深度探索区块链的模块化: Rollup介绍及应用

原文作者:Ben Harvey

10月26日,我收听了由David Hoffman和Ryan Sean Adams主持的关于区块链整体化和区块链模块化的实时 Bankless 播客。如果你不知道这两个术语有什么意义,那很正常,因为区块链模块化的概念让我也大吃一惊,以至于我决定把它分解几篇文章。我认为区块链模块化代表了区块链技术的未来,如果你想在未来掌握区块链生态系统,它们对于理解至关重要。本博客的目的是让你和我一起学习,所以我将把所有相关概念归结为基础知识,以便清楚地了解什么是区块链模块化,它们为什么重要,以及如何投资它们。

在完全掌握区块链模块化之前,有两个关键概念需要理解:(1) Rollup 和(2)分片。本文将重点关注 Rollup ;它们是什么,它们如何工作,以及它们未来的方向。在不久的将来,一篇文章将专注于分片。然后,我将完成这三部分文章系列,并发表一篇文章,将所有内容捆绑在一起,以解释区块链模块化和区块链生态系统的未来。

区块链不可能三角和Layer 2的诞生

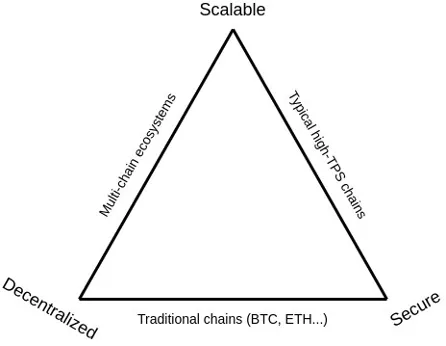

本质上,区块链面临着三大难题,被称为不可能三角。这指的是所有区块链在去中心化、可扩展性和安全性之间面临的权衡,其中区块链只能为两个区块链进行优化,而牺牲了第三个。显然,安全性对区块链至关重要,因此这通常会导致在去中心化或可扩展性方面达成妥协。

为什么去中心化很重要?

你可能想知道,为什么去中心化很重要?这通常是一个被误解的概念,经常有人建议web3倡导去中心化,以抵制政府审查。事实上,这不是去中心化很重要的主要原因。答案主要在于激励创新。

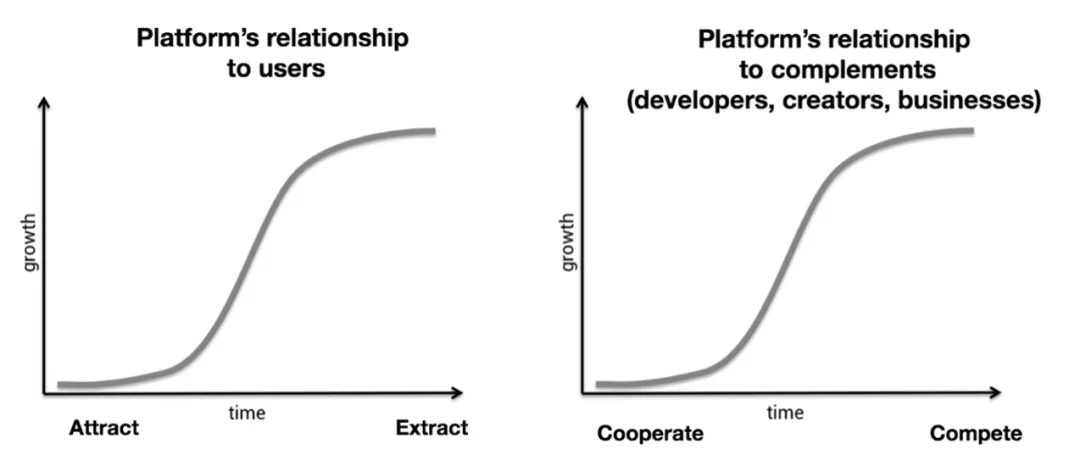

中心化平台的问题主要围绕其可预测的生命周期。起初,平台非常吸引人,因为它们必须吸引用户、开发人员、企业和媒体组织,这不可避免地会使其平台变得有价值。它们降低了进入壁垒,几乎没有提取价值,以创造一个积极的环境来鼓励参与者。正如Chris Dixon所说,中心化平台这样做是为了“使其服务更有价值,因为平台(顾名思义)是具有多方面网络影响的系统。”当平台的S曲线进行演化,并对其用户和开发人员获得更多权力时,就会出现问题。

集中平台生命周期

一旦中心化平台达到其S曲线生命周期的顶峰,其与平台参与者关系的性质就会从正和减为零和。一般来说,这意味着中心化平台将转向从用户那里提取数据并将其货币化,并与在其平台上开发的互补业务争夺关注(例如,Twitter扼杀了对第三方客户的支持)。这对创新和这些平台的持续发展来说是个坏消息。

在过去的十年里,我们看到这个生命周期在多个平台上进行:Facebook、Twitter、Microsoft、YouTube和Google等。这些正是当今基本上拥有互联网的平台。归根结底,这促使企业家、开发人员和投资者对这些类型的平台保持警惕,许多人拒绝与中心化平台建立合作。当强大中心化平台如此控制他们的作品时,他们为什么要这样做呢?为什么他们的创作有被夺走的风险?想想内容创作者在YouTube上开发品牌,结果他们的观众人数被他们无法控制的推荐算法减半,或者开发人员开发了一个带有全球社区的游戏作为Facebook插件,但Facebook上却删除他们的第三方客户端API。除此之外,你还从用户的角度在中心化方面遇到问题,用户容易受到安全漏洞的影响,并放弃对其数据和隐私的控制。

另一方面,去中心化平台不构成审查风险。企业家和开发人员可以自由地、良心地进行建设。这与互联网的第一个时代(1980年代至21世纪初)密切相关,当时互联网服务主要基于互联网社区本身拥有的开源协议。根据规定,去中心化平台无法从用户和开发人员那里提取价值,而是允许用户和开发人员创造价值。为了确定这一点,谷歌将自己与“Don’t be evil”的座右铭联系起来,而在一个去中心化平台上,这进一步地转向了“Can’t be evil”。

这听起来都很棒,虽然我认为我们有一个令人信服的去中心化平台的理由,但它们会真的胜利,甚至在现实中发生吗?互联网的第一个时代是通过去中心化开源协议赢得的。第二个时代由谷歌、Youtube和Twitter等中心化应用程序主导。我认为互联网的第三个时代可能会去中心化。原因很简单:这是开发者的选择。由于上述原因,企业家和开发人员被拒绝在中心化平台上开发,他们正在涌入以太坊等去中心化平台上开发。没有企业家和开发商,互联网的第三个时代会是什么?当然,你可以说中心化平台可能能够简单地支付开发人员的报酬,但在我看来,它们将无法超过去中心化平台上的开发,而且它们肯定无法与完全自由的企业家的创新速度相匹配。考虑到互联网去中心化第三个时代的象征性时,尤其如此,企业家能够以惊人的速度筹集资金,从而减少集中平台的影响,只需支付给开发人员社区。

区块链技术是web3终极平台的滋生地。这里不需要第三方参与,效率低下的问题在很大程度上也被消除了。如果我们要鼓励企业家、开发人员和投资者在这些区块链平台上开发,我们必须让他们去中心化。如果想了解这个主题的更多详细信息,我强烈建议你阅读本文。

很好,从创新、用户隐私和数据所有权的角度来看,去中心化区块链是有道理的。不幸的是,这意味着放弃区块链不可能三角中的可扩展性。

区块链的组成部分

这些区块链过去的工作方式是,当有人发布交易时,矿工会对其进行验证,然后将其发布在区块链上,但网络中的所有其他矿工也必须对其进行验证。考虑到去中心化网络中可能有大量的矿工,这显然代表着许多低效和浪费的工作。

然而,去中心化、安全性和可扩展性只是区块链的属性,由构成该区块链的组件决定。作为一个基本概念,概述以下组成部分很重要:(1)共识,(2)数据可用性,以及(3)执行。共识部分要求通过网络节点对交易进行集体验证,为存储在区块链上的数据提供安全性和真实性。数据可用性是指结算层保证可用于在区块链上交易的数据(无论是传输、持有状态等)。执行是指使用新信息更新区块链所需的计算。

简而言之,共识部分是商定和存储区块链上的交易记录的地方。数据可用性组件是区块链在任何时间点添加额外数据的空间。执行组件是在验证并写入永久记录之前,在区块链上注册新交易的地方。

Layer 2扩展解决方案的开发成为了区块链不可能三角的解决方案。Layer 2协议可以被视为以太坊结算层的扩展解决方案,这使得结算层能够优化去中心化和安全。在本文后面,我将延伸不同类型的扩展解决方案及其工作原理。Layer 2扩展解决方案完全专注于区块链的执行和(偶尔)数据可用性组件。共识部分本质上必须与和解层共存,以利用其去中心化和安全特征。

到目前为止,在Layer 2解决方案中已经锁定了约66.2亿美元的价值,Arbitrum和dYdX(由StarkEx提供支持)等领先解决方案吸引了大部分。

Layer 2协议的总锁仓

扩展解决方案有很多种,从状态通道、plasma、侧链和 Rollup 。为了本文的目的,由于状态通道、plasma、侧链和验证码扩展解决方案的固有限制,我将专注于 Rollup 。在区块链的三个组成部分的背景下, Rollup 主要集中在执行层。

Rollup 类型

Rollup 是将交易捆绑、压缩和发送到共识层进行验证的解决方案。通过同时验证多个交易,它们极大地提高了效率,同时允许以太坊在不牺牲安全性的情况下从每秒15个交易增加到3000多个交易(TPS)。

本质上,用户没有将交易发送到Layer 1矿工,而是将其交易发送到 Rollup 服务器,从而验证这些交易是否有效。因此,他们正在以太坊主链之外执行交易执行,但这些 Rollup 然后将交易数据发布到以太坊主链。将交易发布到主链时,他们继承了Layer 1的安全属性。

有两种类型的 Rollup ,它们具有不同的安全模型:(1)Optimistic Rollup 和(2)零知识(Zero Knowledge,ZK) Rollup 。

Optimistic Rollup

Optimistic Rollup 捆绑了数百个传输,并且只发布链上所需的最低信息,没有证据。这基本上假设没有实施欺诈或恶意行为,因此被称为“Optimistic”的名称。只有当转让或状态受到质疑时,Optimistic Rollup 才会提供证据。

Optimistic Rollup 的好处,除了明显地增加了扩展性外,还包括EVM和稳固兼容性,这意味着你可以在以太坊Layer 1上做的任何事情,都可以在Optimistic Rollup 上做。

然而,由于潜在的欺诈挑战,链上交易的等待时间可能很长。你必须等待大约1周才能从Optimistic Rollup 中提取资产,因为这为发现和解决欺诈提供了时间。假设没有实施欺诈或恶意行为,这是一个固有的问题。

Optimistic Rollup 的另一个缺点是,需要将所有证人数据,如签名、预言机数据等发布在链上。这限制了可扩展性,特别是与零知识 Rollup 相比,我很快就会讨论。

大型Optimistic Rollup 协议包括Arbitrum和Optimistic,我们将在本文后面探索这些协议。

零知识 Rollup

零知识(ZK) Rollup 与Optimistic Rollup 不同,因为它们通过利用零知识技术集成了隐私。零知识是指在不披露证明必要信息的情况下向另一方证明某事(交易或状态)的能力。

用户没有将交易发送到Layer 1矿工,而是将交易发送到执行交易的 Rollup 服务器。ZK Rollup 中使用的两个最常见的验证证明是ZK-SNARKS和ZK-STARKS,我会在后面的部分中联系ZK-STARKS。然后生成ZK-SNARKS(零知识简洁的非交互式知识论据)作为交易有效性的证明,并发布到Layer 1主链中。如果你对ZK-SNARK的确切内容及其形成方式感兴趣,我强烈建议你阅读这篇短文。这些证据生成速度快,令人信服,验证速度惊人。对于上下文,数百笔交易可以 Rollup 成一个证明,验证该证明大约需要5毫秒。

通过利用这项技术的零知识功能,Layer 1的矿工将永远不知道交易中的数据是什么。只有 Rollup 矿工才会知道交易数据。这是一项非常令人兴奋的技术,因为它意味着数据可以是私有的,即使在公共区块链上也是如此。这对苹果这样的公司至关重要,他们可能想保密他们支付的某些实体等。

在ZK Rollup 中,提取资产时不会出现延迟,因为ZK Rollup 合约接受的ZK-SNARK证据已经验证了资产。这是Optimistic和ZK Rollup 的主要特征差异之一。

如上所述,ZK Rollup 的优点包括更快的最终时间,以及比Optimistic Rollup 更易受到经济攻击。然而,ZK-SNARK证明计算起来很激烈,对于几乎没有链上活动的应用来说,这可能是不值得的。

文章稍后,我将讨论主网上的四个主要ZK Rollup 协议,但有关ZK Rollup 协议的完整目录,请查看此链接。

这里值得注意的是,目前大多数ZK Rollup 尚未实际利用ZK技术的隐私方面。相反,他们专注于可扩展性方面,即证明可以比本机计算小得多,也更倾向于验证。

Optimistic和ZK Rollup 的技术比较

以太坊联合创始人Vitalik Buterin撰写了大量关于 Rollup 技术以及Optimistic和ZK Rollup 的比较的文章。以下是基于技术比较的Vitalik在这两种技术方面的前景。

一般来说,我个人的观点是,在短期内,Optimistic Rollup 可能会在通用EVM计算中获胜,ZK Rollup 可能会在简单的支付、交换和其他特定应用程序的用例中获胜,但在中长期内,随着ZK-SNARK技术的改进,ZK Rollup 将在所有用例中获胜。——Vitalik Buterin

下面我总结了Optimistic和ZK Rollup 之间的技术比较。

Rollup类型之间的复杂权衡

虽然Optimistic Rollup 目前比ZK Rollup 更实用,但仅仅由于其复杂性较小,ZK Rollup 显然有可能为用户提供更大的好处。在本文的下一节中,我将探索每种 Rollup 类型的未来路线图。

Rollup 的未来

虽然这两种 Rollup 类型目前都提供了高于本机以太坊链执行层的好处,但有一些具有挑战性的方面需要改进或完成开发。

面临的挑战

EVM代表以太坊虚拟机,可以被视为计算区块链上每种任务的大型去中心化计算机。它本质上是以太坊整个运营结构的基石,并运行执行和智能合约部署。

EVM兼容性意味着另一条链,例如 Rollup 链,将能够在所述链上部署以太坊智能合约。因此,如果没有EVM兼容性,另一条链就不可能运行以太坊智能合约。EVM兼容性显然非常有益,因为它意味着已经在以太坊上部署的项目,认为Uniswap等DeFi巨头可以部署在兼容链上。这意味着,如果用户比以太坊执行模块具有显著的竞争优势,兼容链相对容易在执行模块中吸引用户。鉴于以太坊社区内的开发人员规模,这对兼容链来说也是一个巨大的优势。通过与EVM兼容来利用该社区,兼容的链能够受益于上述开发人员的采用力和网络效果,以及未来将产生的创新。

EVM兼容性的缺点源于复杂性以及相关的安全漏洞风险。因此,为什么总的来说,EVM兼容性的发展在 Rollup 方面很缓慢,但已经取得了一些突破,特别是在Optimistic Rollup 方面,我稍后会提到这一点。

Rollup 的另一个挑战,实际上是我看到未来发展最兴奋的挑战,是直接的“fiat on-ramp(法币兑换)”。“fiat”是指传统货币,如美元、大英镑和日元。“on-ramp”是指你能够直接转换法定货币以换取加密货币的服务。该服务目前通常位于中心化交易所(CEX),如Coinbase和Binance。

到目前为止,购买加密货币的过程中存在几个瓶颈,纯粹是因为很难从传统银行账户获得法定货币,并进入加密世界。如果你希望与去中心化交易所(DEX)互动,通常的做法是将法定货币存入CEX,然后必须将该法定货币兑换成加密货币,但只能将其转移到你选择的钱包(例如MetaMask),然后从那里与你选择的DEX进行交互。这显然有点麻烦,并显著降低了用户体验。值得注意的是,有一个名为Dharma的项目,这是以太坊唯一一个可以在以太坊和Uniswap等去中心化交易所之间无缝移动法定货币的以太坊钱包,Polygon是一个费用较低的侧链。然而,这个解决方案仅适用于美国银行,而且相对较新。

Rollup 的挑战更加严峻。为了在 Rollup 时与加密货币交互,你面临着将加密货币放入你选择的钱包的瓶颈,从那里,你必须将加密资产与 Rollup 本身联系起来。这是一个非常糟糕的用户体验,需要很大的耐心。值得注意的是,法币兑换解决方案Ramp最近宣布与Zk Rollup 的zkSync合作。我将在文章后面讨论这个问题。

我真的相信,大规模采用直接的法币兑换,即从你的传统银行账户直接到 Rollup 的路径,将极大地增加使用率。这就是为什么我对他们的开发如此兴奋;增强的用户体验无疑将为用户提供一个不再直接与Layer 1交互的理由,并将标记从Layer 1执行到Layer 2执行的大规模迁移,让Layer 1专注于共识和安全。这将是采用区块链模块化的真正开端。

还值得注意的是,为了达到最低费率,需要最大限度地在Layer 1链上结算交易。这是在 Rollup 到许多交易中均匀分配费用。因此, Rollup 费用可以被视为Layer 1费用的产物,也可以被视为 Rollup 需求的产品。因此,与以太坊相比,为了真正发挥其降低费用的潜力,它们需要更高的需求水平。这通常被称为规模经济,这意味着下一次边际交易的边际交易成本会下降。

这几乎创造了一个鸡和鸡蛋场景,用户被要求大幅降低费用,但只有在费用大幅降低时才能实现。然而,我认为这不是一个特别的问题。事实上,这是一个突破,因为它颠倒了区块链的传统成本结构,区块链通常每次边际交易的成本都会变得更加昂贵。这也是ZK Rollup 性能优于Optimistic Rollup 的例子,鉴于Optimistic Rollup 将始终需要包含每笔交易的签名,从而增加了另一个成本因素。另一方面,ZK Rollup 不需要签名,并且具有更好的数据压缩,从而具有卓越的可扩展性潜力。

现有的Optimistic项目

Aritrum

我将谈到的第一个Optimistic Rollup 是Arbitrum,这是Offchain Labs开发的Optimistic Rollup 协议。Arbitrum于2021年8月完全发布到以太坊主网,称为主网网络Arbitrum One。全面启动的同时,Lightspeed Venture Partners牵头为Offchain Labs筹集了1.2亿美元资金。

Arbitrum支持所有EVM语言,并原生支持所有以太坊工具,而无需任何特殊适配器,从而使其完全兼容EVM。这包括部署智能合约和dApp。然而,由于Arbitrum虚拟机,这一切都是可能的,尽管这从未暴露给开发人员或用户。

到目前为止,这种EVM兼容性使以太坊生态系统中一些最大的dApp能够部署到Arbitrum,包括DeFi巨头Uniswap、SushiSwap、Aave、Curve和1Inch。钱包、dApps等生态系统的完整列表可在此链接中找到。这些部署的结果是锁定在网络上的总价值超过26.5亿美元。

从吞吐量的角度来看,Arbitrum One理论上的最高TPS为40,000,尽管实际上记录的最高TPS目前约为49。与以太坊主网相比,使用Arbitrum One的成本效益在很大程度上取决于传输类型,例如,对于普通传输,Arbitrum One的费用约为以太坊主网的36%,而Uniswap v3交易的费用约为6.9%。

Optimistic

Optimistic主义是我今天要谈到的第二个Optimistic Rollup ,它于2021年7月发布在主网上。自发布以来,Optimism已积累了4.66亿美元的锁仓量,处理了220多万美元的交易。

据Optimism称,他们Optimistic Rollup 解决方案在与以太坊主网交易时帮助节省了超过1亿美元的gas费用,表示你可以在毫秒内进行交易,并节省了10-100倍的费用。该网络本身拥有超过10万个独特的钱包地址(用户)。

2021年11月,Optimism在Optimistic以太坊上与EVM等效一起上线,取代了之前使用的Optimistic Virtual Machine解决方案。EVM等效性完全符合以太坊堆栈。当然,每个调试器、工具链、节点实现都允许部署智能合约和dApp。

这种EVM等效性使以太坊生态系统中的许多关键参与者能够部署到Optimism网络。这些关键玩家包括但不限于Uniswap、Synthetix和1Inch。

值得注意的是,目前Optimistic主义在没有欺诈证据的情况下运行。换句话说,这意味着Optimistic Rollup 技术方面尚未开启。

现有的ZK Rollup项目

StarkNet

我将要接触的第一个ZK Rollup 项目是StarkNet,这是StarkWare的以太坊主网ZK Rollup 。StarkNet Alpha(StarkNet的未经审计版本)于2021年11月29日在主网上发布,并于2020年6月部署到testnet,这是一个由较新版本的基础软件驱动的区块链的不言自明实例,用于测试和调试。

StarkNets的前身StarkEx于2020年6月在主网上推出,并为一般智能合约提供支持。部署在StarkEx上的应用程序是dYdX、ImmutableX、DiversiFi和Sorare。到目前为止,他们已经处理了6500万笔交易,四项协议的累计交易量为2150亿美元。StarkEx网络还显示,交易费率为9000个TPS,转账费率为18000个TPS,这相当于以太坊主网执行层交易的可扩展性增加了约600倍。

StarkNet遵循了其令人印象深刻的前身的道路,在完全可组合的网络上提供通用智能合约。可组合性是指应用程序相互协调、相互开发和互连的能力。其他StarkNet合约和通过L1<>L2消息传递的Layer 1合约都支持这种可组合性。StarkNet也将是无权限的,这意味着它使dApp能够利用StarkNets无限规模进行计算,而无需请求在网络上部署的权限。然而,目前StarkNet Alpha仅适用于白名单的dApp。

在与ZK Rollup竞争方面,StarkEx和StarkNet的最大好处之一是他们的ZK-STARK(零知识可扩展透明知识论据)技术。ZK-SNARK和ZK-STARKS都是增强隐私的技术,因为它们减少了用户之间通信所需的信息量。它们也是扩展解决方案,因为它们允许以比本机以太坊执行模块更快的速度验证证明,因为它们不包含非专用系统的全部信息。然而,虽然ZK-SNARKS需要一个受信任的设置阶段,但ZK-STARK使用可公开验证的随机性来创建不受信任的可验证的计算系统。结果是,与ZK-SNARK相比,ZK-STARK在计算速度和大小方面更具可扩展性。

除此之外,ZK-STARKS对计算无界的探测器具有健全性,因为强大的加密原语,如有函数。这意味着验证者确信错误的ZK-STARK的可能性为零。结果:ZK-STARK是后量子的,因为它们的安全性不依赖于证明人的计算能力。有关更多详细信息,请查看下面的推文主题,解释ZK-SNARKS和ZK-STARKS在此背景下的比较。

然而,StarkNet不直接与EVM兼容。相反,他们开发了一种名为Cairo的STARK优化编程语言。Cairo用于在区块链上编写可证明的程序,使开发人员能够使用验证技术。一个名为Nethermind的软件解决方案团队随后开发了一个将Solidity(EVM语言)传输到Cairo的解决方案,因此存在间接的EVM兼容性。STARK和Cairo都是由StarkWare内部开发的,并为其所有生产级应用程序提供了动力。

正如你从下面的StarkNet路线图中看到的,最后一步是将StarkNet带入去中心化治理模式。StarkNet目前没有代币,这意味着普通投资者没有流动的方式投资于该项目,因此也没有技术。然而,去中心化治理模型可能会引入一个相关的代币,该代币可用于推测该技术。话虽如此,StarkNet核心开发人员一再拒绝回答“wen token”的问题,所以这纯粹是猜测。

StarkNet路线图

zkSync

第二个ZK Rollup 项目,我们看看zkSync,这是Matter Labs的主网ZK Rollup 。几个月前,Matter Labs从a16z获得了5000万美元的投资,帮助他们将ZK Rollup 可扩展性带到以太坊。zkSync于2020年6月启动到主网,主要用于可扩展支付。这意味着用户可以以太坊成本的一小部分存入网络并在其他zkSync帐户之间转账。

到目前为止,zkSync已经处理了400万笔交易,总锁仓量2400万美元。2020年7月,该网络通过zkNFT添加了NFT功能。

Matter Lab对zkSync的迭代,zkSync 2.0计划在主网上发布,旨在在ZK Rollup 上具有完全可组合的智能合约。zkSync 2.0将引入zkEVM,这是一种模拟以太坊等环境的虚拟机,从而使其与EVM兼容,并启用以太坊智能合约部署。zkEVM测试网已与Uniswap V2的分叉UniSync成功推出,以演示其功能。自10月推出以来,UniSync在其测试网上处理了300多万笔交易。

zkSync的一个巨大发展是宣布与Ramp合作,直接在zkSync协议上提供法定匝道。这是总体 Rollup 的主要缺点之一的解决方案,无疑将推动zkSync网络的大量采用。

下面的zkSync路线图与StarkNet相似。我们已经看到了将zkSync引入主网的第一阶段。zkSync 2.0将在部署到主网时完成第二阶段。最后阶段,审查阻力,最终将要求平台去中心化并变得无许可,这可能意味着引入治理代币。zkPorter,一个为zkSync 2.0提供链外数据可用性的赌注验证链,预计将有自己的令牌。

Loopring

Loopring是一种ZK Rollup 协议,允许开发高度可扩展的交易所和支付解决方案,允许以太坊上的高吞吐量、低成本交易和支付。Loopring 3.0,他们的第一个ZK Rollup 迭代于2019年12月发布到主网,是第一个部署到以太坊主网的零知识 Rollup DEX协议。最新版本的Loopring,v3.6于2020年12月部署到主网。

到目前为止,Loopring在协议中的总锁定价值超过6.5亿美元。Loopring本身认为,他们的ZK Rollup吞吐量约为以太坊的1000倍,或高达每秒2,025笔交易,这极大地增强了本机以太坊执行模块的用户体验。Loopring利用ZK-SNARKS来实现这一点,就像zkSync一样。

Loopring是唯一具有自己智能钱包的ZK Rollup 协议,可以在iPhone和Android上作为应用程序下载。它允许你在加密资产的 Rollup 时存储,并与他们的ZK Rollup 功能、交易和付款进行交互。然而,目前设置Loopring原生钱包的费用约为300美元。预计在不久的将来,这将被完全免费的Loopring钱包的发布所取代。2021年8月,Loopring宣布,它现在直接在其ZK Rollup 协议上支持NFT铸造、交易和转让。

Loopring有一个原生代币$LRC,可以在包括Coinbase和Binance在内的许多交易所上使用。该令牌在整个2018年分三阶段空投期间发布给Loopring v1的早期用户。$LRC是Loopring协议的治理代币,使其完全去中心化。$LRC YTD的表现如下所示。

以美元YTD计算的LRC表现

在Loopring路线图方面,他们的团队概述了2021年第四季度需要注意的一些事情。鉴于我们只剩下不到一个月的时间了,我们应该预计很快就会看到其中一些功能被添加。首先是在Loopring上开发NFT市场。与StarkWare合作中,去中心化自动做市商功能也被提前预告。

Polygon Hermez

2021年8月,以太坊扩展协议Polygon宣布收购Hermez并与Hermez合并。Polygon是一种用于开发和连接以太坊兼容的区块链网络的协议和框架,目标是聚合以太坊上的可扩展解决方案,从而支持多链以太坊生态系统。他们通过开发执行和数据可用性模块的能力,基本上支持以太坊生态系统的模块化。

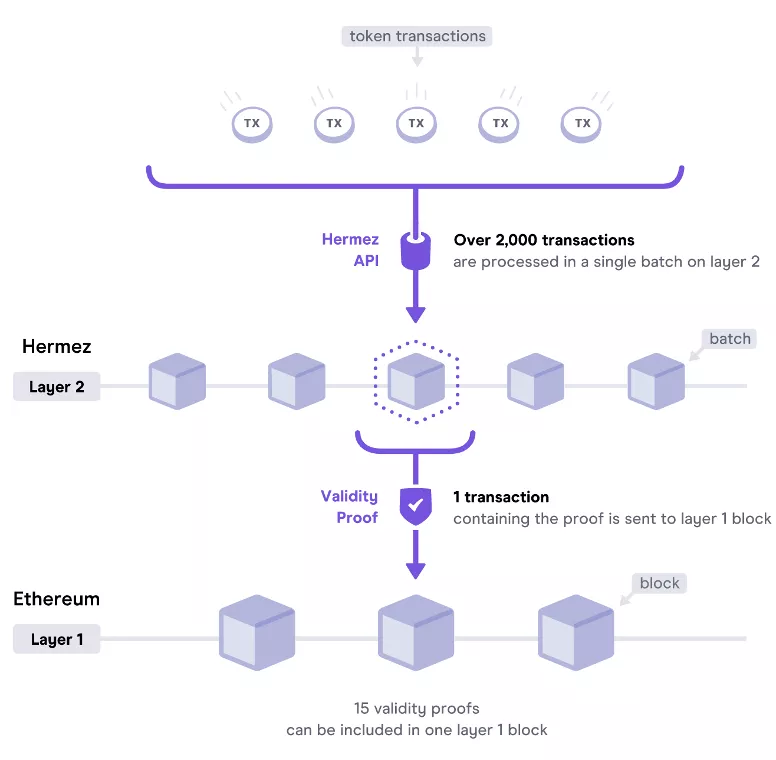

Hermez本身是Polygon生态系统的一部分,是一个开源的ZK Rollup ,由以太坊网络保护,针对安全、低成本的令牌传输进行了优化。通过使用零知识技术,Hermez表示,他们能够比以太坊主网增加133倍的吞吐量,同时将令牌传输成本降低90%以上。

以下是Hermez制作的直观图表,概述了我们在本文中讨论的一般 Rollup 概念,同时解释了如何在单个Hermez网络批处理2000笔交易。

Hermez是一个完全去中心化网络,就像StarkNet和zkSync计划在他们的路线图中一样。这意味着它有一个原生代币$HEZ,用于网络内的治理等。$HEZ代币可在包括Uniswap v2在内的DEX上使用。$HEZ YTD的表现如下所示。然而,鉴于Hermez已被Polygon收购,Polygon拥有现有的原生代币$MATIC,目前还不清楚$HEZ未来会发生什么。

以美元YTD计的HEZ性能

即将到来的 Rollup催化剂

EIP-4488

本文中有一个重要的事情(如果你已经走到了这一步,我假设你对了解ZK Rollup 非常感兴趣!)是 EIP-4488。对于那些不熟悉EIP的人来说,它们代表以太坊改进提案,是指定以太坊潜在新功能或流程的标准。以太坊社区内的任何人都有能力创建EIP,尽管必须充分同意才能实施。

总之,EIP-4488将调用数据成本从每字节16个gas降至3个gas,每个块的调用数据上限为降低安全风险。本质上,这意味着 Rollup 间接成本降低,而对于 Rollup 的最终用户来说,这意味着费用更低。有关EIP-4488的更详细了解,请查看proto.eth在Twitter上的以下主题。

Sharding

Rollup 的另一个重要催化剂将是分片,这是区块链模块化背景下需要理解的一个关键概念,本质上是以太坊数据可用性限制的解决方案。我将发布一篇纯粹关注分片的文章,作为这三部分系列中关于区块链模块化的第二篇文章。

结束语

Rollup 无疑对区块链的未来至关重要,可以说是dApps的日常用户与区块链技术互动的网络。这些用户甚至可能不知道他们正在使用哪个 Rollup ,就像互联网一样,我们经常不知道网站使用哪种云托管服务。

正是因为这个原因,我对 Rollup 感到非常兴奋。我们仍然处于他们生命周期的早期,因此该技术的复杂性和在某些情况下缺少功能。这意味着我们将能够观察它们的发展,甚至可能能够在未来几个月和几年内猜测各种 Rollup 技术。

如果你想了解更多信息,或了解 Rollup 的技术进展及其采用,可以在推特上关注以下人员:

@likebeckett

@epolynya

@SwagtimusP

@EliBenSasson

@l2beatcom