Terra系交易者如何在LUNA和bLUNA间套利?

本文来自Cointelegraph,原文作者:ELAINE HU,由 Odaily星球日报译者 Katie 辜编译。

Terra 市场分析

通常年底是休息和为假期做准备的时候,但 2021 年最后几周,加密市场没有显示出“休息”的迹象。

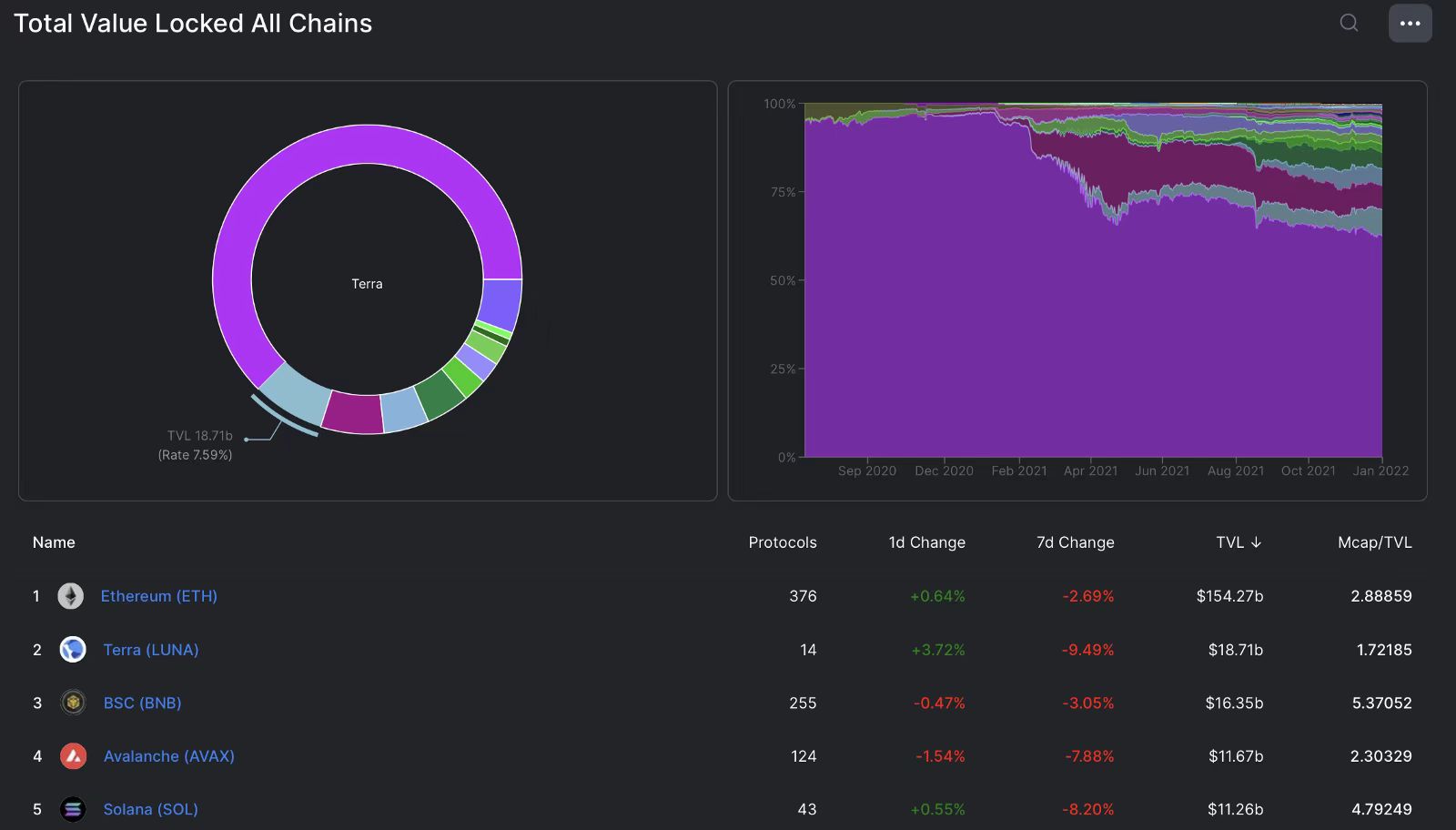

最引人注目的新闻之一是 Terra 在 TVL(总锁仓价值)方面达到了历史新高,该项目超过了 BSC,成为仅次于以太坊的 DeFi 链。根据 Defi Llama 的数据,在 12 月 24 日达到 200 亿美元大关后,Terra 的 TVL 在撰写本文时已降至 193 亿美元左右(并不是一个看跌信号)。

锁仓值前五的公链。来源:Defi Llama

目前,Terra 只有 14 个建立在链上的协议,而 BSC 上有 257 个协议,以太坊网络上有 377 个协议。Terra 的协议非常成功地吸引了流动性,最近的 Astroport 协议的发布与 Terra 的本地治理代币 LUNA 在 2021 年 12 月 26 日的迅速反弹非常吻合,创下了历史新高。

以美元计算的 TVL 与 LUNA 相比,前者自 2021 年 9 月以来经历了指数增长,而后者在同一时期保持相当平稳。不难看出,最近 TVL 美元价格上涨的主要原因是 LUNA 价格本身的上涨。

Terra美元总锁仓值与LUNA对比。来源:Defi Llama

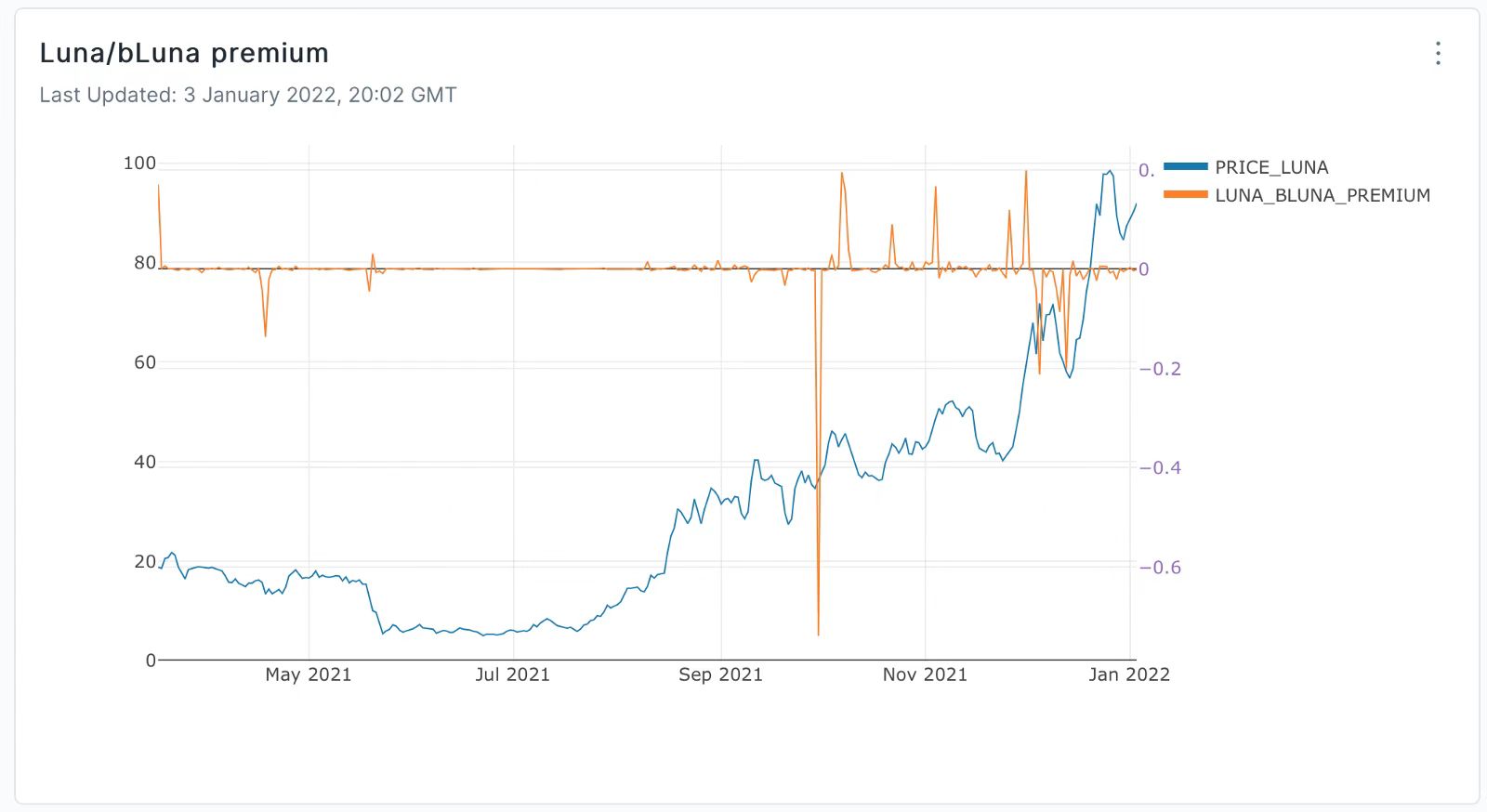

虽然治理代币的价格上涨通常表明投资者对公链和协议的信心,但似乎也是其因为出现了更有利的套利机会。

让我们来了解一下 LUNA 和它的担保资产 bLUNA 之间套利的一些策略。

LUNA价格VS LUNA /bLuna溢价比例。来源:Flipside Crypto

为什么在 Terra 的市场上会出现这种情况?

LUNA 是 Terra 公链的治理和质押代币,而 bLUNA 是代表质押的 LUNA 的代币及其相应的区块奖励。由于bLUNA和 LUNA 一样是同质化的和可交易的,它也在 Terra 的去中心化交易所进行交易。

与交易所交易的其它货币或代币交易对一样,在不同的去中心化交易所(DEX)交易的 LUNA/bLUNA 交易对,可能会由于不同平台的价格低效率而具有不同的价格。套利者将通过以较低的价格从一项协议中买入,在另一项协议中以较高的价格卖出而获利,帮助平台解决价格效率低下的问题,并最终在所有交易所达成一个公平的价格。

除了价格低效率的共同原因之外,还有其它因素,如与 bLUNA 的性质相关,使 LUNA/bLUNA 的价格在不同协议之间不同。

bLUNA 价格高于 LUNA 在 Anchor 协议上的。这是因为 bLUNA 一旦在 Anchor 上用于担保和铸造,只能在 21 天(加上 3 天的处理时间)后烧毁和交易成 LUNA,除非它是立即烧毁的。

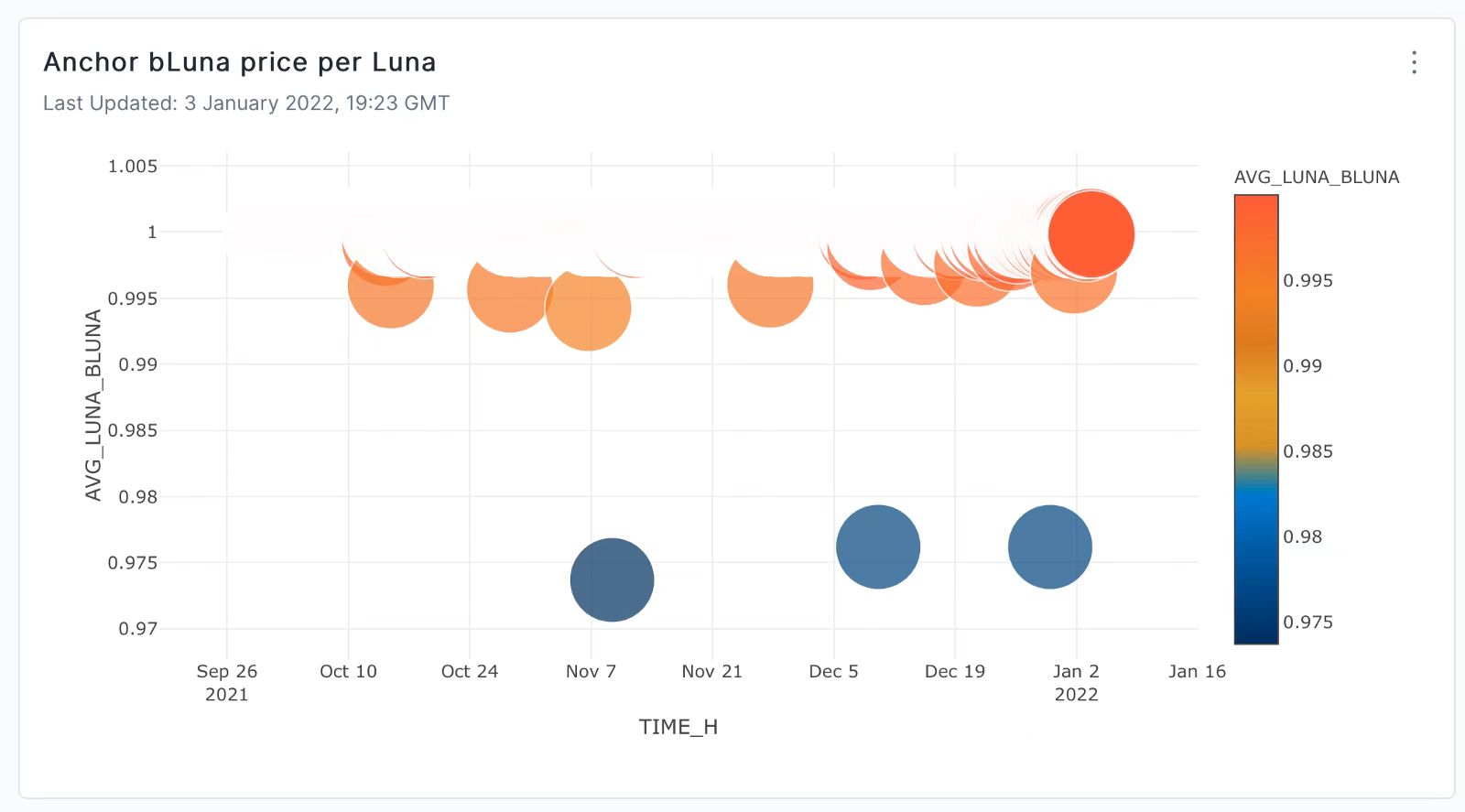

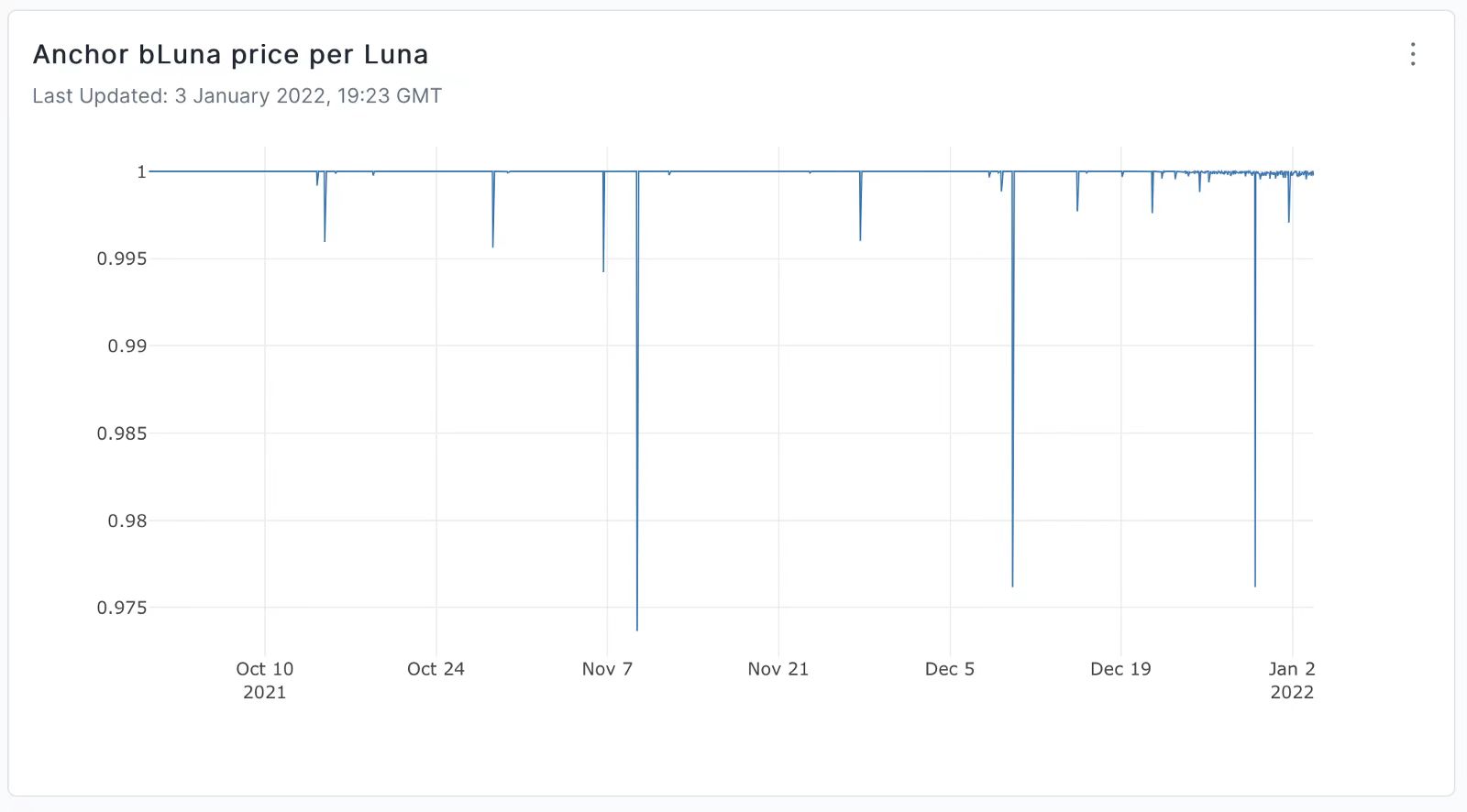

由于 bLUNA 不仅代表了所持 LUNA 的价值,还代表了 21 天锁仓期所持 LUNA 的区块奖励,其价值始终高于 LUNA。如下图所示,在 Anchor 上,bLUNA 的价格在大多数时候略低于 1,三个不同的异常值显示bLUNA在 0.97(bLUNA / LUNA)的比率下更有价值。

LUNA 在交易所的价格通常高于 bLUNA,原因可能是:

出售 bLUNA 比在 DEX 上购买 bLUNA 更多(因此 bLUNA 价值更低),因为如果不是立即烧毁,在Anchor 协议上烧毁 bLUNA 就需要 21 天。所以,如果用户想要立即得到 LUNA,他们需要去 DEX 出售 bLUNA。对于在 Anchor 协议上瞬间烧毁的 bLUNA,其速率与 TerraSwap 相同。

除非用户需要在 Anchor 协议上使用它们作为质押品,不然用户不会像对 bLUNA 一样期待得到其它 LUNA系列资产。目前,Anchor 提供了绑定功能,以非常接近但略低于 1 的比率进行 LUNA 和 bLUNA 之间对交易。即投资者以 1 个 LUNA 获得略低于 1 个 bLUNA。尽管在 DEX 的汇率更好,因为交易员可以在 DEX 上通过 1 个 LUNA 获得 1 个以上的 bLUNA。但用户倾向于寻求最方便的方式,即使用 Anchor 债券来获得他们的 bLUNA,这样他们就不必在不同的协议之间切换。

如何利用 Terra 的套利机会

根据前面给出的价差解释,套利 LUNA 和 bLUNA 主要有两种方式。

TerraSwap、Loop Markets 和 Astroport 都提供 LUNA/bLUNA 的交易。这些交易所之间通常存在微小的价差,这为交易员创造了套利机会,他们可以在一个交易所以较低的利率买入这一交易对,在另一个交易所以较高的利率卖出。

LUNA/bLUNA在DEXs上的价格比较。来源自:Flipside Crypto

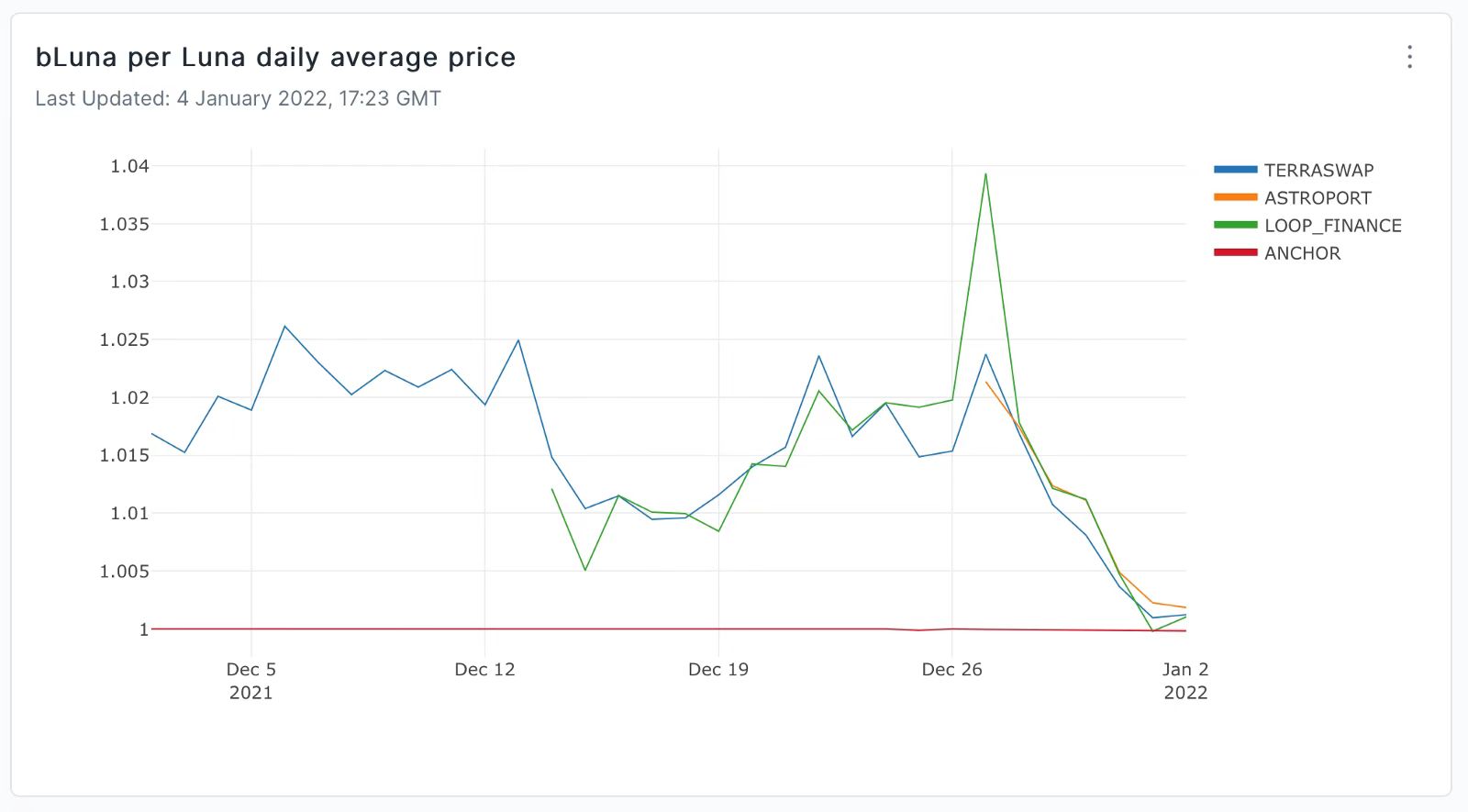

下图显示了 2021 年 12 月期间不同平台的 LUNA/bLUNA 交易日均价格。该比率是实际收到的 bLUNA 总数(扣除费用和费用后)除以为交易提供的 LUNA 总数。正如前一段所解释,由于在 DEX 上对 LUNA 的需求增加,一个 LUNA 可以在 DEX 上交易成多个 bLUNA。

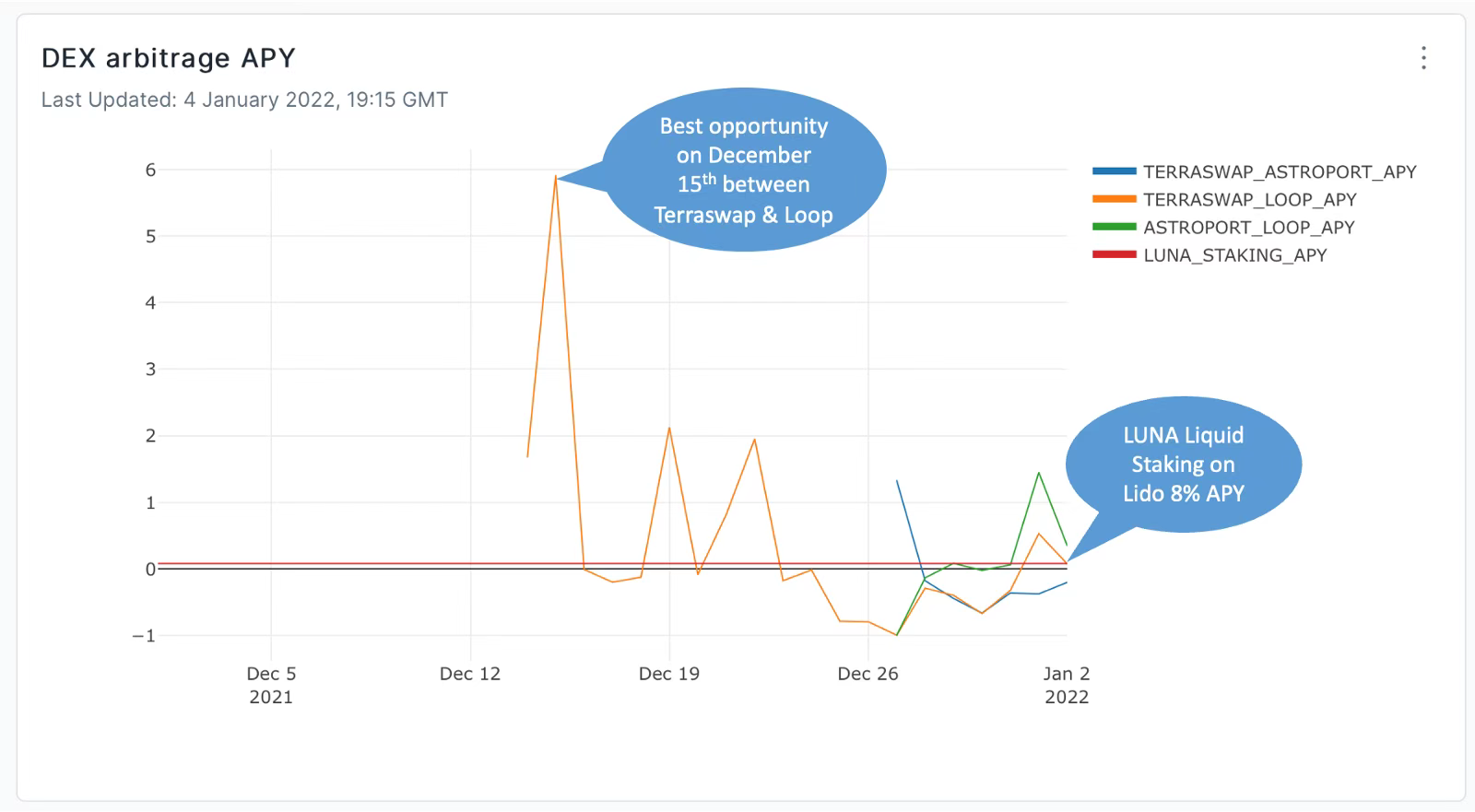

下图计算了三个交易所中任意两个交易所的套利日回报率。最好的机会出现在 12 月 15 日的 TerraSwap 和 Loop 之间,年收益率(APY)接近 600%。

在不同的DEXs之间套利LUNA/bLUNA交易对。来源:Flipside Crypto

DEX 和 Anchor 协议之间的套利

投资者可以将 LUNA 交易到每 LUNA 提供最高 bLUNA 的 DEX 之一,在 Anchor 协议上烧毁 bLUNA,并等待21天(加上 3 天),即可获得更多的 LUNA。注意,Anchor 协议上的烧毁必须是正常的“缓慢”烧毁。因为交易率与TerraSwap 相同,所以“瞬间烧毁”将起不到作用。

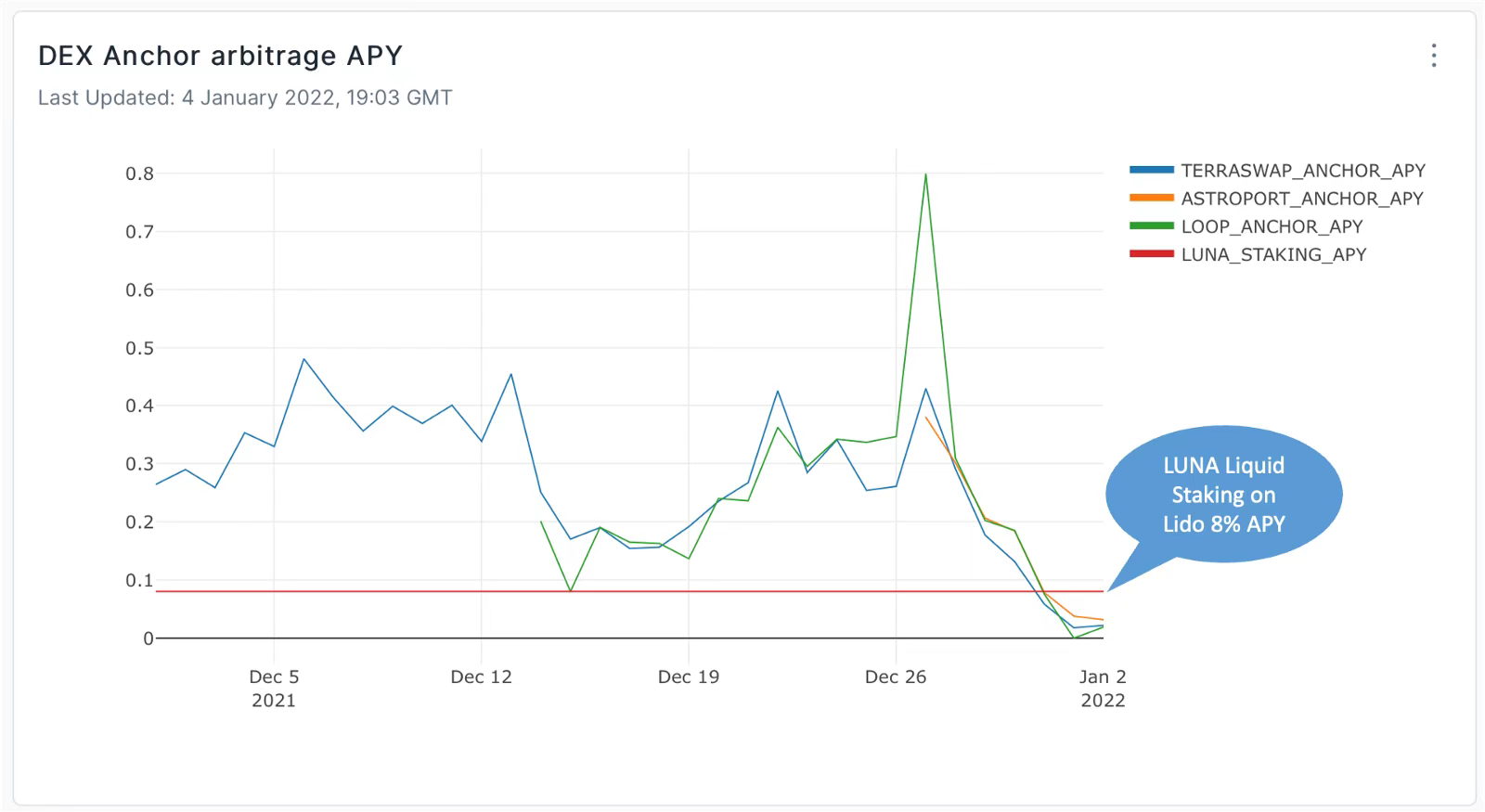

基于24天(Anchor 烧毁的 21 + 3 天处理)的年化回报,下图显示了不同 DEX 和 Anchor 之间套利的年收益率(APY)。

DEX和Anchor年收益vs. LUNA 质押年收益之间的套利。来源:Flipside Crypto

Lido 从 LUNA 流动质押中获得的8%年均收益率也被添加为无风险基准回报率比较。在 12 月,12 月 27 日的最高年平均收益率达到 80%,此后大幅下降,在新的一年里低于无风险回报。

这可能是因为 Terra 的被更多用户采用和更多用户参与到不同的 Terra 协议中,帮助合理化了平台间的价格,降低了价格的低效率和套利机会,从而创造了一个更公平的价格。

精明的投资者总是在摩拳擦掌,等待下一个机会

从 2021 年 12 月观察到的交易数据来看,Terra 上不同协议之间存在 LUNA/bLUNA 交易对的套利机会。交易员可以选择风险更大的方式在不同的 DEX 平台(如 TerraSwap、Astroport 和 Loop Markets之间套利),也可以选择更安全的方式在这些 DEX 平台和 Anchor 协议之间套利,前提是他们愿意持有 bLUNA 24 天。

在 2021 年 12 月,DEX 和 Anchor 协议套利策略的年化回报一直优于无风险的 Lido 流动性质押。直到最近,这种回报在 2022 年 1 月 1 日几乎蒸发。

这可能是由于在 Terra 协议中更多的用户参与和价格合理化。由于交易量和参与率的波动,或由于新的 DEX 协议的推出,套利机会可能在未来再次出现。

本文所表达的观点仅为作者个人观点,每一个投资和交易都有风险,在做决定时先自己研究。