From Jay Clayton to Gary Gensler, the "eight-year legendary road" of BTC ETF

This article comes frometf, original author: Sumit Roy

Odaily Translator |

Odaily Translator |

Holding BTC may be an experience like no other for the average investor, but not everyone has easy access to the digital currency. US investors can open a Coinbase account to buy and trade Bitcoin, however not everyone is willing to do so, and for various reasons, people seem to prefer buying and selling securities in traditional brokerage accounts.

And this is where the BTC ETF comes in handy.

There are every indication that a BTC ETF is just around the corner.

secondary title

eight years legend

It's been a long road for those in favor of a BTC ETF. Cameron (Cameron Winklevoss) and Tyler Winklevoss (Tyler Winklevoss) twin brothers who accused Facebook founder Mark Zuckerberg of plagiarizing their ideas had already submitted a BTC ETF application to the SEC in 2013.

However, today, eight years have passed, and no BTC ETF has been approved.

The rejected ETFs come in all shapes and sizes, ranging from “physical” BTC ETFs, to futures products that hold derivative contracts on CME, to long-only funds, to leveraged and inverse products — — but all of those filings failed to pass the SEC's scrutiny.

secondary title

The Jay Clayton era

Former SEC Chairman Jay Clayton has not been kind to cryptocurrencies.

In the eight-year journey to the approval of a U.S.-listed BTC ETF, nothing has been more torturous than the summer of 2018. In August 2018, the SEC rejected 9 proposed BTC ETFs in a single day, and Jay Clayton (2017-2020), who served as the chairman of the SEC at the time, explained it this way in 2018:

“All platforms that trade digital currencies lack rules and oversight to prevent market manipulation.”

“While CME and CBOE are regulated bitcoin derivatives markets, the SEC cannot draw conclusions based on market size records. Furthermore, since bitcoin futures have been traded on CME and CBOE since December 2017, the US The Securities Commission has no basis to predict how these markets will grow or develop over time, or if or when they are likely to reach significant size."

secondary title

now, it's time

After seeing the attitude of Jay Clayton, chairman of the US Securities and Exchange Commission, there are fewer and fewer applications for BTC ETFs, but the dream of listing in the United States has never disappeared. After two years of calm, with the departure of Jay Clayton, the number of applications for BTC ETFs in 2021 has increased significantly, and the market's expectations for the successful launch of BTC ETFs have reached unprecedented heights.

Frankly speaking, there are three main reasons for the approval of BTC ETF:

First, the cryptocurrency ecosystem has become more mature over the past few years. At the time of writing, the market capitalization of Bitcoin has exceeded $1 trillion, and Bitcoin futures have been traded on CME Group for more than three years; many reputable exchanges have started offering BTC trading and/or custody services, such as PayPal and Fidelity wait.

Finally, perhaps the most important reason for the listing of BTC ETFs in the United States is that the chairman of the US Securities and Exchange Commission has changed! The new chairman, Gary Gensler, has directly hinted that a BTC ETF may be approved.

secondary title

Gary Gensler is here!

In August of this year, Gary Gensler expressed his willingness to consider BTC ETFs in his speech at the Aspen Security Forum, after which the market's expectations for the SEC's final approval of BTC ETFs rose sharply.

Gary Gensler said at the time:

“I anticipate filings for ETFs under the Investment Company Act ['40 Act], which, when combined with other federal securities laws, provide important investor protections. Given these important protections, and I look forward to staff reviewing such applications, especially if the documents are limited to Bitcoin futures traded on CME.”

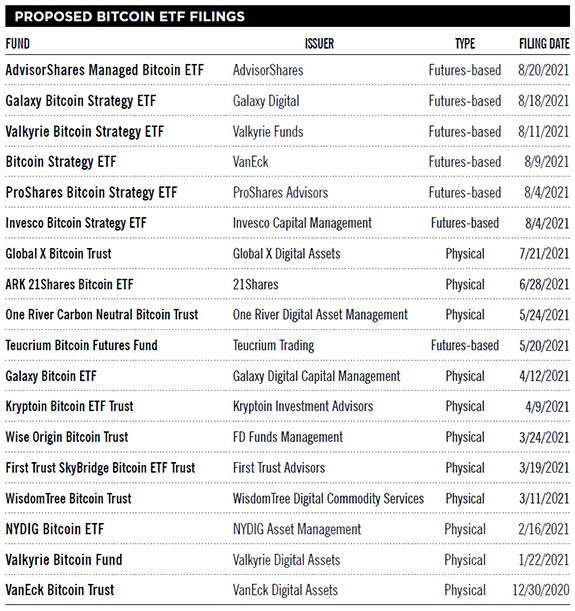

The market was quick to react to Gary Gensler's stance, and within two weeks of his speech, six futures-based bitcoin ETF filings made it to the SEC.

The good show is finally about to begin.

secondary title

rising expectations

If 2018 marked a market low for U.S. BTC ETFs, with the arrival of Gary Gensler, market interest began to gradually pick up.

After the U.S. Securities and Exchange Commission approved three BTC mutual funds this summer, there is a growing sense that regulators may finally approve a Bitcoin ETF. Since these funds invest in Bitcoin futures, the market believes that futures-based ETFs may First to be approved.

secondary title

Summarize

Summarize

After “eight years of struggle,” the jury is still out, at least for now, on whether the U.S. will be able to list a BTC ETF, but analysts say the first BTC ETF is likely to be popular with investors once it is approved by the SEC — — although perhaps not as much as the popularity of “physical” Bitcoin ETFs.

The general consensus in the U.S. ETF industry is that BTC ETFs are almost a done deal, as U.S. regulators are unlikely to prevent the products from starting trading next week.