Coin Metrics以太坊状态报告 :低gas费用会成为新常态吗?

本文来自 Coinmetrics,原文作者:Nate Maddrey 和 Coin Metrics 团队

Odaily 星球日报译者 | Moni

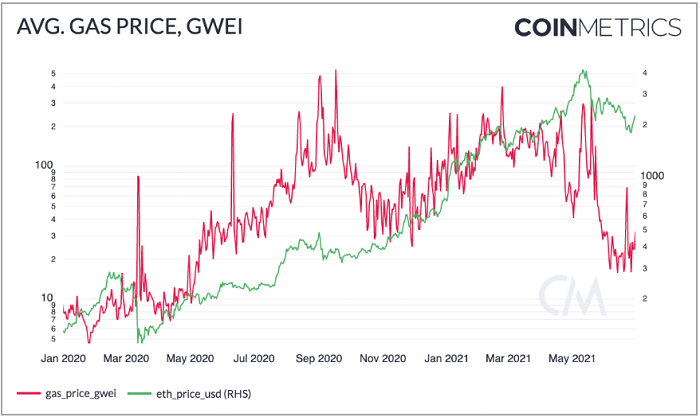

对于以太坊来说,最近最受关注的就是 gas 费用出现大幅下降,目前已降至 2020 年 3 月以来的最低水平。 虽然几个月前 gas 平均价格经常达到 150-200 GWEI,但自 5 月底以来已降至 15-30 GWEI 范围。

上图资料来源:Coin Metrics Formula Builder

虽然这次 Gas 价格的下跌看上去与 ETH 的价格暴跌有关,但实际上,从 4 月下旬开始,以太坊网络交易费用就开始下降,远在市场暴跌之前, 5 月 1 日时,以太坊平均 gas 价格已经低至 40 GWEI。

5 月 12 日和 19 日,ga s价格暂时回升至 250-300 GWEI,这是市场震荡期间 gas 价格表现最糟糕的两天。但经过仔细分析,我们发现 gas 价格大幅上涨是由极端市场状况引起的,而且持续时间相对较短。

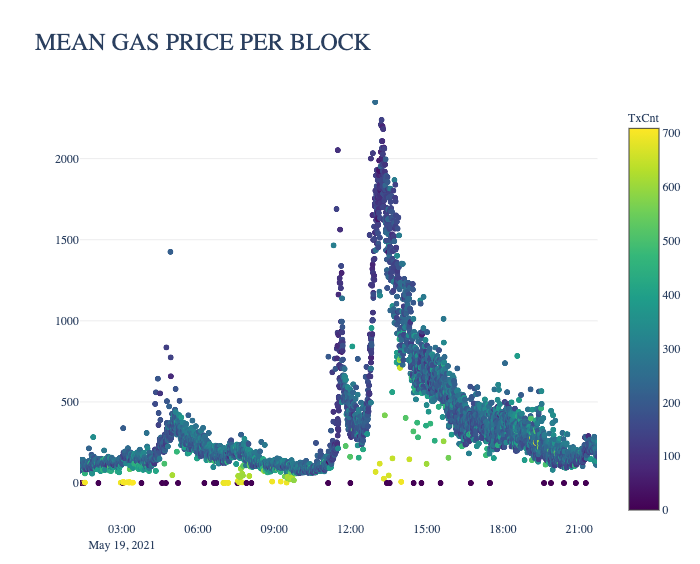

5 月 19 日世界标准时间 11:00 左右,以太坊平均 Gas 价格在不到两个小时的时间内突然从低于 100 GWEI 飙升至超过 2,000 GWEI,然后又在几个小时后下降到大约 300 GWEI。

上图来源:Coin Metrics Network Data Pro

由于以太坊历史上最严重的一次崩盘,导致 gas 价格发生了极端飙升,当时 ETH 价格从约 3,400 美元跌至 1,900 美元以下。突如其来的市场暴跌导致 DeFi 清算螺旋上升,由于投资者拼命试图避免自己的抵押品被清算,导致 gas 价格不断上涨。根据 AAVE 的报告显示,5 月 19 日出现了 AAVE 和 Compound单日清算总额创下历史最高记录。

上图资料来源:Coin Metrics Network Data Pro

事实上,除了 5 月 12 日和 5 月 19 日两天出现相对极端的情况外,以太坊 gas 价格大多呈下降趋势。

那么,为什么现在以太坊平均 gas 费用出现下降呢?实际上,这是由多种因素促成的,主要有三点:

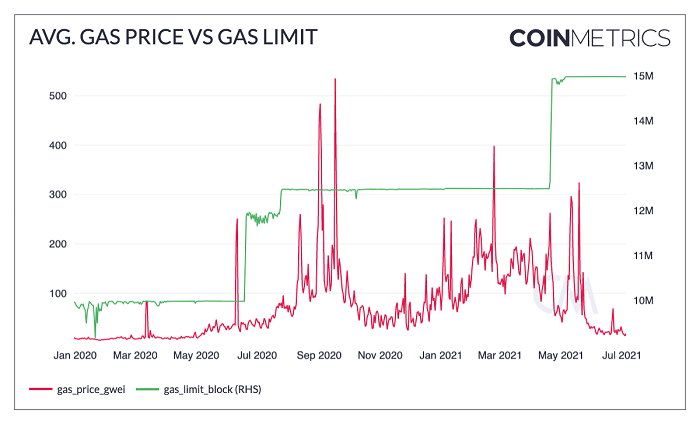

首先,2021 年 4 月 22 日,以太坊的 gas 上限提高到了 15,000,000,这意味着每个区块可以执行的交易操作变得更多,有助于缓解拥堵。

上图资料来源:Coin Metrics Formula Builder

其次,自 4 月下旬开始,一些以太坊扩展解决方案取得了不错的进展。比如:

1、Polygon 是以太坊的侧链可扩展性协议,在过去几个月中势头强劲,目前已经被 AAVE 和其他 DeFi 协议采用。

2、Arbitrum 于今年 5 月底推出,它使用 Optimistic Rollups 来实现网络可扩展性。

毋庸置疑,随着越来越多的交易转向这些可扩展性解决方案,有助于消除以太坊上的拥堵问题并进一步降低 gas 价格。

最后,Flashbots 正在帮助 DeFi 套利机器人不在以太坊区块链上直接进行交易。随着 Uniswap 等去中心化交易所 (DEX) 的兴起,套利机器人已成为高 gas 费用的“主要贡献者”。由于 DEX 交易可以在内存池和链上查看,机器人将监控传入的交易,然后尝试提前进行套利或其他获利机会。对于这种类型的交易而言,交易时机至关重要,因此这些机器人通常愿意支付极高的 gas 价格,以试图给出高于交易对手的价格并优先确认他们自己的交易。但是现在,Flashbots 已经开始将这个竞价过程转移到平行链上,顺利脱离了以太坊主链,这显然有助于减少以太坊区块链上的 gas 费用竞争并降低整体 gas 价格。

在过去两个月中,较低的 gas 价格导致整体 ETH 费用下降,更重要的是,随着 EIP-1559 将于 8 月初上线,gas 费用有可能进一步降低并产生另一个潜在的后果:EIP-1559 部署之后,以太坊区块链网络上消耗的交易费用将大幅减少。

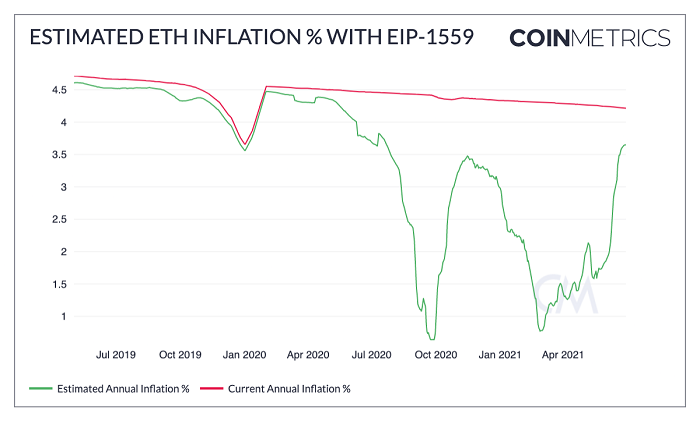

下图显示了如果 EIP-1559 导致 75% 的 gas 费用被销毁,ETH 的年通货膨胀率(30 天平均值)会发生什么变化。(注:就目前而言,EIP-1559 上线后被销毁的 gas 费用的具体百分比数字还不得而言,我们只能参照历史数据,通过从每日发行的 ETH 数量中减去每日费用的 75% 估算得出。)

2021 年 3 月和 4 月初,在以太坊 gas 费用较高的情况下,ETH 年通货膨胀率已经降至 2% 以下,但在 5 月份网络费用下降后,ETH 年通货膨胀率已升至 3.5% 以上。即便如此,这一数字仍将大大低于 ETH 当前的年度通货膨胀率(不会像之前估计的那么低),但是 gas 费用可能会随着时间的推移继续波动。如果最终 gas 总费用回升,以太坊依然可以使用 EIP-1559 的费用消耗机制确保 ETH 年度通货膨胀率下降。

在这些因素的推动下,低 gas 费用可能会成为以太坊网络的新常态吗?坦率地说,这个问题已经引起加密社区广泛关注了。

上图资料来源:Coin Metrics Formula Builder

有关以太坊 gas 机制的详细说明以及在 EIP-1559 之后将如何变化,请参阅以太坊 Gas 报告。要跟踪本文中使用的数据并探索其他链上指标,可以免费查看相关图表工具、公式生成器、关联工具和移动应用程序。

以太坊和比特币网络数据洞察

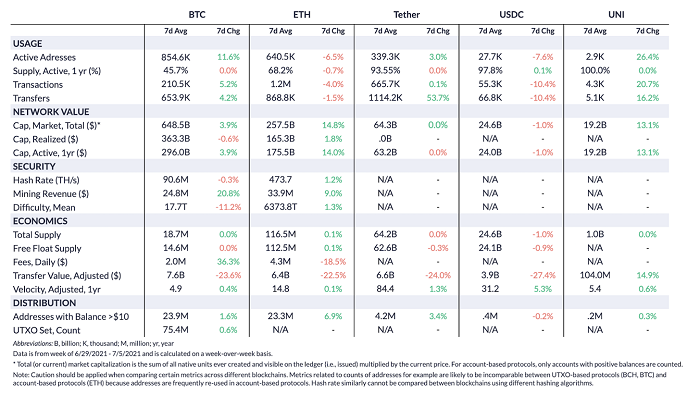

指标汇总

上图资料来源:Coin Metrics Network Data Pro

我们发现,比特币活跃地址周环比增长了 11.6%,但与此同时,以太坊活跃地址却下降 6.5%。在上周短暂超过比特币之后,以太坊活跃地址数量没有增加太多每日活跃地址,现在反而被比特币再次超越。由于区块之间的平均时间飙升,上周比特币 的使用量有所下降,这导致添加到区块链的比特币区块比平时少。区块时间的增加可能是由于网络算力下降导致,这可能会使开采的区块数量减少。6 月 27 日,比特币全网算力跌至 2019 年以来的最低水平后,但从上周开始,算力似乎开始逐渐趋稳。

以太坊和比特币网络亮点

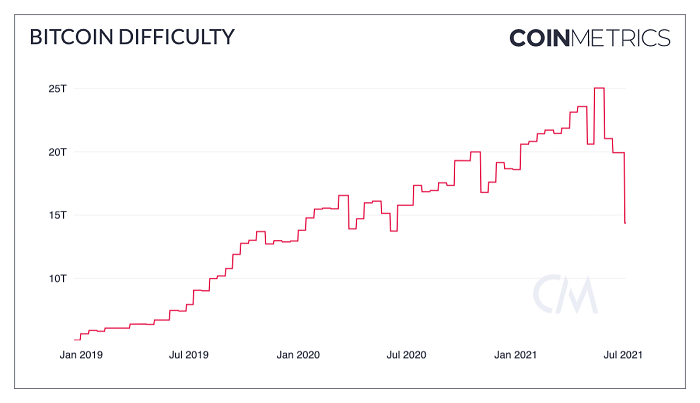

7 月 3 日,比特币挖矿难度下降了约 28%(如下图所示),这是比特币历史上最大的难度下调。尽管过去一个月比特币全网算力出现了相对较大的下降,但比特币网络原始设计可以更好地适应网络变化,并确保网络安全。

上图资料来源:Coin Metrics Network 数据图表

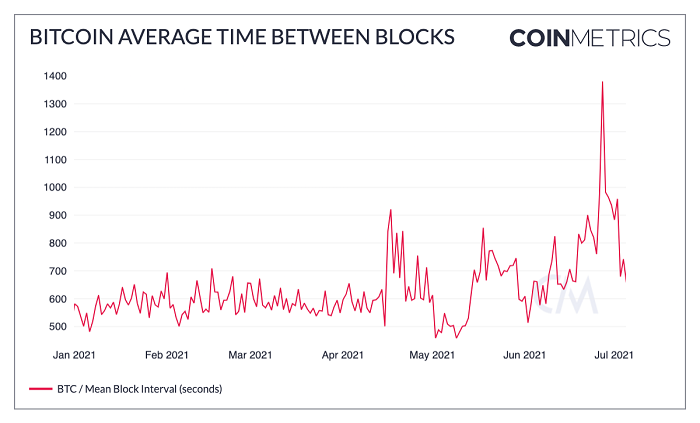

上周,比特币区块间隔时间一度超过 23 分钟,创下自 2010 年以来的最高水平,之后比特币网络进行了挖矿难度调整。比特币的平均出块时间之所以会在 6 月份有所增加,可能是由于四川等省叫停比特币挖矿引发矿工不断迁出中国所导致。

自比特币挖矿难度调整以来,网络平均出块时间已降至约 658 秒,这与初始 10 分钟的出块时间目标已经非常相近了。

来源:Coin Metrics Network 数据图表