,OpenSea的交易量主要由PhantaBear推动,该NFT系列在过去7天的销售额为17124.79 ETH(约合5300万美元),Bored Ape Yacht Club以16657.78 ETH(约合5150万美元)位居第二。根据Dune Analytics分析,OpenSea活跃用户数量快速飙升至260369,正迅速接近上个月创下的362679的历史新高。(Cointelegraph)

(5)Unstoppable Domains宣布为以太坊和Polygon推出基于NFT的登录服务

1月11日,区块链域名项目Unstoppable Domains宣布为以太坊和Polygon推出基于域名NFT的登录服务,用户可以将电子邮件地址、信用评分、KYC数据等,通过将单点登录协议绑定到NFT域名,进而允许应用程序查找用户有关信息。该登陆方式类似于Google登录,但没有隐私窥探并且具有更大的灵活性。(coindesk)

以太坊消息推送服务EPNS宣布在以太坊主网上线,用户可以在以太坊区块链上的app.epns.io访问EPNS,创建频道或者订阅频道。接下来,EPNS将公布主网路线图的更多信息,包括激励、治理、多链支持等。

(7)Polygon(MATIC)将于1月18日进行伦敦硬分叉引入燃烧机制

1月12日,Polygon(MATIC)发推称:“继去年在孟买测试网上成功升级EIP-1559之后,期待已久的伦敦主网上硬分叉即将开始!#EIP1559和相关的EIP将于在区块高度23,850,000时被验证激活,预估日期在2022年1月18日星期二上午8:00(UTC)/上午3:00(ET)。”

据悉,2021年12月,Polygon在孟买测试网上推出了以太坊改进提案1559的测试网实施方案,以引入MATIC代币燃烧和更好的gas费可见性,此举借鉴了以太坊的燃烧机制。

(8)以太坊隐私交易平台Tornado.Cash已部署至Optimism

据官方消息,以太坊隐私交易平台Tornado Cash已部署至Optimism。公告称,Tornado Cash合约由其社区部署至以太坊L2 Optimism,目前已经上线运行。此前Tornado.Cash已成功部署至Binance Smart Chain、Polygon、xDAI Chain和Avalanche。

4.借贷

Defipulse 数据显示,上周链上锁仓抵押品价值从 922.28 亿美元上涨至 960 亿美元,一周上涨 4%;前一周净减 87.5 亿美元,上周净增 37.72 亿美元,环比上涨 143%。具体来看,上周 ETH 抵押量从 909.1 万个下降至 894 万个,涨幅 1.6%;BTC 抵押量从 233658 个下降至 230853 个,跌幅 1.2%。

从单个项目来看,锁仓价值前三名分别是:Maker 190.9 亿美元;Curve 146.8 亿美元;Convex Finance 122.6 亿美元。

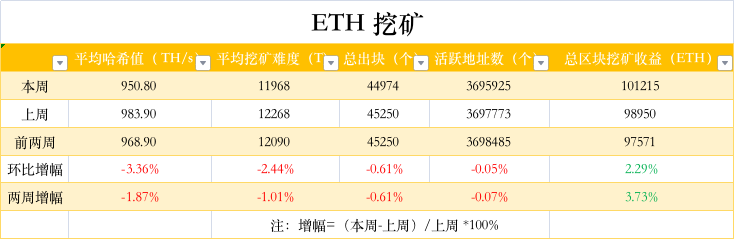

5.挖矿

(数据来自etherchain.org)

etherchain.org 数据显示,上周平均算力环比下降 3.3%,暂报 950.8TH/s;平均挖矿难度环比下降2.5%,暂报 11968T;链上活跃度环比下降 0.5%,挖矿总收入环比上涨 2.3%。

四、消息面

在接受CNBC采访时,美国SEC主席Gary Gensler表示,自己不会透露以太坊是否被视为证券,同时,加密项目对公众的信息透明度将决定其是否被纳入《证券法》。Gensler称,金融体系基于信用,无论是对于企业还是官员,防止内幕交易对于信用体系都很重要。

Gensler强调,有些加密项目正在从公众那里融资,这些项目是否向公众披露了足够的信息,其广告又是否真实,这些问题都将决定项目是否被纳入《证券法》监管。无论是加密货币,还是SPAC,只要项目从公众那里融资,就必须披露基本信息。

Cosmea Financial Holdings和Kling Trading India合资企业Torus Kling Blockchain IFSC已与印度INX签署了一份谅解备忘录 (MoU),以推出该国首个比特币和以太坊期货交易所交易基金 (ETF),将成为美国以外首个由加密货币支持的期货ETF。该期货ETF预计将在本财年末在国际金融服务中心管理局 (IFSCA) 的沙盒结构下推出。产品的推出需获得IFSCA和其他监管部门的批准。

根据谅解备忘录,India INX将成为交易平台,Cosmea Financial Holdings将成为分销商,而Kling Trading将成为技术合作伙伴。Cosmea已向印度储备银行 (RBI) 申请小型金融银行 (SFB) 许可证,并正在等待监管部门的批准。Torus Kling Blockchain IFSC将通过智能订单路由提供全天候流动性,成为印度INX的流动性提供者。(Livemint)

(3)USDC成为以太坊上流通量最大的稳定币

据欧科云链链上大师数据显示,当前以太坊上稳定币流动总量为1086亿美元。其中ERC-20 USDC流通量为398.29亿美元,ERC-20 USDT流通量为398.28亿美元。USDC在以太坊上的流通量首次超过USDT,成为以太坊上流通量最大的稳定币。

(4)V神发起面向太坊社区的民意调查,ADA以占比42%赢得票选

日前,以太坊联合创始人Vitalik Buterin(V神)在推特发起面向以太坊社区的民意调查。内容为:当你在2035年醒来时,世界上80%的交易和储蓄都不是ETH。你更希望是哪一种?选项为:BTC、USD、SOL、ADA、TRON、BNB、CNY、NEO。现调查结果显示,共计600,697名用户参与了投票,ADA以占比42%赢得票选。(the crypto)

(5)大英博物馆现已接受以太坊购买其展品的NFT版本

1月16日,福布斯编辑Michael del Castillo在推特发文表示,大英博物馆现已接受以太坊购买其展品的NFT版本,并且已与MetaMask和Fortmatic集成。

(6)分析:自EIP-1559上线以来,ETH发行量净减少约68%

推特用户@CryptoGucci表示,自EIP-1559上线以来,ETH发行量净减少了约68%,相当于148万枚ETH被销毁。到7月,合并将使ETH发行量再减少90%,ETH将进入通缩状态。这将是以太坊历史上最看涨的催化剂。