一文洞悉比特币期货 ETF 存在的缺陷与机遇

随着美国欢迎首个基于比特币期货的比特币ETF的推出,比特币(BTC)的价格达到6.2万美元。

ProShares的比特币策略ETF最早将于下周开始交易,投资者可以以$BITO的代码交易这只ETF。其他几家上市公司,Mike Novogratz 的 Galaxy Digital、Cathie Wood 的 ARK Invest、Invesco 和 Valkyrie ,已申请在未来几周推出类似的ETF。

比特币ETF vs 传统ETF

ETF或交易所交易基金只是在纽约证券交易所(NYSE)等公开交易所进行股票交易的投资工具。

它们利用指数作为价格跟踪的代理,跟踪证券的价格,如股票、债券、商品等。

以SPY等追踪标普500指数的传统ETF为例,购买该ETF的股票可以让基金经理获得所需的资金,根据指数的比例购买该ETF中的500只股票。

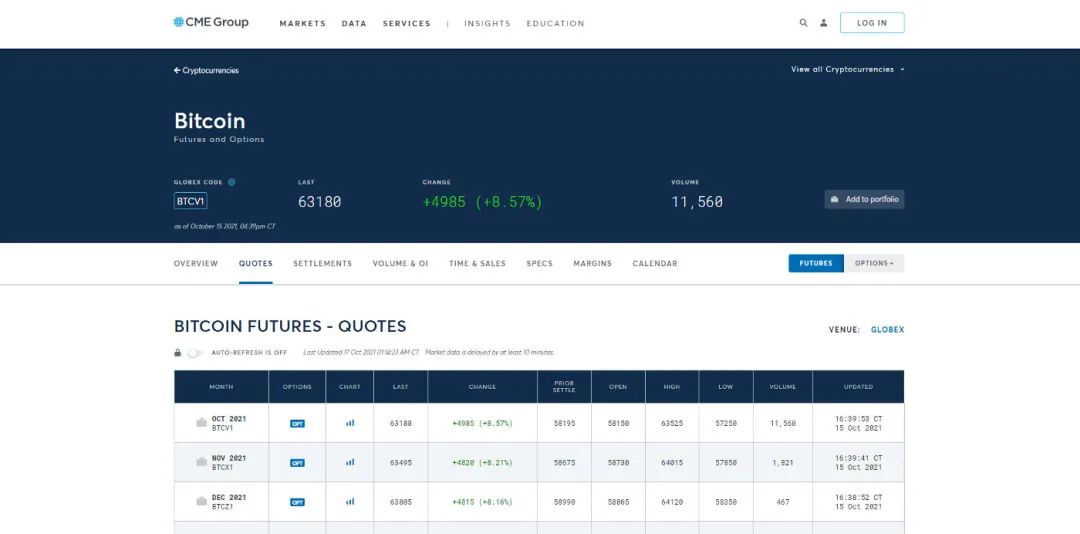

然而,比特币ETF并不是一个纯粹的ETF,它的工作方式也有很大不同。它没有跟踪比特币的现货价格,而是投资于在芝加哥商品交易所(CME)交易的比特币期货合约。投资期货意味着该公司以现金形式持有合成比特币,因为它们为获得监管机构的批准提供了更容易的途径。

彭博社的 $BITO

该基金并不持有真正的比特币,也不持有由真正的比特币支持的股票。相反,你得到的股票与未来购买比特币的合同捆绑在一起。

在通过股票创建过程从投资者或市场授权参与者那里收到现金后,基金经理使用现金投资于比特币的定向投注。假设比特币的价格在期货到期后上涨,然后ETF收到额外的现金回报,可以用于再投资。

因此,这基本上是一种基于现金的彩票,可以用ETF的形式来投机比特币的走向。

比特币期货ETF的缺陷

虽然这是首个在美国公开交易所上市的比特币ETF产品,但它不是对比特币的直接投资,也没有提供对比特币价格变化的适当敞口。

事实上,机构投资者早就可以通过CME期货合约获得比特币期货,而新上市的ETF也以CME期货合约为基础,这降低了机构使用比特币期货的吸引力。

此外,考虑到期货价格偏离期货溢价或现货溢价的情况,ETF往往是一种有用的投资工具,可以尽可能密切地跟踪现货价格。

即将推出的比特币ETF并没有真正利用ETF的一个关键优势,而且由于期货溢价,它的交易价格可能会高于比特币的现货价格,与单纯购买现货比特币相比,它作为投资工具的吸引力更低。

鉴于持有现货比特币的缺点,对比特币期货产品的需求仍是一个悬而未决的问题。

比特币ETF的推出也提供了重大机遇

尽管存在缺点,但对加密货币来说,这仍然是一件大事,因为它们受益于不断增长的零售兴趣和零售资本。

通过比特币ETF,散户和养老金领取者等普通人可以在正常的市场时间投资加密货币,并将其纳入退休和储蓄计划。

这可能最适合那些很难克服在Binance、FTX、Gemini或Coinbase等交易所购买加密货币的人;或者管理加密货币相关的开销,比如私钥或钱包。

我们还看到,Fidelity、Vanguard 和 Blackrock等其他顶级资产管理公司也可能竞相推出和打包自己的比特币ETF和共同基金,以抓住投资者的偏好,在未来10年里赚取管理费用。

在未来几个月,我们甚至不排除出现新的加密货币相关ETF的可能性,如以太坊ETF、ChainLink ETF或追踪广泛加密货币市场的ETF,让投资者有更多机会涉足加密货币。

Source:https://medium.com/stakingbits/bitcoin-etfs-are-coming-heres-what-you-need-to-know-2a9fb0a2c73e

本文来自去中心化金融社区,星球日报经授权转载。