ETH周报 | 9月3日为ETH首个通缩日;MetaMask今年7月活跃用户量突破1000万(8.30~9.5)

作者 | 秦晓峰

编辑 | 郝方舟

出品 | Odaily星球日报

一、整体概述

据ETH Burn Bot统计,9月3日以太坊网络共销毁13,838枚ETH,而产出的区块奖励为13,485枚,净减少352枚ETH,为ETH首个通缩日。据Ultrasound数据显示,截止目前,以太坊销毁总量超20万枚,平均每分钟销毁4.54枚ETH。

二级市场方面,目前 ETH 价格短时可能小幅回调,支撑位 3100 美元,阻力位 3500 美元。

二、二级市场

1.现货市场

OKEx 行情数据显示,上周 ETH 价格一度上涨超过 4000 美元,周内收于 3907 美元,环比上涨 22.5%。

(ETH 日线图,图片来自OKEx)

日线图上显示,价格站上布林带中轨,支撑位为 3800 美元以及布林带中轨 3400 美元;上方阻力位是 4000 美元,短期内有望再次冲击该点位。

2.资金流动

(币牛牛)

资金方面,主力持仓单日最大净流入 5700 万美元(周一),单日最大净流出 9600 万美元(周五);ETH 上周主力持仓净增 1013 万美元,环比下降 70%;未来一周,价格层面将继续保持震荡或小幅回调。

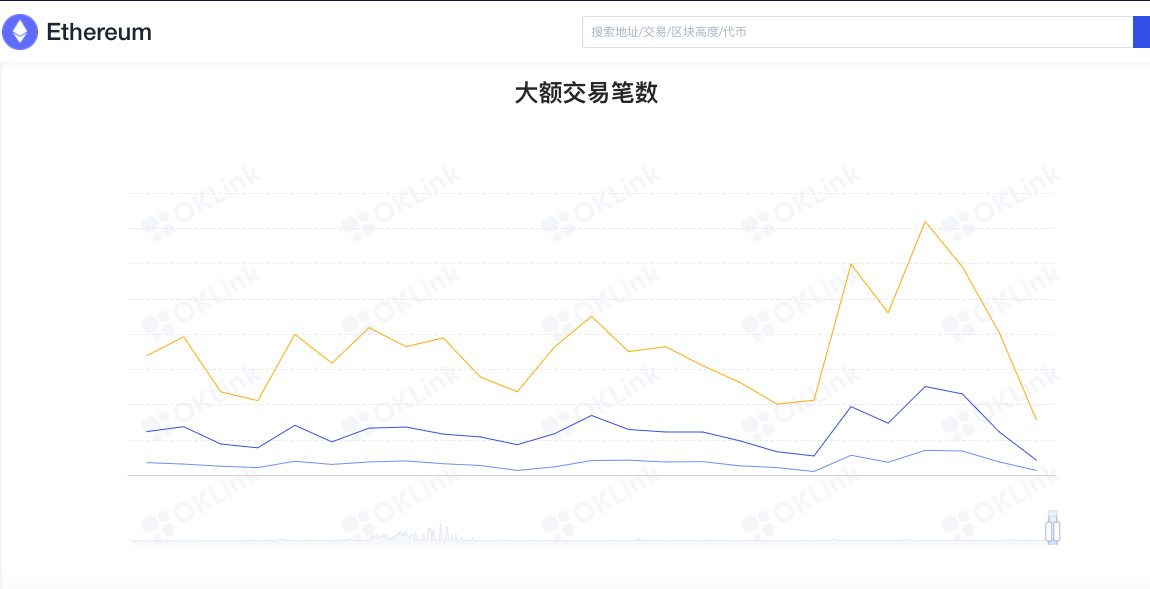

3.大额异动

欧科云链OKlink数据显示,链上转账次数上周小幅上涨,“1000 ETH 以上”、“2000 ETH 以上”以及“5000 ETH 以上”转账次数分别环比上涨 34%、23% 以及 31%,巨鲸活跃程度明显上升。

欧科云链OKlink数据显示,目前 ETH 持仓前 300 名,掌握了总计 53.29% 的 ETH,环比上涨 0.17%;此外,整个持仓分布呈现椭圆形结构,各个部分占比分别是:第 1~100 名,占比 38.92% ,环比上涨 0.42%;第 101 ~ 300 名,占比 14.37% ,环比下降 0.18%;第 301 ~ 500 名占比 6.46% ,环比下降 0.05%;第 501 ~ 1000 名,占比 7.49%,环比下降 0.07%;第 1001 名后,占比 32.78%,环比下降 0.04%。

三、生态与技术

1.技术进展

(1)数据:9月3日为ETH首个通缩日,销毁量比区块奖励多352枚ETH

据ETH Burn Bot统计,9月3日以太坊网络共销毁13,838枚ETH,而产出的区块奖励为13,485枚,净减少352枚ETH,为ETH首个通缩日。据Ultrasound数据显示,截止目前,以太坊销毁总量超20万枚,平均每分钟销毁4.54枚ETH。

(2)以太坊开发者Tim Beiko提醒发送交易时在MetaMask查看优先费,旧版web3js或导致花费用户资金

以太坊开发者Tim Beiko提醒表示,如果用户要发送交易,有必要在MetaMask查看优先费(priority fee)设置的并不是最高费用,若是,可能多付了超2倍费用。大多数时候合理的优先费是1.5-2.5 gwei。原因可能是有升级到最新的web3js版本,如果仍在使用EIP-1559前的web3js,则可能会花费用户资金。

2. 社区之声

(1)V神:以太坊最令我惊讶的用例是NFT

以太坊创始人V神在推特中开展“你问我答”活动,以太坊核心开发者、MyCrypto创始人兼首席执行官Taylor Monahan向V神提问:“以太坊哪个用例最令你惊讶?”对此,V神回应称是NFT。

此外V神表示正在考虑稳定币的问题:“有些人认为稳定币是纯粹的过渡技术,post-hypercryptoization时代的BTC和ETH将稳定下来。我认为这很有可能是错误的。即使在post-hypercryptoization之后,我们仍然需要明确的稳定币。”

前高盛高管、现任Real Vision创始人兼首席执行官Raoul Pal认为以太坊将很快超越比特币。Pal在与YouTuber BitBoy Crypto及其122万订阅者交谈时表示,以太坊今年可能会接近比特币的市值。下一次牛市,以太坊永久超越比特币。Pal这么说的理由是,ETH有许多涉及交易、NFT和开发者活动的用例。与同一阶段的比特币相比,该网络的用户群也在以更大的数量增长。此外,EIP-1559升级正在削减ETH的供应,使其变得数量有限并随后更有价值。此外,随着ETH2.0的到来,以太坊可能会呈指数级增长。然而,由于其升值的价值,大多数持有比特币人更愿意长期持有它。BTC可以成为全球货币的基础,但其他加密货币也可以实现相同的目标。(Crypto News Flash)

3.项目动向

(1)以太坊扩容网络Arbitrum宣布主网测试版本Arbitrum One已全面上线

据官方消息,以太坊扩容网络Arbitrum宣布主网测试版本Arbitrum One已全面上线。官方强调,虽然这是一个重要的里程碑,但Arbitrum One仍处于测试阶段。我们将密切监测此次发布,并保持快速升级的能力,甚至在必要时暂停系统。完全去中心化仍然是我们对Arbitrum One的最终计划,为了专注于这个目标,我们承诺继续使用“beta”的名称,直到实现完全去中心化。我们已经移除了可访问网络的白名单限制,但在生态系统进一步成熟之前,我们将继续保留一个白名单,用于向我们的桥接添加新的代币,并成为一个活跃的验证者。

此外,如果在网络上检测到异常活动或潜在的安全事件,我们会暂停网络。和所有的Optimistic Rollups一样,Arbitrum也有一个特点,那就是需要大约一周的时间来确认提款。资金将在系统内停留一周,并给了我们时间暂停和响应潜在的安全事件。万一真的发生此类事件,快速桥接协议可以取消这种可操作性,因此我们建议所有快速桥接解决方案在早期都限制其流动性。在接下来的几个月和几个星期里,我们将继续监控网络使用情况,提高稳定性和性能,并随着时间的推移逐渐提高交易上限。此外,我们还将添加一些新功能,以进一步改善Arbitrum的开发者体验。

(2)Arbitrum开发商Offchain Labs完成1.2亿美元B轮融资

以太坊扩展解决方案Arbitrum开发商Offchain Labs宣布以12亿美元估值完成1.2亿美元B轮融资,Lightspeed Venture Partners领投,Polychain Capital、Ribbit Capital、Redpoint Ventures、Pantera Capital、Alameda Research和Mark Cuban等参投。(TheBlock)

MetaMask在今年7月的活跃用户数量突破1000万人。根据以太坊软件公司ConsenSys的数据,MetaMask用户从2020年7月的每月545,080名增加到2021年8月的10,354,279名,增幅超过1,800%。现在有超过1000万用户使用MetaMask交换代币、借入、借出、铸造和购买NFT以及玩游戏。此外,MetaMask用户按国家分布排名前十五位的分别是:菲律宾、美国、越南、英国、中国、印度、俄罗斯、巴西、印度尼西亚、泰国、土耳其、德国、法国、加拿大、西班牙。(CoinDesk)

(4)Vine联合创始人计划向所有以太坊地址推出Synthetic Loot代币

Twitter旗下短视频共享应用Vine的联合创始人Dom Hofmann发推表示,将对所有以太坊地址推出合成Loot代币(Synthetic Loot),具体而言,将根据给定的钱包地址返还合成Loot代币的“虚拟NFT”,且每个钱包只有一个,同时因为它不是真正的NFT,所以不可铸造、转移、销售等。此外建立在Loot代币之上的创作者可以选择将合成Loot代币作为一种允许更广泛的冒险家参与生态系统的方式,同时仍然能够轻松区分初始Loot和合成Loot代币。

4.借贷

Defipulse 数据显示,上周链上锁仓抵押品价值从 820.92 亿美元上涨至 978.84 亿美元,一周上涨 19.2%;前一周(8.23~8.29)净减 20.48 亿美元,上周净增 157.92 亿美元,环比上涨 871%。具体来看,上周 ETH 抵押量从 980 万个下降至 976.5 万个,跌幅不到 1%;BTC 抵押量从 195686 个上涨至 202697 个,涨幅 3.5%。

从单个项目来看,锁仓价值前三名分别是:Aave 179.3亿美元;Maker 140.7 亿美元;Instadapp 134.6 亿美元。

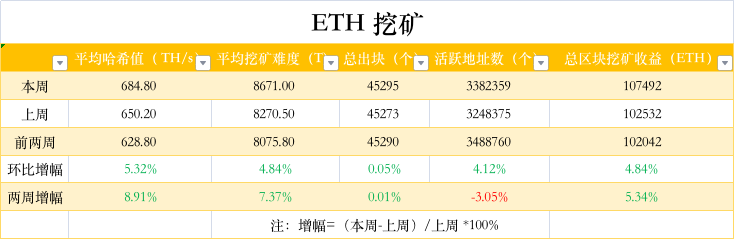

5.挖矿

(数据来自etherchain.org)

etherchain.org 数据显示,平均算力环比上涨 5.3%,暂报 684.8TH/s,算力再创新高;平均挖矿难度环比上涨 4.84%,暂报 8671T;受 NFT 热潮影响,链上活跃度环比上涨 4.1%,挖矿总收入环比上涨 4.8%;特别是 9 月 2 日,以太坊Gas费用一度暴涨,极速高达1776 Gwei,快速达到1082 Gwei(算术平均值)。

四、消息面

(1)数据:以太坊上NFT市值约为110亿美元,接近以太坊市值的3%

Messari分析师Ryan Watkins发推称,Nansen数据显示,以太坊上的NFT市值估计约为110亿美元,接近以太坊市值的3%。

(2)数据:受益于NFT热潮,8月以太坊矿工收入在EIP-1559升级后保持稳定

根据The Block的数据,8月份以太坊挖矿收入为16.5亿美元,比7月份增长了60%以上。币价方面,以太坊本月大部分时间徘徊在3000美元附近,而7月则围绕2000美元波动。数量方面,据Etherscan数据,截止8月29日,以太坊矿工本月共挖得以太坊约6.1万枚,环比大幅减少(7月共挖得9.1万枚)。8月份的矿工收入很大程度上要归功于NFT热潮中,以太坊上的链上活动不断增加,这在NFT市场上产生了大量交易量。8月5日,以太坊的EIP-1559升级后交易费总额下降,因为该升级激活后销毁了之前属于以太坊矿工的部分网络交易费用。(The Block)

(3)英国拍卖行佳士得将于10月1日拍卖NFT Curio卡套装

英国拍卖行佳士得宣布将于10月1日拍卖一套独特的NFT收藏品,称为Curio Cards,这是2017年生产的最古老的以太坊NFT收藏品之一。目前,Opensea上的Curio Cards Wrapper市场数据显示交易量达到22900以太币,约7520万美元,有3,700名Curio所有者。(Bitcoin News)