2021 NFT年终盘点:这是属于NFT的「夏天」

原文作者 | 刘全凯

原文编辑 | Colin Wu

如果说 2020 年是加密货币市场的 DeFi 元年,那么 2021 年毫无疑问是属于 NFT 。

在这一年里,NFT 从去年的不知何物,到截至当下 Nansen 统计下的蓝筹 NFT 系列市值超过 90 亿美元。NFT 的野心从未满足局限于圈内,NFT 成功破壁,传统互联网厂商趋之若鹜,竞相入局,NFT 亦成为了继 BTC、ETH 等主流通证外,又一个成功出圈,并令圈内圈外同样为之疯狂的加密标的。

从 OpenSea 发展总览 NFT 市场

很难说是 OpenSea 的发展带动了 NFT 的繁荣,还是 NFT 的爆发让世人认识了 OpenSea,但当前 NFT 市场绝对的霸主当属 OpenSea 无疑。在这一年里,OpenSea 展现了极强的统治力,据 ConsenSys 分析,OpenSea 交易量可占整个 NFT 市场总量的 97% 左右。

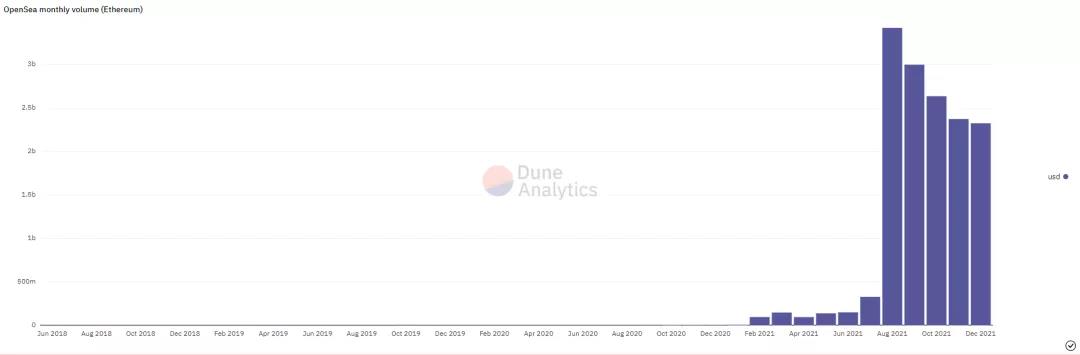

依据 OpenSea 交易量,NFT 市场可划分为如下几个阶段:

无人问津:2021 年 2 月前(月交易量长期低于 1 千万美金,甚至长期不足百万)

初步发展:2021 年 2 月 - 6 月(月交易量维持在 1 亿至 1.5 亿美金,十倍级别的爆发式增长)

蓄势待发:2021 年 7 月(对比前五个月,月交易量实现翻倍增长,超过 3.2 亿美金)

势不可挡:2021 年 8 月(月交易量对比前月十倍大爆发增长达到峰值,超过 34 亿美金)

热度降温:2021 年 9 月 - 11 月(月交易量逐月呈递减趋势,对比峰值月,11 月降低了约 44%)

企稳之势:2021 年 12 月 - 至今(本月交易量已与 11 月时相仿,存在企稳之势)

从划分的阶段上来看,NFT 市场同样展现出了加密货币市场高波动的特征,爆发速度极快,上升并非阶梯式而是跳跃式,因而更容易带动 Fomo 情绪,8 月交易量峰值并非是 NFT 售出最多的月份,交易量衰减的次月才是,以及滞后的活跃交易用户数增长也体现了这一点;但爆发的基础仍然是基于长期主义的厚积薄发,也符合加密货币市场更奖励于早期用户和忠诚用户的特点,12 月的活跃交易用户目前仅次于 10 月峰值,这也为 NFT 市场的企稳创造条件。

总体而言,经过一年的发展,OpenSea 的 NFT 总交易用户超过 85 万,月活跃交易用户维持近 30 万。即便在遇冷期,每日日交易量大多数时候维持在 5 千万至 1 亿美金之间,强势日还能突破 1.5 亿美金。

爆款产品点燃 NFT 市场

NFT 市场的快速发展,离不开爆款产品,而爆款产品的买卖往往又离不开 OpenSea。

OpenSea 将不同类型的 NFT 分成艺术类、收藏类、音乐类、摄影类等。在习惯上,我们常将 NFT 分为收藏型 NFT 和实用型 NFT,收藏型 NFT 主要可分为头像类和艺术画作类,实用性 NFT 则以链游 NFT 为代表。一般认为,收藏型 NFT 的大规模爆发在时间上要稍先于实用型 NFT,这主要是因为收藏型 NFT 主要应用在 ETH 链上,实用型 NFT 则主要在 Axie 大火之后逐渐向 Gas 费用相对较低的 BSC 等链上转移才大规模爆发。

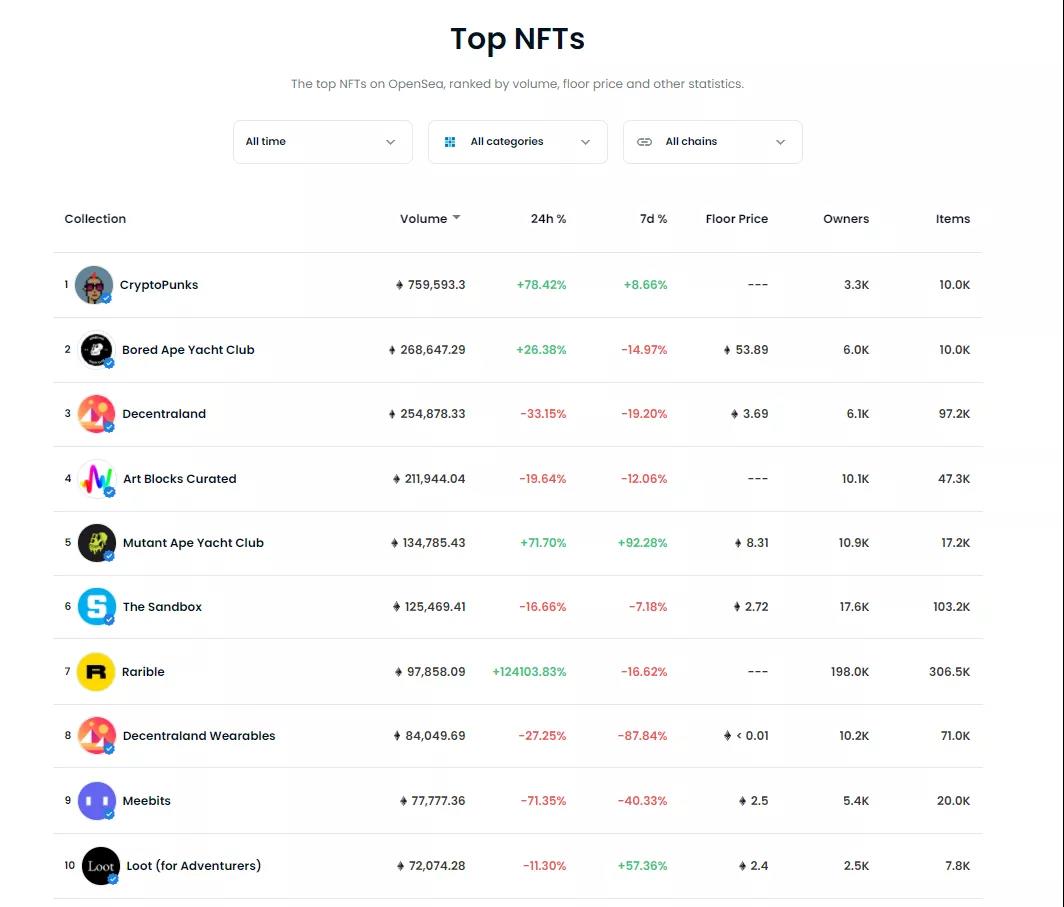

(1)CryptoPunks:最早 ERC-721 艺术作品之一

在 NFT 热潮持续高涨下,那些古老的 NFT 作品,那些曾被时代遗忘的 ERC-721 作品再次成为了人们口中具有跨时代意义的和资本追捧的标的,头像类 NFT 代表 CryptoPunks 便是其中最成功的作品。Ben Roy 曾在《The Fat CryptoPunks Thesis》一文中写到,CryptoPunks 的新颖之处在于它们是以太坊上第一批具有验证唯一所有权的内置方法的数字艺术作品。这是通过加密哈希完成的,因此以太坊上的钱包地址可以以安全的方式拥有对 CryptoPunk 的所有权。

在今年,CryptoPunks 一次重要的跨越式增长正是来自于 8 月 - 9 月间,其销量在此一个月期间翻了一番,总销量超过 11 亿美金,一个月销量超过 6.6 亿美金,几乎占据 OpenSea 8 月交易量的 20%。CryptoPunks 地板价也在此月疯狂地增长至 100ETH 以上。

而更令人意外的是,在 8 月 23 日支付巨头 VISA 宣布以约 15 万美元购买了 CryptoPunks 7610。DappRadar 分析指出,在 VISA 购买之后,CryptoPunks 的平均售价在 2021 年增长了 4580%。此外,购买或收藏 CryptoPunks 的非加密原住民的投资者还包括了著名互联网投资人冯波、著名天使投资人蔡文胜、香港明星余文乐等。

圈内圈外的投资者花费大价钱购买或者偷偷收藏,让传统媒体对购买者或者收藏家争相报道,CryptoPunks 也成为了一种超高曝光度的营销工具,如中国 Meme 社区 Losercoin 与 DefiVillage 合作花费 79ETH 购买 CryptoPunk 7326、Web 3 项目 Mask Network 以 159ETH 购买 CryptoPunk 6128等。

与此同时,一场来自各行各业的不同专家,他们持有 CryptoPunk NFT,并围绕 CryptoPunks 的延申展开社区化的讨论。NFT 俨然又代表了一种社交文化,一种圈层文化,成为认识更多志同道合之人的入场券。然而颇显遗憾的是,这场顶层的讨论似乎并未能开展实质性的行动,逐渐被埋没。

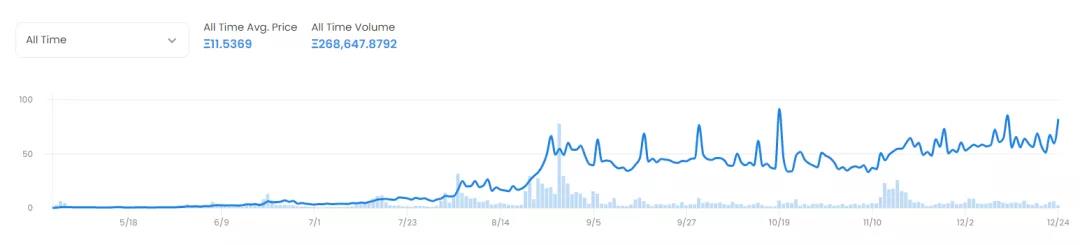

(2)Bored Ape Yacht Club:NFT 中的以太坊、猴子家族的领导者

NFT 市场上有这样一种说法,CryptoPunks 是 NFT 中的比特币,BAYC 是 NFT 中的以太坊。这样的说法体现了两点,一是二者在伴随 NFT 市场的发展都展现出了极高的投资回报和出圈知名度;二是或许体现出了在投资中去寻找估值替代品的做法,在我们认识到 NFT 市场即将要火热起来的时候,CryptoPunks 价格已经很高了,BAYC 正好在各方面都合适,因而也成为了一种替代。

与 CryptoPunks 类似,今年 Bored Ape Yacht Club 的一次跨越式增长同样来自 8 月 - 9 月,甚至在 8 月 28 日当日达到了近 5400 万美金的交易量,而彼时的地板价也已超过 50ETH。

但与 CryptoPunks 在还未步入 NFT 爆发起来的 8 月时其地板价便已超过 20、30ETH 不同,BAYC 在 7 月时其地板价甚至还不到 5ETH。这个在 4 月 23 日才发售的 NFT,在首次发售时还卖不完,直至到 5 月初时,在 NFT 早期收藏家 Pranksy 宣布购买了 250 多个 BAYC NFT 后,其用户和销量才迎来较大增长。

而 BAYC 的成功并不源于 Pranksy 的“喊单“,而是通过将购买了 NFT 的用户迅速笼络了起来,并发展成为了一个庞大且有趣的社区。正如 BAYC 中的 “club” 一样,社区就像是一个俱乐部,用户将其社交头像换成 BAYC NFT,用户彼此间会互相聊天,互相关注。BAYC 团队非常注重社区之间的活动和社区成员与成员之间的互动,推出过 BAYC NFT 持有者专属的涂鸦创作浴室,在 The Sandbox 上购买土地让其成为持有者用户的独特娱乐场所,在 Decentraland 上开展虚拟聚会等。正是社区文化,让 BAYC 能发展并成为 NFT 中仅次于 CryptoPunks 的存在。

除了 BAYC NFT 之外,BAYC 团队还为了让更多的用户参与进来建立或衍生出了一些额外的和猴子相关的项目,如 Mutant Ape Yacht Club、Ape Kids Club 等。曾经在 OpenSea 还出现过在 24h 交易量排名前十被多个猴子项目霸榜的情况。

而 Bored Ape Yacht Club 社区的“会玩“还不仅于此,其官方推出的由 BAYC 和 MAYC 共生的手机游戏上线在即,BAYC NFT 未来将不只是作为一个头像类 NFT 而存在,未来我们可能会看到在元宇宙游戏的某个沙滩上不同猴子家族的成员一起坐着喝着椰汁吹着海风。BAYC 持续的高社区热度让 CryptoPunks 的叙事相形失色,近两日 BAYC 的地板价甚至超过了 CryptoPunks。

(3)Art Blocks Curated:最艺术的艺术 NFT

艺术品是艺术家智力劳动成果的结晶,凝聚了艺术家的思想与灵感。而在生成艺术中,艺术品 NFT 不仅仅是创作者的思潮,还是计算机技术对艺术的一种独特的表达方式。Art Blocks 便是这样的一个随机生成艺术品的平台,生成的每一幅艺术画作 NFT,在真正铸造出来之前,就连创作者也只知其轮廓,留白是计算机独特的“思想力”。

Art Blocks Curated 中不同类别的艺术作品 NFT 价格差异会较大,有的动则价值上百 ETH,有的则显得更加平民化,但相较于 CryptoPunks 和 BAYC 这类 NFT,Art Blocks Curated 作品艺术气息更加浓厚,艺术家花费的心血也相对会更多。因此,Art Blocks 团队和社区也更加倾向于让每位艺术家的作品可以得到更长远的发展。

除了在 8 - 9 月期间,Art Blocks Curated 作品销售较多外,在 NFT 整体遇冷的时候,也仍能有一些新的系列 NFT 获得较好的销量,甚至会因为作品铸造而引发 Gas 费用战。目前,在 OpenSea 销量史上,Art Blocks Curated NFT 销量接近 22 万 ETH,排名第四。多次登上苏富比和佳士得传统拍卖行拍卖便是 Art Blocks Curated 价值的最好体现。

(4)LOOT:缺的并非想象力,而是化想象为现实的大众工具

LOOT,一张黑底白字的 “JPG”。每张 “JPG” 只有 8 行字,如同官方介绍一般简洁。LOOT 是随机生成的冒险者装备,并存储在区块链上。统计数字、图像和其他功能被有意省略,供他人解释。8 行字代表了 8 个不同类型的装备。省略掉所有的视觉效果、统计数据和评判指标,目的在于为 LOOT 持有者让其以自己的方式诠释和描绘出他们对于所拥有的 NFT 的理解。

LOOT 诞生于 NFT 市场热度最高的 8 月末,上线不到一周其地板价便被推高上百倍,一度接近 20 ETH。在这一周中,服务于 LOOT 的各种衍生品 NFT 层出不穷,一时间竟有点分不清是蹭热度还是大家都在为这场范式革命而做贡献。然而热潮退去也只用了不到一周,上周还炒得火热,这周竟然有价无市。而各种 LOOT 的衍生品 NFT 大多真的变成了 JPG,不少日销量跌至个位数,甚至 0。截至目前,LOOT 及其衍生品 NFT 的发展大多表现不佳。

LOOT 的上限可以是无穷的,但下限也十分之高。对于开发者或懂编程、美工的用户来说,LOOT 的诞生是福音,可以根据已有的字符一步一步按照自己的想象力绘制出心目中的画像,甚至还能当成是解密,为此制作各式各样的番外;但对于大众而言,空有想象力而没有能够付出的执行力,市场上还缺乏足够有效且便捷的工具支持更多的用户参与。

不过,LOOT 在一定程度上指引了收藏型 NFT 应更多地往实用型 NFT 和游戏化方向发展的趋势,其所蕴含的对于角色、装备的思想是广大游戏用户所喜闻乐见的。而伴随着 Web 3.0 工具的发展以及链游格局的持续推进,有理由相信 LOOT 会回归到大众视野。

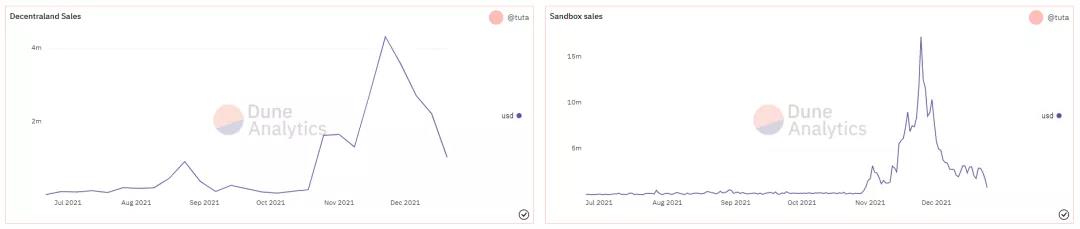

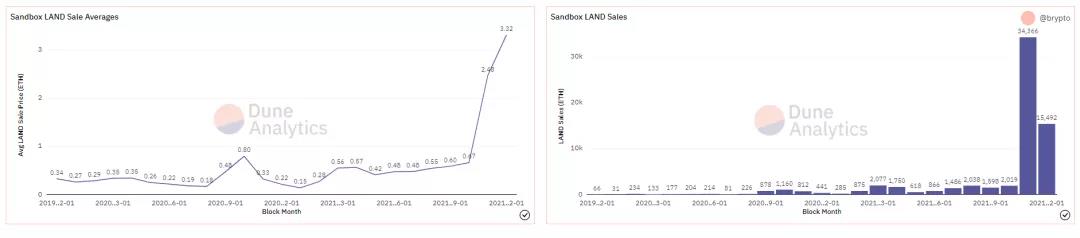

(5)Decentraland & The Snadbox:“炒房热”刮进元宇宙

如果再从 NFT 里挑选出最吸引人眼球的标的,元宇宙房地产一定榜上有名。今年下半年后半段,元宇宙浪潮袭来,作为元宇宙中最重要的生产资料之一的地块 NFT 成为了众人哄抢的对象。抢购最火热的元宇宙游戏的地块,就好比在现实中买一个好地段的房子。

Decentraland 和 The Sandbox 是目前加密货币市场最火爆的两大元宇宙游戏,二者的 NFT 销量主要集中在 11 月,目前前者地板价达 3.617ETH,后者地板价达 2.86ETH。

其中购买元宇宙地块 NFT 的用户不乏一些来自圈外的投资,如四大审计公司之一普华永道在 The Sandbox 里购买土地,入驻元宇宙服务客户;知名歌手林俊杰在推特宣布购买了 Decentraland 的三块土地,约花费 78 万人民币。

拥有了一块元宇宙土地,就相当于拥有了在这片土地上的主宰权,可以按照自己的想法打造任何你想要的世界。随着 VR/AR 等技术的发展,元宇宙的叙事还会持续相当长的一段时间,相对稀缺的大热元宇宙游戏中的地块也会变得更加珍贵。

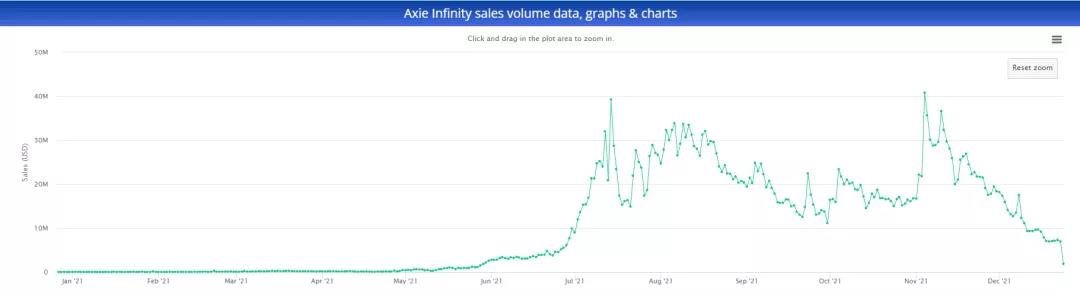

(6)Axie Infinity:链游龙头、NFT 销冠

Axie Infinity 作为一款基于 NFT 的区块链游戏,在 play-to-earn 模式上做到极佳,甚至可以实现让游戏取代工作。自诞生以来,Axie Infinity 在 NFT 销售中达到了 37.58 亿美金,相当于售出了 121 万个 ETH 的资产,这近乎等于 CryptoPunks、Art Blocks 和 Bored Ape Yacht Club 总销量之和。

Axie Infinity 的 NFT 销量峰值有两个波峰,一是出现在七月中旬,当时链游已初显繁荣迹象,自身围绕战斗和繁殖的优秀 play-to-earn 体系以及蒸蒸日上的 NFT 市场让其迅速称为链游中的佼佼者;二是出现在十一月初,收藏型 NFT 热度降温,而链游热度持续高涨,以链游游戏 NFT 为代表的实用型 NFT 得到了市场资本亲睐,也成为了入场游戏的第一张门票,作为链游龙头的 Axie Infinity 也从中得到市场反哺。但随着多款链游的崩盘,以及 Axie 经济系统自身的困境,新入场玩家减少,其NFT 销量下滑明显。

此外,有一点十分关键,Axie Infinity 的 NFT 销售并不直接依赖于 OpenSea 平台,大多数的销量是在自家的游戏平台上完成的。尽管在整体 NFT 市场上很难区分平台和产品间先有鸡还是先有蛋的问题,但在链游的这个局部 NFT 市场中,链游的本质是游戏平台,NFT 销售则是基于此而运行,必然是以在某段时间内优秀的游戏运行机制来吸引用户购买 NFT 参与游戏。

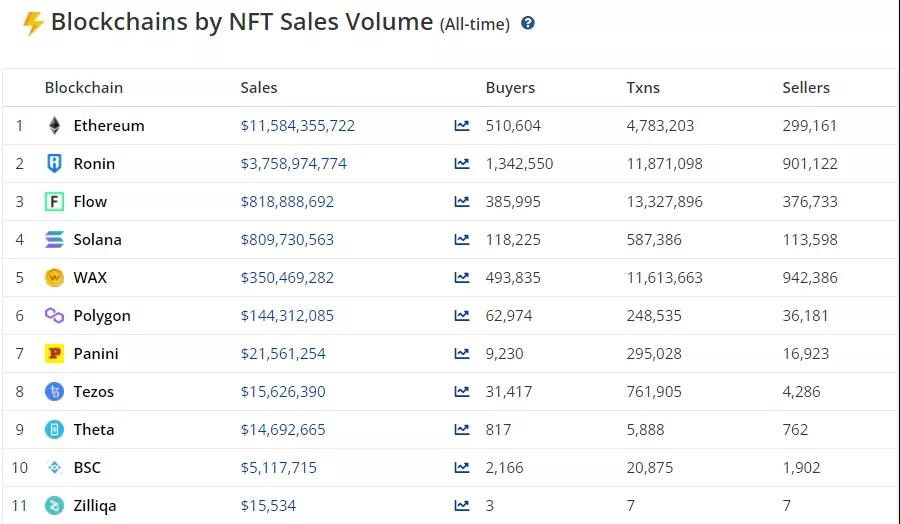

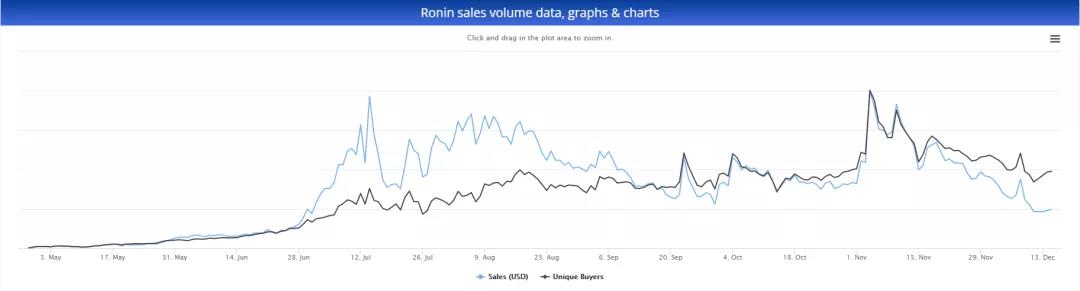

NFT 在公链间的格局与机会

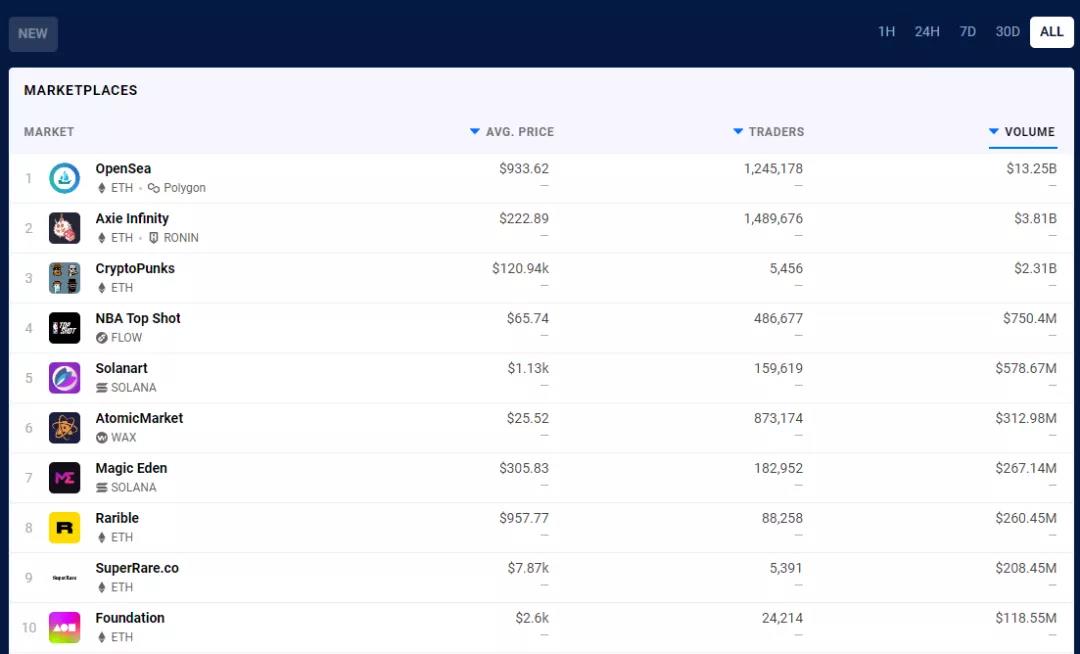

从公链格局上来看,各大公链之间在 NFT 销量上存在明显差异,Ethereum 独一档,Ronin 属于 T2,Flow 和 Solana 则属于第三梯队,WAX 和 Polygon 则靠后;但从交易用户数和交易计数来看,以游戏为生的 Ronin 和 WAX 显然更活跃,Ethereum 和 Flow 差距不大,Solana 则要靠后。

Ethereum 在 NFT 销量远超其他公链,这主要和 OpenSea 及爆款 NFT 主要在 ETH 链上活动有关,其正统性地位无可比拟。但从另一方面来看,潜在爆款 NFT 的铸造往往极易推高链上 Gas 交易费用,这为用户的广泛参与提高了参与门槛。此外,ETH 链上相对较高的 Gas 费用并不太适合需要频繁进行交互操作的链游发展和用户吸引,但对于项目方来说,ETH 链上的正统性是游戏长期运行的重要保障以及相对提高的门槛也杜绝了一部分投机性较强的玩家。伴随着 Ethereum-L2 网络的发展,正统性和 Gas 费用的平衡皆可顾及,届时将更多地还是考验游戏本身的硬实力。因此,基于 Ethereum-L2 网络的链游可以多多关注。

Ronin 的崛起依靠 Axie Infinity 游戏的长期保持较高热度,较多的活跃用户和交易计数也体现了这一点。但在链游的不断发展下,Axie Infinity 面临的挑战者将会越来越多,再加之 Axie Infinity 正面临着早期玩家获利颇丰,通证持续承压,新入场玩家减少的困境,NFT 销量自 11 月第二波峰以来下滑明显,如何破局显得十分关键。另外,尽管 Ronin 更多是因为 Axie Infinity 而推出的链,但从长远来考虑,Ronin 链上单一的布局应该要有所改变,Axie 团队或也可通过推出新游戏或子游戏来寻求母游戏 Axie Infinity 面临难题的破局之道。

作为第三梯队的两条公链 Flow 和 Solana,是投资者值得重点关注的公链。这两条公链一个有别于其他公链的特点是 NFT 的买卖手较为均衡,这让 NFT 的买卖对手方存在更多的博弈空间,NFT 流动性也会相对更佳。

细分来看,Flow 是一条专注于链游和数字艺术品的公链,不追求数量主打精品,享有 NFT 第一公链的美称。Flow 的当家链游是 NBA Top Shot,在体育迷的眼中,这款链游可以带来的经济效益丝毫不亚于 Axie Infinity。目前也有一些游戏公会是以 NBA Top Shot 作为主要打金收入的游戏,如 BlackPool。此外,链上还有备受关注的 Chainmonsters 类宝可梦游戏等。而更难能可贵的是,Flow 团队拥有极高的素养,其更加专注于打磨产品本身,而非尽快的盈利,因此选择在 Flow 链上推出的项目往往都能较好地保持初心,大多不会选择过分早地发行通证,而是专注于将项目打造成现象级的产品。项目方更愿意是与用户共成长,那么对于用户而言,如果不深入链上项目挖掘很有可能会错过一些优质的早期项目。

Solana 背靠 SBF,无论技术还是资金自不必多说,链上与 NFT 相关的生态项目约超过 500 个,其中热度最高的当属链游 Star Atlas。从自宣传手册发布以来,Star Atlas 3A 级别的大制作便广受好评,游戏上线或可能整体拉升链游的质量水平。另外,Solana 上的首个类 OpenSea 的 NFT 销售平台 Solanart 自诞生以来交易量超 5.78亿美金,与 Flow 上的当家链游所产生的交易量相距并不遥远。Solanart 的首个爆款 NFT 是 Degenerate Ape Academy,其为平台带来了超过 1.1 亿美金的销量,目前地板价约 34 SOL。但值得注意的是,Solana 生态的项目较多较杂,在通证发布的时候,往往是以极低的流通量来压低整体估值从而抬升市值,那么对于项目中后期来说通证价格或可能存在持续的承压。

作为活跃用户数量最多的公链,依靠低廉的 Gas 费、相对较低的部署成本和良好的运行体验,BSC 打造了多款爆炸级别的链游,全民打金的盛宴一度将链游热度推高顶峰。然而成也萧何,败也萧何,多款爆炸级别链游一夜之间崩盘成为人人喊打的过街老鼠,甚至直接带崩了链游 NFT 市场。究其根本,这些所谓爆款游戏本身质量极其匮乏以及依靠增量用户和资金推动的机制无法长期持续,雷在游戏初始已埋下,然而大多数用户却被疯狂上涨的价格所煽动。集各种优秀条件于一身的 BSC,显然拥有最适合发展链游的土壤,然而自由发展的土壤难以防止市场劣币驱逐良币,此时玩家在识别优秀链游项目之时,除了技术衡量,更要关注项目方能否保持初心。

另外,当前 BSC 上链游 NFT 的发行往往是在自家的游戏平台上作发行和交易。在链游大热之时,用户极易 Fomo 从而削弱了判断,往往先买后分析,而在热度退散之后,基于自家游戏平台交易或可能无法吸引到足够的关注度。一个能将链游 NFT 等各类型 NFT 归集于一身的类 OpenSea 交易平台显得十分重要,一方面用户进行多个不同游戏不同类型的 NFT 交易会更加方便,另一方面这同时是平台和项目方一种双向的担保与联手。

一家独大的 OpenSea,其他 NFT 平台现状

前文提到,据 ConsenSys 分析,OpenSea 交易量可占整个 NFT 市场总量的 97% 左右,用户和项目方的选择平台的范围变得稀少,往往不得不用。而对于 OpenSea 本身而言,也许也并非完全是好事。彭博社曾报道,OpenSea 正寻求以 120 亿美金以上的估值融资约 10 亿美元,并且进行 IPO。这一定程度上引起了用户的不满。尽管在后续的回应中,OpenSea CFO 对彭博的消息作出一定的否认。但 OpenSea 应该认识到在加密货币领域,社区永远都应该放在首位。作为市场的绝对龙头也不应该背离社区,背离社区也终会被社区抛弃。那么真正根植于社区,以社区化的形式管理和运营的 NFT 平台在未来有望获得用户更多亲睐。

OpenSea 应用的公链主要是 Ethereum 和 Polygon,其中 Polygon 链上交易量仍相对较少,因此在平台上亦可分为 ETH 链上、ETH 外其他链上和多链支持的 NFT 平台。

除去 OpenSea,ETH 链上 NFT 交易平台主要有 LarvaLabs、SuperRare、Foundation 和 Rarible,其中 LarvaLabs 是以 CryptoPunks 交易为主,具有一定的排外性,尽管整体成交量远远超过其他三者之和,但实际用户数较少,以高端用户为主;Rarible 总交易量排名于剩下三者之首,亦不过 260 万美金成交总量,并没有绝对的鸿沟,但其用户数远超其他平台,并且平均售价较低,主要策略是抢占低价位 NFT 市场,以服务零售用户和高频用户,目前通证市值约 7 千万;SuperRare 也是少数发行了通证的平台之一,在运营和管理上也显得更符合社区的定位,目前市值在 1 亿美金上下,策略与 LarvaLabs 相似,主要以中高端用户为主;Foundation 定位则相对更加中性,均价和用户数配比也更为均衡。

除去 ETH 链上,定位于自家公链的 NFT 平台主要集中在 Solana 上。据官方回顾,在 2021 年全年,Solana 共铸造了超过 100 万个 NFT,而这还直接造福了存储 NFT 的 Arweave 协议,NFT 需求的激增带动了存储器协议收入的暴涨。除了上述提到的 Solanart NFT 平台外,还有 Magic Eden、DigitalEyes Market 和 Solsea 等,其中 Solanart 的成交量和交易数用户数都极其出色,承担了 Solana NFT 大半市场的使命;DigitalEyes Market 主打像素风,满足了许多长尾用户的 NFT 资产需求。此外,Solana 上还有两大爆款 NFT 产品,分别是 Solanart 上的 Degenerate Ape Academy 和 Solana Monkey Business,是目前 Solana 上唯二销量超过 1 亿美金的 NFT。

多链 NFT 平台主要是以 BSC 或 Polygon 等低廉 Gas 费为主阵地向外链拓展,主要代表是 NFTrade 和 Treasureland,但受限于公链的整体 NFT 市场规模,二者整体交易量都仍较小。此时一款爆款 NFT 的出现就显得尤为重要,以低 Gas 费为主要阵地的 NFT 平台,其用户量大多有足够的保证,欠缺的是点燃 NFT 市场的火柴。或许链游 NFT 与 NFT 平台强强联手,是破局之路之一。在链游大多以自家游戏平台承担起 NFT 的发售和交易,以及用户对链游持续性信心下降的背景下,链游和 NFT 平台联手推动,双重保障下有望重拾和增强用户的信心,让更多的用户购买 NFT 进入游戏,对于链游和 NFT 平台都会是双赢。

其他

除了传统圈层的大咖入场购买圈内的 NFT 外,不少传统领域的厂商也宣布进军 NFT 市场,但大多数厂商都只是在“粗暴”地向圈内用户发售了自己的 NFT,以获得营销层面的市场加成,热度往往持续不到一周,如百事可乐发售的 Pepsi Mic Drop NFT 系列,地板价从高点下来已夭折,日成交量仅个位数。传统厂商在入局 NFT 时,往往自视甚高,并没有从社区的角度出发,其推出的 NFT 作品的高热度往往首先得益于它在传统领域所打出来的名声。待热度消散,传统厂商或已另寻他处。

国内的 NFT 市场也在积极发展,受限于政策现状,NFT 中 Token 的概念被剥夺,逐渐向数字藏品的概念演变。最值得一提的便是阿里系的基于蚂蚁联盟链数字收藏平台鲸探(原蚂蚁链粉丝粒),与众多知名 IP 合作推出数字藏品。不过平台暂不支持交易,转赠也需要用户持有满 180 天方可发起。但是条件上的阻碍并没有影响投机客的炒作,在二手交易平台闲鱼、阿里拍卖等二次交易或拍卖平台上都出现过将蚂蚁链数字藏品进行期货式交易的炒作。

参考文章:https://ben-roy.medium.com/the-fat-cryptopunks-thesis-d397601e5748

https://new.qq.com/omn/20210713/20210713A087YE00.html?ivk_sa=1024320u

吴说:独立可信的报道者 欢迎在这里关注我们

中文推特 https://twitter.com/wublockchain12

电报Telegram中文频道 https://t.me/wublock

官方网站 https://www.wu-talk.com/

根据央行等部门发布“关于进一步防范和处置虚拟货币交易炒作风险的通知”,本文内容仅用于信息分享,不对任何经营与投资行为进行推广与背书,请读者严格遵守所在地区法律法规,不参与任何非法金融行为。吴说内容未经许可,禁止进行转载、复制等,违者将追究法律责任。