2022如何在混乱和无序中实现生存的胜利?

原文作者:TYLER DURDEN

最恐怖的艺术作品之一是勃鲁盖尔1562 年创作的 《死亡的胜利》 ,这幅画描绘了地球上生命的终结。

我真诚地希望这不是未来一两年世界的真实面貌,但从隐喻上讲,这并不是一个不太可能,这个混乱的描述可能会袭击我们所有人。

(勃鲁盖尔1562的作品《死亡的胜利》)

14 世纪的黑死病瘟疫杀死了世界上多达一半的人口,显然对画家产生了重大影响。

道德信息是,当混乱袭来时,破坏将影响到每个人,无论贫富,老少,没有人会因权力或奉献而逃脱。

即将席卷全球的金融、经济和道德灾难,99.5%以上的人将如晴空万里的一道闪电般突然出现。

对于大多数人来说,即将发生的事件就像CHAOS一词的定义 :“ 完全混乱和无序的状态 ”。

混乱 1:COVID

谈到混乱,就像激发勃鲁盖尔绘画灵感的黑死病一样,世界现在正面临着全球大流行。但是,今天我们看到的不是在 1300 年代中期死亡的近 50% 的全球人口,而是当前占世界人口 0.06% 的大流行造成的总死亡人数!由于应用的分类规则,即使是这个数字也可能被高估。

对于这个微不足道的百分比,世界现在已经连续第三年陷入瘫痪。有封锁、隔离、带有无内衬助推器的强制疫苗、covid 护照、关闭的学校、关闭的办公室、休闲大出血等主要行业、航空公司破产、劳动力、组件、产品短缺、边境关闭,以及少数敢于这样做的人并且可以跨越国界、比在警察国家更多的官僚主义、文书工作和测试。与此同时,印钞和信贷创造呈指数级增长。

政客们显然将所有强加给人民的规则归咎于科学家。有趣的是,世界上有近 200 个国家,每个国家都有不同的规则来应对新冠病毒。如果所有这些规则都基于科学,你会认为所有 200 个国家的规则都是一样的。

或者可能是许多观察家认为政客利用大流行为自己谋利。或者更有可能的是,科学家和政治家都不知道如何应对一种几乎不会造成超过正常死亡人数的疾病?

例如,在瑞典,没有封锁、没有隔离、没有关闭商店、没有口罩要求,工业运作正常。Covid病例和死亡人数处于欧洲平均水平的较低范围。嗯——对于大多数国家的所有这些惩罚性规则来说就这么多了。

我们被告知疫苗会解决问题,但两次注射并没有达到我们承诺的程度。所以现在每个人每隔几个月就需要一个助推器。大型制药公司既是法官又是陪审团,并且从他们自己的建议中受益高达数百亿美元,我们如何知道真实的真相?

例如,我有一个 19 岁的孙女接种了疫苗,她在 8 月份感染了 Covid。现在她第二次感染新冠病毒,幸运的是普通感冒。政府/科学家的解决方案显然是以更频繁的间隔接种更多疫苗。仍然没有人正确测试过疫苗对我们身体的长期影响 ,只是没有时间这样做!?

这些不断变化的规则和关闭的后果,显然将对已经非常脆弱的世界经济和金融体系产生破坏性影响。

混乱2:全球债务

因此,如果科学家和政府不知道如何应对 Covid,我们至少可以假设央行行长和政府已经控制了经济和金融体系。

我们能错到什么程度?自 1913 年美联储成立以来,中央银行和商业银行家一直在为自己的利益成功地运行金融体系。但真正让他们全权印刷无限量钞票的事情发生在 1971 年 8 月,当时尼克松关闭了黄金窗口。从那时起,托马斯杰斐逊总统对银行家的愤世嫉俗的看法真正成为现实。

上面的说法是多么的有先见之明。我们必须记住,美联储是一家完全控制美国金融体系的私人银行。只要美元仍然是世界储备货币,美联储就还控制着全球金融体系的主要部分。

杰斐逊在通货膨胀和通货紧缩方面也是正确的。当前的金融体系正在进入通货膨胀阶段,很可能会导致恶性通货膨胀, 正如我在我的文章中多次讨论的那样。

但在这个金融体系结束之前,完全没有价值的债务必须通过通货紧缩的内爆来摧毁,不仅是债务,还有由凭空创造的印钞融资的泡沫资产。

因此,通货紧缩的萧条很可能是法币体系又一次失败实验的终结,该体系在 111 年前在杰基尔岛创建之日就注定要失败,杰斐逊当然告诉我们这将在 200 多年前发生。

如果历史教会了我们什么,那就是没有人从历史中吸取教训,每个人都认为今天不同,因为我们在这里。

P read ç change, more this is the mê me something——变化越多,就越保持不变。

所以回到勃鲁盖尔。金融体系的崩溃以及全球经济的崩溃显然将对地球上的生命产生重大影响。

我们必须记住, 历史上从未 发生过如此大规模的全球债务危机。欧洲、北美和南美、亚洲、非洲和大洋洲的债务泡沫从未达到我们现在所经历的水平。

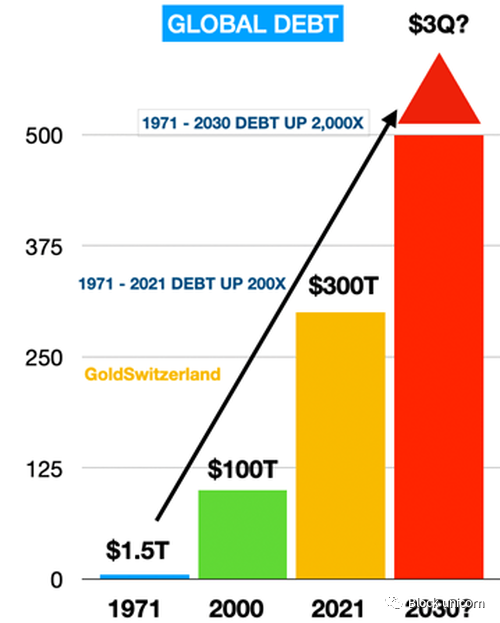

看看自 1971 年以来产生的债务规模。

1971 年全球债务达到 1.5 万亿美元用了几千年。29 年后债务增长了 66 倍至 100 万亿美元,此后又增长了 3 倍至 300 万亿美元。

因此,当 1971 年关闭黄金窗口摆脱束缚时,银行家和政府之间就可以自由地创造无限量的货币。

天哪,他们成功了!自从尼克松拿走美元和所有其他货币的黄金支持以来,全球债务增加了 200 倍。

关于 2030 年 3 万亿美元的债务,我将在本文后面发表评论。这个货币时代的最后阶段始于 2006 年的大金融危机。印刷、借出和担保的数十万亿美元设法暂时修补了 Humpty Dumpty(矮胖子)。

但我和其他一些观察者很清楚,补丁不会持续很长时间。因此,早在 2019 年 9 月,金融体系就承受着巨大的压力,各国央行纷纷恐慌,试图用大量流动性来挽救破产的银行体系。对银行来说方便的是,自从几周后 Covid 开始以来,他们就有了印钞的借口。

通常政府需要发动战争才能有借口印钞票。但是在实验室中产生的流行病效果更好。世界现在处于完全未知和非常不稳定的水域。一艘处于这种危险中的船只只需要一场小风暴就可以遭受无法弥补的损坏。

没有人可以预测会发生什么,因为我们没有什么可以比较的。但很有可能的是,这个由银行家和政府创造的生物(来自杰基尔岛)将迎来可怕的命运——只有未来的历史学家才能告诉世界的命运。

混乱3:衍生品

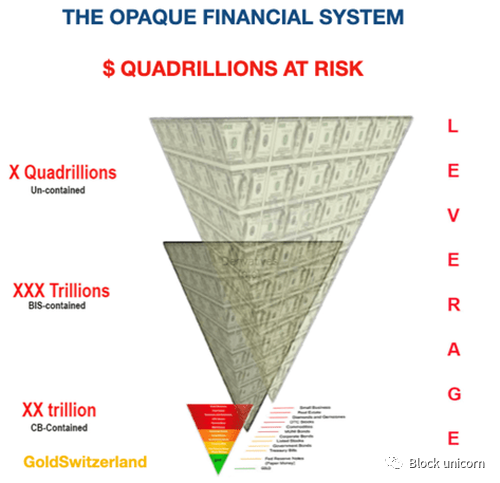

国际清算银行在巴塞尔(国际清算银行)报告的全球衍生品在 2000 年代中期为 1.4 万亿美元。到 2000 年代末,BIS 通过净头寸方便地将这一数字降至 600 万亿美元左右。

德意志银行或摩根大通等银行报告的未偿还衍生品总额为 40-50 万亿美元。但所有银行都将衍生品的总金额净减至微不足道的水平,认为这些低且完全具有误导性的金额是他们的真实敞口。

好吧,银行家有时可以愚弄一些人,但最终我们知道谁才是真正的愚人!净额结算的问题在于,当交易对手失败时,总风险仍然是总风险。

衍生品一直是银行和其他金融实体最不可思议的赚钱工具。今天,有许多不透明的方式可以在官方报告中创建和隐藏衍生品,以至于没有人知道实际未偿付金额,但它很容易达到数万亿美元。

请记住,今天创建的几乎所有金融工具都包含衍生品,无论是 ETF 股票还是债券基金、利率掉期、外汇掉期、抵押贷款等,这个列表是无穷无尽的。

当有持续需求时,衍生品在受操纵的有序系统中运行良好 。但是,当音乐停止并且流动性枯竭时,我们才会知道实际未偿还金额。

我的一个非常好的联系人是对系统风险的出色解释,他创造了这些倒立金字塔,当前的金融体系位于底部,靠的是少量黄金,顶部是巨额债务。在此之上,我们看到了 BIS 报告的 600 万亿美元的已知衍生品,此外还有可能达到数万亿美元的不透明金融体系。

没有人知道确切的金额,但很容易达到2万亿美元甚至更多。

混乱 4:定时炸弹

因此,如果我们展望未来 5-10 年并描绘出金融体系可能发生的情况,世界面临的风险是可怕的。

全球债务肯定会从 300 吨增加到至少 500 吨。这个数字真的被严重低估了。我们再加上全球无资金准备的负债(养老金、医疗保险等),这些负债很容易达到 500 万亿美元。

最后,我们添加了 2 万亿美元的衍生品——也可能太保守了。当交易对手倒闭时,中央银行将需要印制所有货币以防止银行倒闭。

因此,如果我的假设是正确的,那么在未来 5 到 10 年内,全球债务将从 300 万亿美元增长到 3 万亿美元。

但我可能在很多方面都错了,就像它不会花 10 年。我们从历史中知道,恶性通货膨胀进行得非常快。此外,对债务和衍生品的大多数估计可能太低了。

尽管如此,让我们假设世界现在正面临着 3 万亿美元的定时炸弹,确实是一个非常可怕的前景。

沃伦巴菲特在 2002 年将衍生金融工具称为大规模破坏时就知道他是对的。可悲的是,我们很快就会看到证据。

由于历史上所有的货币体系都已走到尽头,我们必须假设有史以来最大的全球泡沫也将终结。

由于这种病态的系统触及我们生活的各个角落,并导致道德和伦理价值观几乎消失的颓废世界,世界需要以森林火灾的形式进行净化,以便新的嫩芽重新开始。

准备并实现生存的胜利

正如我在本文中指出的那样,没有人确切知道事情会如何发展。但我们所知道的是,风险可能比历史上任何时候都大。因此,谨慎告诉我们要摆脱股票、债券和投机性资产等泡沫资产。一旦下跌开始,这些资产的实际价值可能会下跌 90% 或更多,这意味着对黄金而言。

大多数股票投资者可能会在市场下跌时逢低买入,却没有意识到他们会一路走低直至底部。而这一次,市场不会在几年甚至几十年内恢复。

除了住宅物业的正常抵押贷款外,摆脱债务也很重要。拥有实物黄金和一些白银(波动性更大)。这将是您抵御腐烂金融体系的保险。

我们拥有并推荐实物黄金已有 20 年,我们从来没有担心过价格。历史告诉我们,政府和中央银行必定会破坏货币的价值。

但对于那些看金价的人来说,我认为黄金的调整已经结束。总有可能最终下跌 50-100 美元。但这不会有什么区别,因为下一次大幅上涨很快就会达到更高的水平。

最后,我们将在世界上度过艰难的时期。所以帮助家人和朋友是非常重要的。

每个人都有责任抵抗死亡的胜利并实现生存的胜利——无论是经济上的还是精神上的——为了我们能帮助的每一个人。

请记住,生活中许多美好的事物都是免费的——友谊、音乐、书籍、大自然和许多爱好。

尽管我们正在进入一个动荡的时代,但我还是希望我们所有的读者圣诞快乐,节日快乐,以及健康和谐的度过2022。