Analysis of the Stream Finance crash: 96 hours of handling a $30 million crisis

The collapse of Stream Finance was not an isolated incident. From the first abnormal signals on October 29th to the eventual cessation of the crisis on November 3rd, this 96-hour crisis management exposed the structural fragility of the current DeFi ecosystem. More importantly, the different responses from various stakeholders in this event provide a rare practical example for understanding the boundaries of DeFi risk management.

Liquidity Depletion: An Underestimated Systemic Risk

On October 29th, Ilya Desyatnik, a member of the Gearbox Protocol team, noticed a significant decrease in available liquidity related to Stream on the Plasma platform. In the on-chain lending market, insufficient liquidity is often the starting point of a chain reaction—when the liquidation mechanism fails due to a lack of counterparties, the risk pricing logic of the entire system collapses. A more critical issue lies in Stream's financing structure: its debt has reached approximately $24 million, but its funding methods exhibit a clear lack of transparency on-chain. For any experienced risk analyst, these signals would be enough to trigger alarm bells. However, Invariant Group's initial choice to resolve the issue through negotiation, while perhaps reasonable in traditional finance, sows the seeds of greater risks in the highly non-linear DeFi environment—time costs are often severely underestimated in this market.

From a technical perspective, DeFi protocols inherently have limited risk management toolsets. Traditional financial institutions can rely on margin calls, regulatory intervention, or off-exchange negotiations to control risk exposure, but decentralized protocols must execute all operations through pre-defined smart contract mechanisms. Under this constraint, the effectiveness of risk management highly depends on the forward-looking nature of tool design. In this incident, the Ramping LT (Linear Liquidation Threshold Adjustment) mechanism demonstrated its practical value: this mechanism does not immediately trigger liquidation but gradually lowers the liquidation threshold, providing borrowers with a window for liquidation while avoiding panic selling during liquidity shortages. This design reflects a deep understanding of the microstructure of the DeFi market—that liquidity itself is highly time-varying, and any one-size-fits-all liquidation strategy may backfire. Without such gradual tools, the situation on October 30th could have become unsolvable: if Invariants were forced to liquidate, they might face even greater slippage losses; if they continued to wait, they would completely lose control.

Time pressure and information asymmetry in multi-party games

From October 29th to November 1st, Stream, Invariant Group, and other participants were essentially engaged in an asymmetric game regarding the time value of money. Stream's strategy revealed a typical risk-gambling logic: refusing to close positions despite a 25% annualized interest rate cost on October 30th indicated that its internal assessment was that the probability of a market rebound was sufficient to cover the delay costs. This was an extremely risky decision, because in the on-chain market, once liquidity disappears, any position could instantly lose its exit channel. Invariant Group faced a more complex trade-off. As a curator, they needed to find a balance between protecting the interests of LPs and maintaining protocol neutrality. Adjusting the quota limit to zero on October 31st and preparing multiple Ramping LT execution plans marked a shift in their strategy from negotiation to enforcement. Notably, this shift occurred after Stream's initial repayment of $4.3 million—this partial repayment both alleviated immediate pressure and provided psychological leverage for subsequent negotiations.

Throughout this process, continuous on-chain data monitoring provided the foundational support for decision-making. The Gearbox team tracked DEX liquidity changes hourly, calculated remaining repayment needs, and assessed liquidation feasibility—these seemingly technical tasks actually formed the underlying information layer of the entire risk management process. As one of the protocols using the Invariant market, Gearbox continuously provided data analysis and risk assessments to the curator. While it had no direct right to interfere with the curator's decisions, this information support helped all parties more accurately assess the situation at critical moments. November 1st became the true turning point. When the Morpho Labs market interest rate soared to 85%, all participants knew the game was over. At this interest rate level, the expected returns of any DeFi strategy could not cover borrowing costs, and continued delays would only accelerate insolvency. Stream ultimately chose to repay in full. Although the source of the funds was not publicly disclosed, the scale of the funds (over $20 million) and the speed of mobilization (completed within a day) undoubtedly involved complex off-exchange coordination. The role played by Invariant member Prada in this process once again confirms an often overlooked fact: even in decentralized systems, human judgment, negotiation skills, and execution efficiency remain irreplaceable.

Structural flaws: When centralized pricing meets decentralized clearing

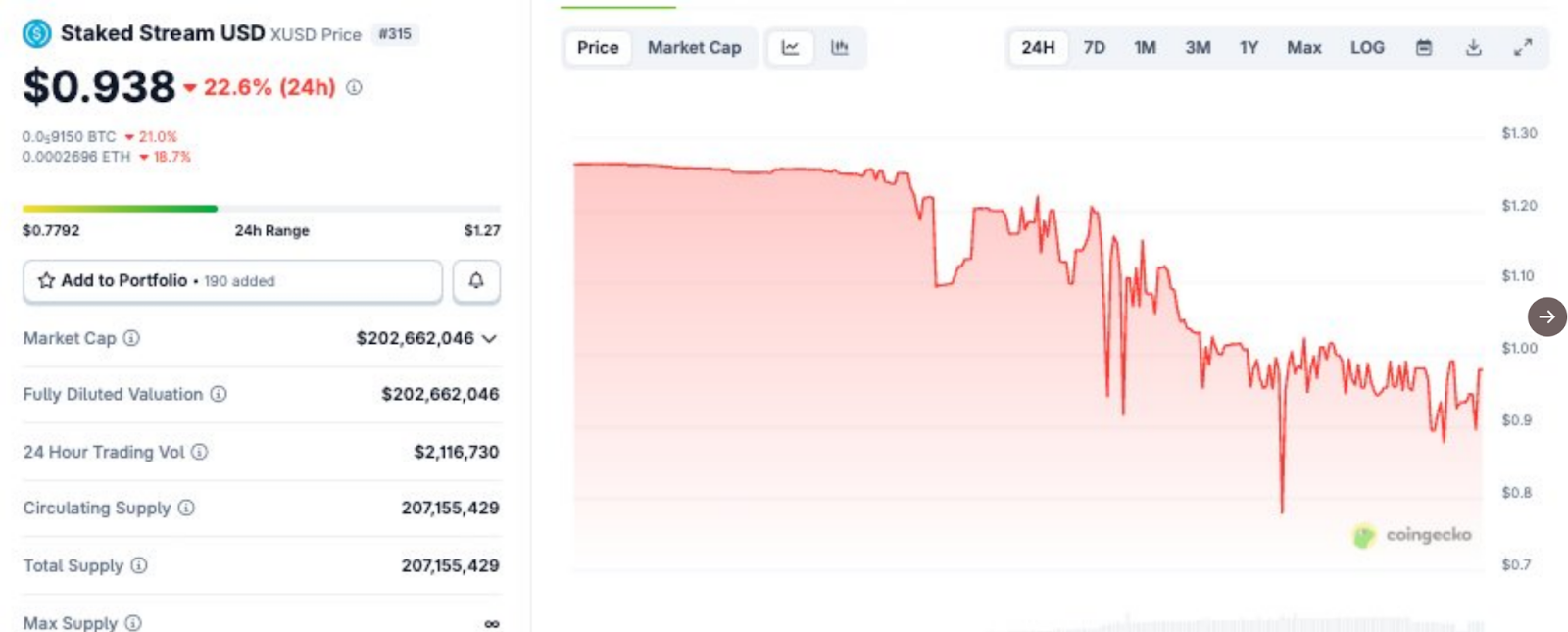

When Stream collapsed on November 3rd, only about $70,000 in residual debt remained within the system. The contrast between the potential loss of $30 million and the final $50,000 in bad debt is stark. For Gearbox Protocol, the impact of this event was minimal, primarily due to early warnings and timely risk isolation measures. However, the handling of this $70,000 exposed deeper systemic problems. Invariant triggered a trade to reduce LT to zero at the last minute, but the liquidation mechanism failed to function as expected: DEX liquidity had run out, while the xUSD oracle price remained at 1.20, significantly deviating from the actual market capitalization. This price decoupling meant the liquidation contract could not find a suitable counterparty, ultimately forcing Invariant to use its own funds to complete part of the liquidation.

This outcome reveals the core contradiction currently facing DeFi: when centralized components (team-controlled oracles, NAV-based pricing, centralized exchange liquidity pools) are embedded in decentralized protocols, the conflict between the two logics can be amplified in extreme cases. Stream's fundamental problem lies not in its code, but in its operational architecture—oracle price updates rely on internal team judgments, funds can be freely transferred on and off-chain, and there is a lack of independent reserve auditing mechanisms. These characteristics make it virtually impossible for external analysts to accurately assess its true solvency through on-chain data. Ilya was able to issue an early warning because he focused not only on the contract logic but also on the entire topology of fund flows—this risk identification capability currently still heavily relies on personal experience rather than a systematic monitoring framework.

Industry-level implications: Tools, early warning systems, and structural reforms

This incident provides several areas for in-depth discussion within the DeFi industry. The maturity of curator toolsets directly impacts risk management efficiency. Modular risk management architectures (such as separating market operations from risk control tools) may be a future trend in protocol design. Gearbox, as a permissionless lending infrastructure, adopts this design approach—the protocol itself does not directly manage the market but provides curators with a complete risk management toolkit, including interest rate adjustments, liquidation threshold controls, asset banning mechanisms, and progressive liquidation tools such as Ramping LT. This architecture maintains decentralization while introducing professional risk management capabilities. However, this also raises new questions: Are curator incentives fully aligned with LP interests? In extreme cases, do curators have sufficient incentive to bear reputational costs to implement stringent measures?

The institutionalization of early warning mechanisms is also urgently needed. While on-chain data transparency provides the technological foundation for real-time monitoring, such monitoring currently relies heavily on individual proactive attention. Without the initial warning on October 29th, all subsequent actions might have been delayed or even missed. The industry needs to establish a more systematic anomaly detection framework, incorporating multi-dimensional indicators such as liquidity changes, debt concentration, and fund flows into an automated monitoring system. A methodology for risk assessment of hybrid assets urgently needs to be established. As more and more DeFi products incorporate CeFi elements (custody, compliance, fiat currency channels), traditional on-chain auditing methods have become ineffective. How to conduct effective due diligence on these hybrid protocols while maintaining room for innovation is a common challenge facing the entire industry. Perhaps a tiered disclosure system similar to that in traditional finance is needed, requiring hybrid protocols to clearly indicate their degree of centralization and key risk points.

The mismatch between perceived returns and risk remains a fundamental problem. Stream's ability to attract $24 million in a short period demonstrates that the market's thirst for high returns far outweighs its rational assessment of risk. In a highly volatile environment where liquidation mechanisms rely on instant liquidity, a 25% annualized return should be seen as a warning sign, not an investment opportunity. Correcting this cognitive bias requires not only investor education but also increased transparency at the protocol level—making risk pricing more explicit.

In the aftermath of a crisis: the mark of maturity is not avoiding failure, but controlling losses.

Looking back at the entire incident, what truly deserves attention is not Stream's failure itself, but the process by which risk was successfully contained within a manageable range. From a potential loss of $30 million to a final residual bad debt of $50,000, this outcome relied on the completeness of the tools, the timeliness of the decision-making, and of course, an element of luck. This incident demonstrated the effectiveness of existing risk management mechanisms but also exposed many shortcomings—early warnings relying on individuals rather than the system, the curator incentive mechanism being imperfect, and the lack of evaluation standards for hybrid assets. DeFi is still a young experiment in financial infrastructure. The rationality of protocol design, the irrationality of market participants, and the gray areas in the regulatory vacuum—these factors intertwine, making any single-dimensional improvement insufficient to eradicate systemic risk. The true mark of maturity is not avoiding all failures, but establishing a mechanism capable of rapid response, effective isolation, and loss control when failures occur.

For market participants, the practical significance of this event lies in the following: the risk structure behind the yield is more important than the yield itself; so-called "decentralized protocols" may contain a large number of centralized components, which need to be identified one by one; early warning signals are often hidden in details such as changes in liquidity and fund flows, rather than obvious price fluctuations. In the fast-paced DeFi market, 96 hours can be the entire cycle of a crisis from its inception to its outbreak. Whether or not the correct judgment can be made within this window often determines the magnitude of the loss.

- 核心观点:DeFi风险管理暴露结构性脆弱。

- 关键要素:

- 流动性枯竭引发2400万美元债务危机。

- 渐进式清算工具Ramping LT控制损失。

- 预言机价格脱锚暴露中心化组件风险。

- 市场影响:推动DeFi风控工具与预警机制升级。

- 时效性标注:中期影响