用链上数据分析FTX三大关键问题

本文来自 Bankless,原文作者:Ben Giove,由 Odaily 星球日报译者 Katie 辜编译。

这是加密领域最黑暗的日子之一。由 SBF 领导的第二大中心化交易所 FTX 正处于崩溃的边缘。FTX 已无法满足用户 1:1 的提款需求,据称有多达 80-100 亿美元的客户存款缺口。

目前尚不清楚 FTX 究竟是如何损失了如此巨额的资金,但许多人猜测,FTX 与 SBF 联合创立并拥有的交易公司 Alameda Research 之间存在资金密切往来。

链上数据告诉我们的也是冰山一角,我们回顾了昨天 FTX 的一系列操作,结合现状和数据深入了解事情是如何展开、Alameda 和 FTX 之间的联系,以及流动性危机对 DeFi 世界的影响。有主要以下三大疑问:

用户从什么时候开始集体从 FTX 取款?

Alameda 向 DeFi 转了多少钱?

哪些 DeFi 协议受到的打击最大?

FTX 经历了大规模的挤兑,巨鲸投资者纷纷逃离

过去一周,FTX 的提款金额超过 87 亿美元,存款金额为 77 亿美元,净流出金额为 10 亿美元。不出所料,这是这一时期所有交易所中规模最大的一次。

交易所的流入与流出。来源:Nansen

尽管在 11 月 6 日 CZ 发布关于 FTX 的推文后,恐慌开始出现,但早在此之前,该交易所就开始出现明显的资金流出。

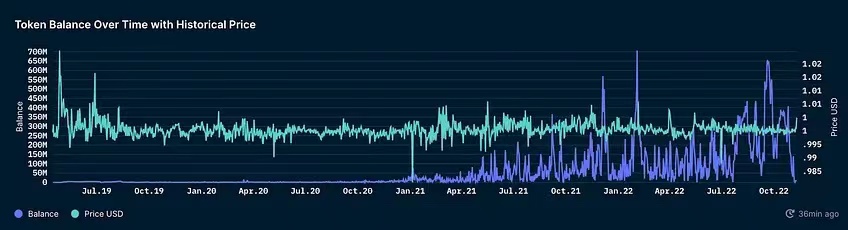

FTX热钱包的USDC余额。来源:Nansen

例如,FTX 的主要以太坊热钱包中的 USDC 余额在 10 月 26 日达到了 4.083 亿美元的峰值,尽管在此期间发起的许多提款都来自 Alameda。这就提出了一些问题,比如他们是否需要提取资金来满足其他地方的流动性需求。

我们还可以看到,交易所稳定币流动性的下降速度惊人。11 月 4 日,FTX 钱包持有 1.403 亿美元的 USDC,但到 11 月 6 日,随着挤兑开始全面形成,这一数字减少至 310 万美元。

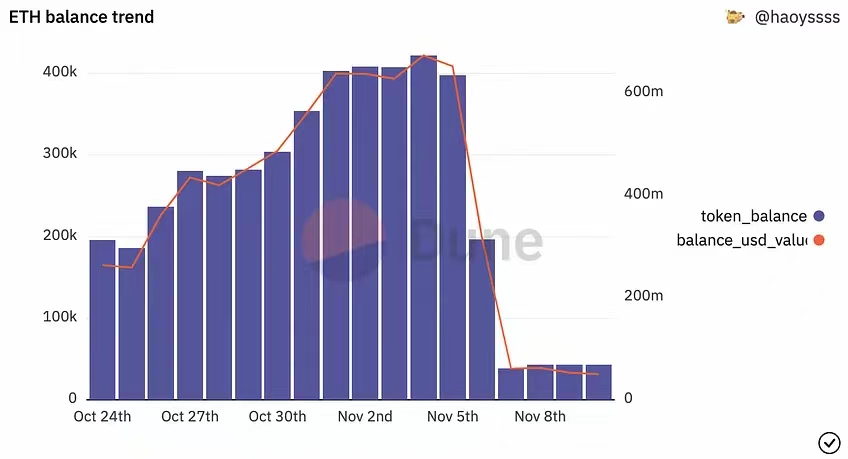

在 CZ 发布推文后,FTX 上持有的 ETH 也大幅下跌,在 11 月 5 日至 11 月 7 日期间,有超过 35.8 万个 ETH 被从平台上撤出。

FTX的ETH余额。来源:Dune Analytics

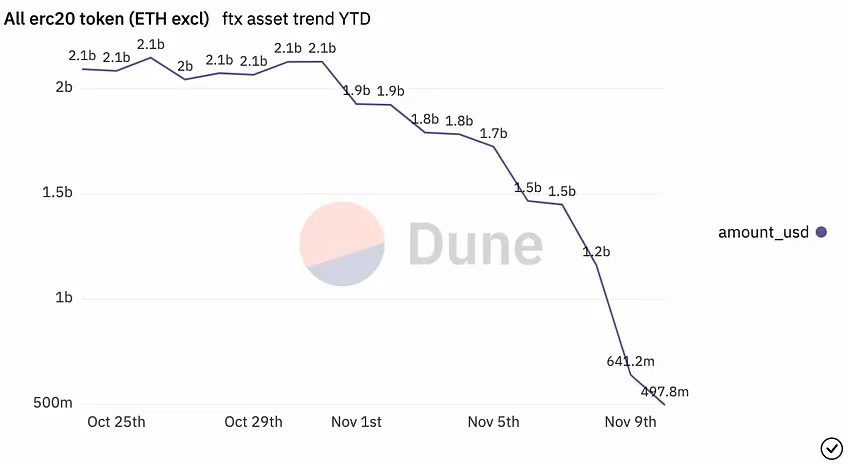

最后下跌的是非 ETH ERC20 代币,在 11 月 5 日至 11 月 10 日期间,这些资产在平台上的价值下跌了约 10 亿美元。尽管其中一些原因可以归因于稳定币流出和价格下跌,但这一余额似乎下降得更缓慢,这一事实表明,FTX 用户“逃往优质资产”,因为他们首先撤出规模较大、流动性更强的资产,然后转向规模较小、流动性较差的资产。

FTX的ERC-20代币余额。来源:Dune Analytics

虽然许多大户(如 Multicoin Capital)都有大量资金被困在 FTX 上,但一些巨鲸能够带着部分或全部资金逃出去。

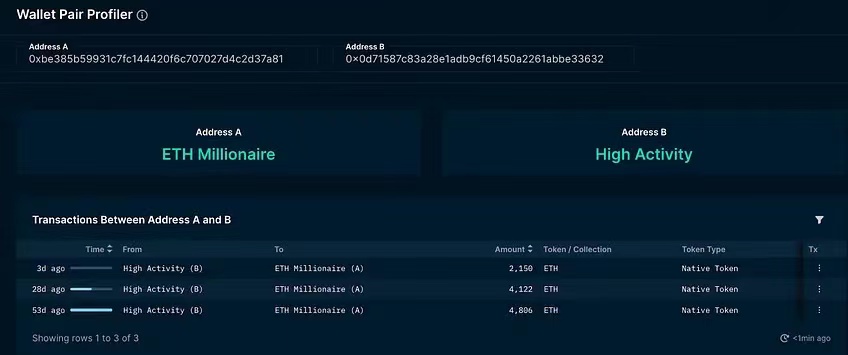

例如,一个名为 0xbe385b59931c7fc144420f6c707027d4c2d37a81 的钱包在 11 月 6 日至 8 日期间从 FTX 提取了 2.69 亿美元的 USDC 和 USDT。

目前还不知道这个钱包的主人是谁,不过我们可以通过查看它与其他地址的有关联系来收集一些线索。

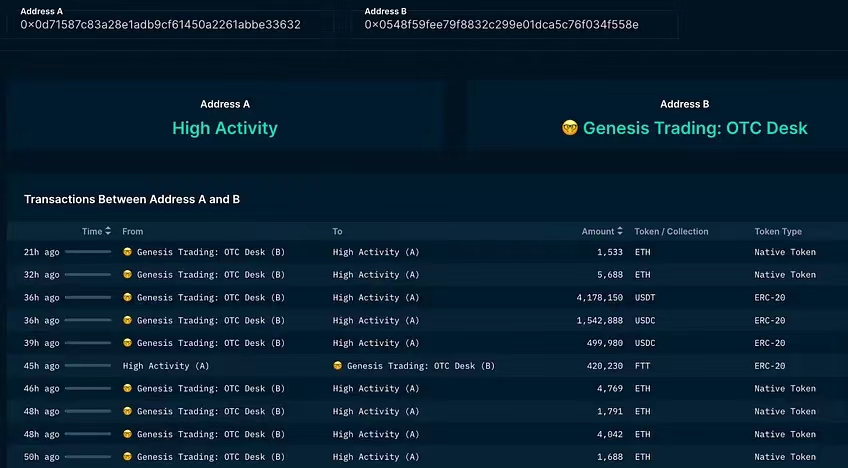

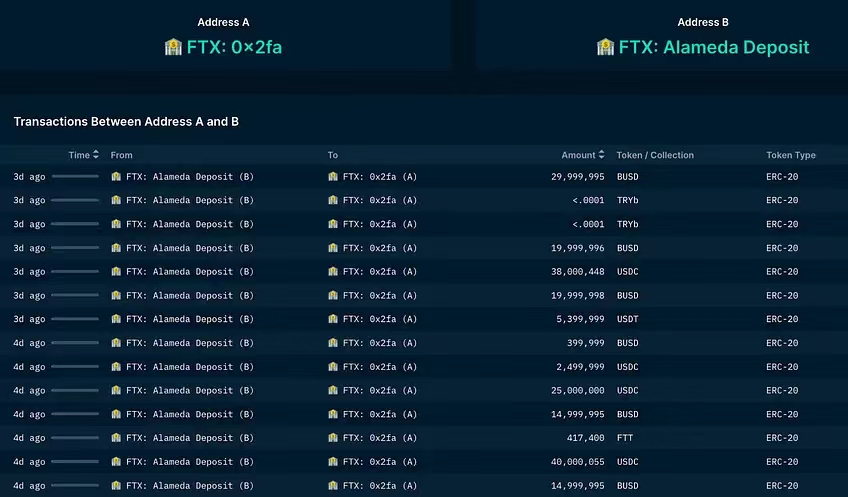

钱包A和钱包B之间的交易。来源:Nansen

自创建以来,钱包(我们称之为钱包 A)已经从另一个地址:0x0d71587c83a28e1adb9cf61450a2261abbe33632(钱包 B)收到了 11008 个 ETH。

钱包B与Genesis OTC交易。来源:Nansen

B 也有同样有趣的交易记录。自创建以来,它已经从 Genesis 场外收到 857860 个 ETH,同时向三箭资本发送 507785 个 ETH。

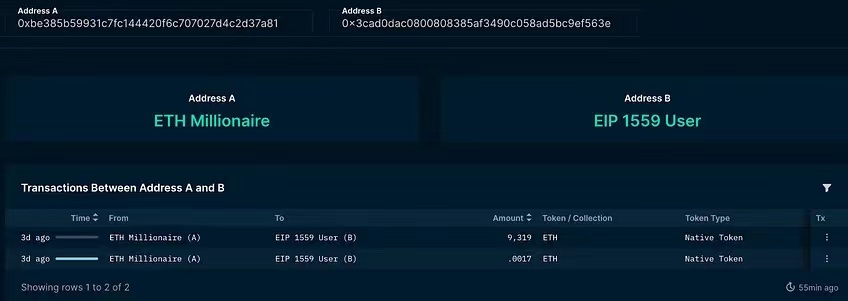

钱包A和钱包C交易。来源:Nansen

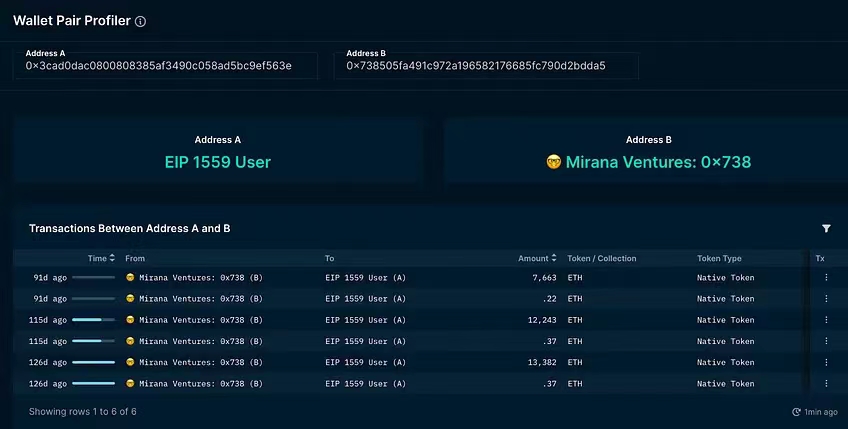

A 也向另一个钱包 0x3cad0dac0800808385af3490c058ad5bc9ef563e(钱包 C)发送了 9319 个 ETH。钱包 C 自身有一个出色的交互记录,接着,它从 Mirana Ventures(中心化交易所 ByBit 的早期投资部门)收到了 33289 个 ETH。

钱包C和Mirana Ventures之间的交易。来源:Nansen

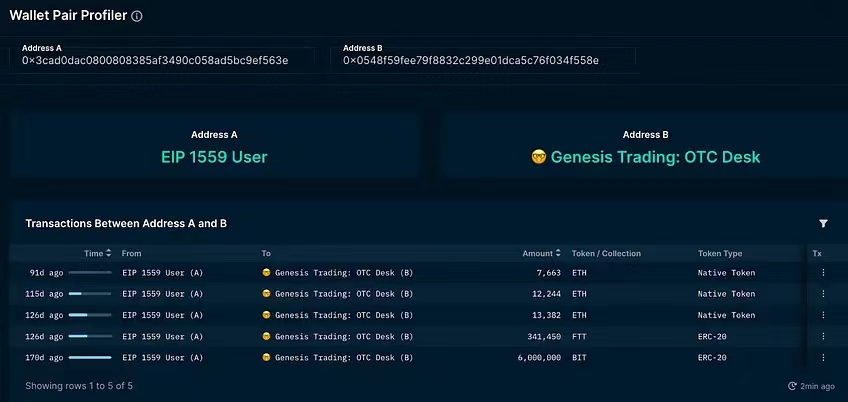

在收到 Mirana 的 ETH 后不久,钱包 C 将其转移到同一个 Genesis 场外钱包。

钱包C与Genesis OTC交易。来源:Nansen

Alameda 堵住了 FTX 的资金漏洞

过去几天发生的事件和披露清楚地表明,FTX 和 Alameda Research 的关系比许多人想象的更为密切。当观察交易数据时,这一观点得到了证实,它表明 Alameda 正试图帮助填补 FTX 的漏洞。

尽管如前所述,Alameda 在 10 月 25 日至 11 月 4 日期间从 FTX 提取了数千万美元,但在 11 月 5 日至 7 日期间,Alameda 将超过 3.609 亿美元的 USDC 和 BUSD 存入 FTX。

这似乎证实了 FTX 与 Alameda 资金混杂在一起的说法,因为没有一个寻求保全资本的参与者会将资金存入正在经历挤兑的金融机构。Alameda 似乎尝试过,但未能堵住 FTX 看似巨大的漏洞。

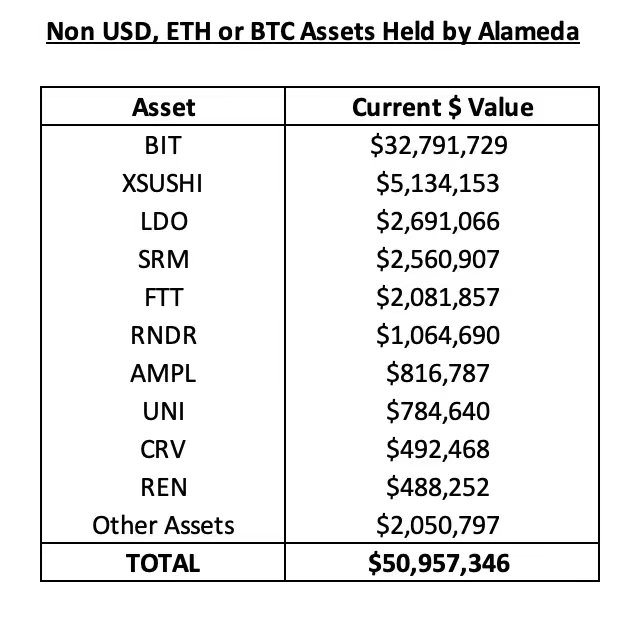

Alameda 仍然持有约 5090 万美元的代币和 1200 万美元的链上抵押不足债务

尽管随着 FTX 的崩溃和 FTT 价格的下跌(该公司使用 FTT 作为贷款抵押品),人们猜测该公司将会破产,Alameda 似乎仍然持有数百万的链上代币。

根据来自 The Block 的 Larry Cermak 的一组疑似 Alameda 钱包,该公司有价值约 5090 万美元非美元、ETH 或 BTC的资产。其中,他们最大的头寸是 BIT(中央交易所 ByBit 的代币),通过 FTT 的代币交易获得。有相反的传言,声称 Alameda 似乎仍持有 1 亿代币,按当前价格计算价值约 3200 万美元。

在与 FTX 或 Alameda 没有直接关联的项目中,头寸最大的是 xSUSHI 和 LDO,该公司总共持有价值 580 万美元的代币。鉴于其不稳定的状态,Alameda 似乎有可能清算他们在每一个这些代币的头寸。

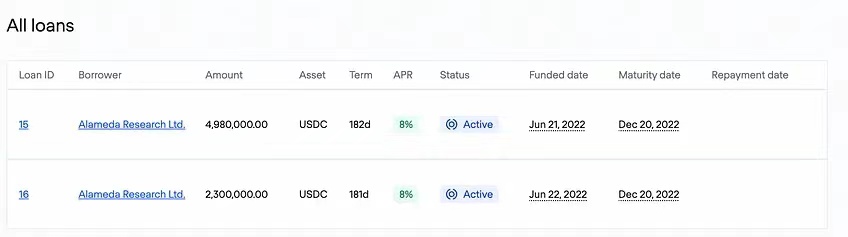

考虑到他们在 DeFi 中非常活跃,Alameda 的曝光,还透露出该公司还拥有 Clearpool 和 TrueFi 这两个抵押贷款平台总计约 1280 万美元的未偿债务。

Alameda Research组合II未偿贷款。来源:TrueFi

Alameda 一直是这些产品的“常客”,因为他们曾经在 Maple Finance 拥有自己的池,这是 DeFi 中最大的抵押贷款平台。值得庆幸的是,该池已被弃用。

此外,值得注意的是,通过 Clearpool 向 Alameda 提供的 550 万美元贷款是通过一个许可池发放的,Apollo Capital 和 Compound Credit Partners 公司是唯一的贷款机构。

MIM、USDT、stETH 面临压力

尽管 Alameda 对 DeFi 代币和抵押贷款机构有一定敞口,但受过去几天影响最大的是 Abracadabra,这是一个超额抵押贷款平台,用户可以铸造与美元挂钩的稳定币 Magic Internet Money(MIM)。

Alameda 是 Abracadabra 的主要用户,他们使用 FTT 作为抵押品来铸造 MIM。Abracabdra 对 FTX 和 FTT 的敞口巨大,因为在 11 月 3 日,超过 35% 的未偿 MIM 供应由 FTT 支持。这导致当 FTX 和 Alameda 的出现问题时,DeFi 用户减少了对稳定币的敞口。

MIM 最大的流动性来源——Curve 上的 MIM-3crv 池变得严重失衡。截至本文撰写时,该池的 3CRV 比例仅为 13.8%,MIM 为 86.2%,而不是理想的 50/50 比例。

MIM/3CRV池子组成。来源:Parsec

这种流动性流失导致 MIM 大幅脱钩,一度跌至 0.93 美元,之后才重新与美元挂钩。

这种快速反弹很可能是由于基于 CDP (抵押债务头寸)的稳定币的性质,因为 Alameda 被激励购买廉价的 MIM,创造了对它的需求,以偿还他们全部的债务。MIM 还受益于 Curve 上非常高的 A 因数,这使得它即使在资金池严重失衡的情况下也能保持与美元的挂钩。

MIM/USDC价格。来源:Parsec

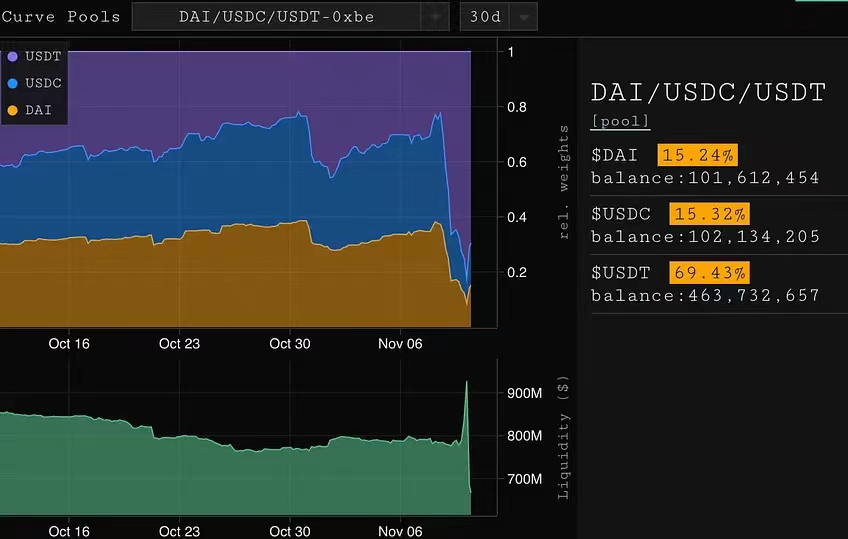

尽管 Alameda 偿还了债务,但稳定币流动性危机已经蔓延到 USDT 等其他资产。

3Pool组成。来源:Parsec

Curve上的3Pool (DAI/USDC/USDT)也存在明显的不平衡,DAI、USDC和USDT的比例分别为15.2%、15.3%和69.4%,而不是理想的三分之一。

这表明,流动性提供者害怕 USDT 的风险敞口,而是通过从池中撤出 USDC 和 DAI 来“逃离”。

USDT Compound的借款利率。来源:Parsec

其他 DeFi 用户也在做空 USDT,因为该资产的利用率分别为 Aave 的 87% 和 Compound 的 92%,导致稳定币的借款利率飙升。这表明,用户借入 USDT 是为了做空它,可能是担心 Tether 对 FTX 和 Alameda 有信用敞口,但他们否认了这一指控。USDT 在 11 月 9 日一度跌至 0.97 美元,但此后又回到挂钩水平。

这些 Curve 池失衡表明市场存在巨大的恐惧,特别是跟 Alameda 有关的已确认或怀疑有风险敞口的稳定币。投资者可能在未来几天和几周内关注自己的资产构成,因为这些资产池的再平衡可能表明,市场的恐慌情绪已经消退。

总结

区块链的透明度让我们能够获得大量关于 FTX 的崩溃影响的分析,而我们在这篇文章中只是冰山一角。

正如我们所看到的,在交易所遭遇挤兑之前和挤兑期间,资金在 FTX 和 Alameda 之间流动,这让人们确信这两个实体的关系比任何人想象的都要紧密。我们还获知作为一个非常大的实体(FTX)能够在运行期间提取数亿美元的稳定币,收回部分或全部资金。我们还可以看到,Alameda 仍有超过 5000 万美元的代币存在被抛售到市场上的风险,还有超过 1200 万美元的未偿贷款,这些贷款似乎有很高的违约风险。

最后,我们可以看到 FTX 的崩溃在整个 DeFi 造成了混乱,MIM 和 USDT 的流动性枯竭,DeFi 用户对后者进行了大量的空头头寸操作。

更多信息将在未来继续曝光。